Fish in a Barrel is a medium-term trading strategy designed for trading the EURUSD currency pair on the H4 time frame. It is implemented using the following four indicators: RSI, Bollinger Bands, MACD and MA. All these indicators are standard built-in indicators of the Metatrader 5 terminal. If for some reason, you cannot find these indicators in your terminal, you can always download them on our website in the Indicators section.

Strategy settings

Overlay these indicators with the specified parameter values on the EURUSD chart with timeframe 4.

RSI with a period of 7;

Bollinger Bands with a period of 20, a deviation of 2 and an application to First indicator data;

MACD with periods of 15, 26 and 1 for the SMA;

Moving Average - period 200.

Please note that the RSI indicator and Bollinger Bands must be enabled in the same window. To doing this, one indicator can be opened through the Indicators tab of the trading terminal, and the other can be dragged from the Navigator window right over the first. Just, for example, if you first open the RSI and then drag Bollinger Bands onto it from the Navigator window, then in the settings of the indicator, you can select “First indicator’s date” in the “Apply to” item.

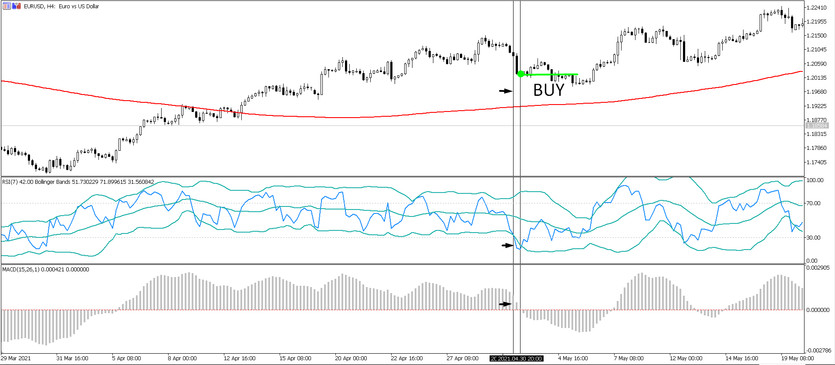

Conditions for opening BUY trades:

The RSI broke through the lower border of the Bollinger Bands, went beyond the channel, and then came back, crossing the lower border from the bottom up.

At the same time, the MACD histograms are above zero, which indicates the presence of an upward movement. The current price is above the MA line.

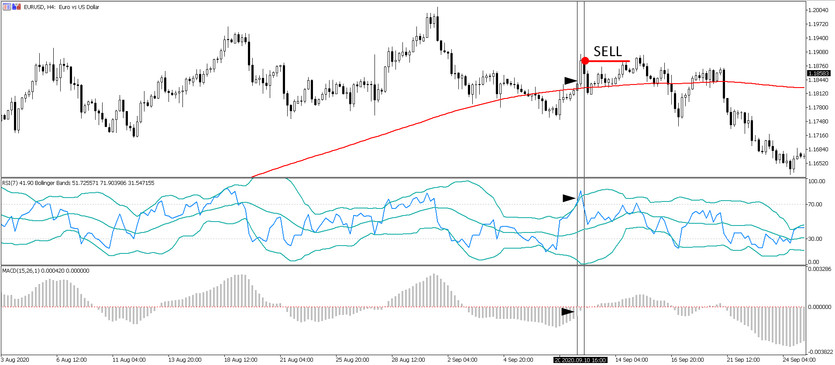

Conditions for opening SELL trades:

After the RSI went beyond the upper boundary of the Bollinger Channel and then returned to it again, crossing it from top to bottom.

MACD histograms are below zero. The current price is below the Moving Average line.

The trade is entered as soon as the candle on which the RSI crossed is closed.

Stop-loss is placed at about 350-400 points at 5-digit quotes or for the nearest local maximum or minimum.

The stop loss is moved to breakeven as soon as a plus 350 points appears on the trade. When the current profit reaches 50 pips, you can place a trailing stop at a distance of 400 pips from the price.

Ideal signals will be when the system offers to buy when the price chart is above the moving 200 and sell when the chart is below this moving one.

It is also recommended not to open new deals 4 hours before the end of the Friday trading session. It is better to look for the next trades on Monday after the weekend. In this way, difficultly predictable movements can be avoided due to weekend operations and gaps that they can cause.

Conclusion

As you can see from the description, the Fish in a Barrel trading strategy is easy to use despite the presence of four indicators. Since the strategy is medium-term and is applied on the H4 timeframe, it gives a small number of trades. Nevertheless, based on the statistics of its application, this strategy gives a rather high percentage of winning trades since its main advantage is the early detection of good entries.