We have already talked about the Fibonacci retracement several times in our strategies, showing the various ways in which this great indicator can be used.

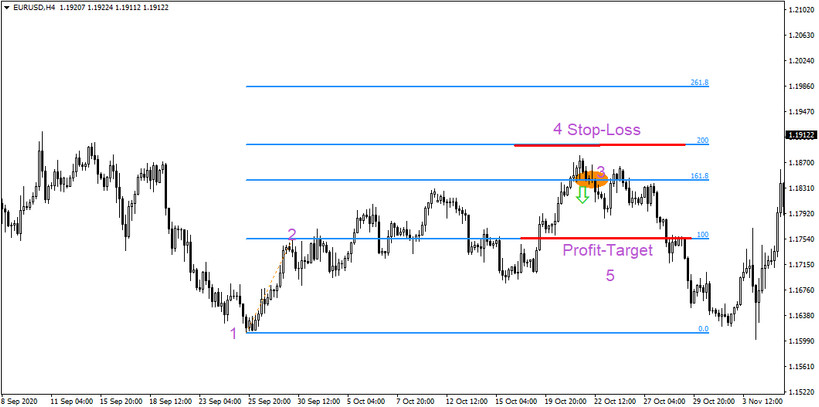

Today, we have another strategy again, but it does not primarily focus on pullbacks from already reached S/R levels, but focuses on pullbacks from the Fibo levels at 161.8, which are a sort of indicator of important S/R zones that the market has yet to reach.

Strategy entry rules

Entering long positions

- Hitting the Fibonacci level 161.8 from above

Entering short positions

- Hitting the Fibonacci level 161.8 from below

The principle of strategy

The Fibonacci bounce strategy at 161.8 is not complicated. All that is needed here is to correctly insert the Fibonacci retracement into the chart and, in addition, to create a new level of 200 in the Fibo settings (this level is not a Fibonacci level, of course, but in this case it serves as an indicator for the placement of the Stop-Loss). Once the Fibonacci is set in this way and the price hits the 161.8 level (see chart above/below), then it is possible to start entering trading positions against the direction of the hit. Finally, the aforementioned 200 and 100 levels (see chart above/below) are used to place the Stop-Loss and Profit-Target. And that's all.

Today's "Fibo" strategy can be expected to have a success rate in excess of 60%, which, given the ratio of about 3:2 between TP and SL, is more than sufficient and, in the long run, considerably pro-growth.