Forex Gambit is a simple yet effective trading strategy that will appeal to traders who value time and nerves. This system shows the highest profit when used on the D1 timeframe and uses only Bollinger bands from the entire technical arsenal, which are often found in trading strategies. It is believed that the rights to this technique belong to the American chess player Walter Downs, who became famous for his developments for the financial markets.

Forex Gambit. Effective trading strategy for 1-Day timeframes

So, first, you need to understand the term "gambit" - why and why it is used here at all. In chess, this is the name of a move in which the attacker sacrifices a pawn or piece in order to provoke an opponent.

This idea is applied here when trading the Bollinger Indicator. The fact is that the Bollinger bands on the basis of which this system is built, are calculated using the standard deviation, and Forex Gambit trades are opened after the price rebounds from the middle of the range.

Thus, in order with a small stop is opened from the central line of the Bands indicator (an insignificant sacrifice), we have a good chance to catch a powerful impulse (the goal for which the trader is risking) since the price cannot stay in an equilibrium state for a long time.

Indicator settings

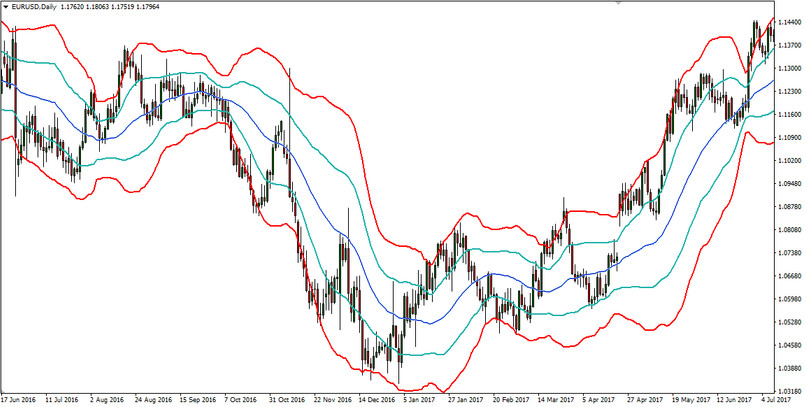

Forex Gambit system includes two BB channels with the following variables:

Period = 30, deviation = 1.0, zero shift, calculation based on closing prices;

Forex Gambit trading strategy. Bands setting

Period = 30, deviation = 2.0, zero shift, calculation based on closing prices.

Forex Gambit Strategy. Bollinger Bands settings for mt4

Rules for opening buy deals

1. The first stage of research will need to determine the direction of the trend. This can be done by the angle of inclination of the central line of the indicator - if it grows for ten days - we are looking for buy signals only.

2. At the second stage of the Forex Gambit strategy, it is necessary to wait for the moment when the price rolls back to the central line of the channel and touches it. Here, attention should be paid to one circumstance - the body of the candlestick should be above the middle line of the channel.

3. And at the last stage of the analysis, after which a long position is opened, it is important to observe one more criterion:

To buy, the High and Low of the signal candlestick must be below the extremums of the same name as the previous one.

For example, as you can see in the example below, within the signal candlestick, the market updated the local minimum, and buyers did not make aggressive attempts to take revenge (the High price did not update the maximum of the previous candlestick).

Forex Gambit. Conditions for BUY

Rules for opening sell deals

The same rules, but with opposite values, are relevant for sell trades.

1. The middle line of the Bands indicator is directed downward for ten days.

2. It is necessary to wait for the price rebound from the middle line of the Bands indicator, and after the candle closes, its body should be below the central line of the indicator.

3. High and Low of this candle should be higher than the High and Low of the previous candle.

Forex Gambit. Conditions for SELL

Stop Loss and Take Profit

Stop-loss according to the Forex Gambit strategy is set a few points below/above the Low/High of the signal candle, while if four days later, the position is profitable, the protective order is transferred to the breakeven area, and then to the near border of the channel. And then it gradually pulls up after the price as it moves.

As for the take profit, there are no fixed targets within the framework of this methodology; instead, the profit is completely closed at the moment of the breakout of the far border of the BB channel (which is built taking into account the double standard deviation).

The first Bollinger Band is used to fix half of the profit, although practice shows that such actions often artificially limit the potential of the system; therefore, the mentioned rule on-trend instruments can be ignored.

Conclusion

Summing up, it should be noted that the Forex Gambit strategy generates signals very rarely, so you have to monitor the situation on 15-20 assets at once. But the small number of signals of this strategy is compensated by the quality of the trades.