The basis of trading success is not only quality education, but also experience and, last but not least, a well-chosen trading strategy.

Full Coverage is a Forex strategy that a trader does not have to worry about whether it is a good choice, because it simply is. In addition it is a strategy that does not take even ten minutes to understand, which is also a huge advantage over other equally successful strategies.

The principle of strategy

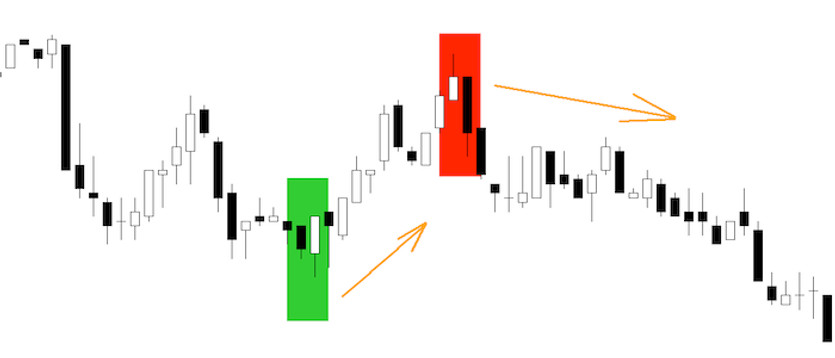

Full coverage is one of the relatively simple but effective trading strategies. Its principle is to look for situations where the body of the next candle fully covers the body of the previous candle, and the bodies of the two candles are in opposite directions to each other. This situation here means a trading signal in the direction in which the younger candle is moving (see chart below).

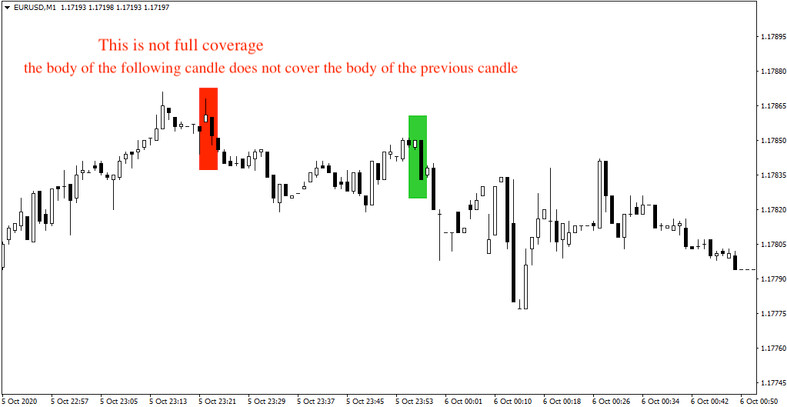

The graph below highlights two situations where the first case (red underlining), although it may not appear so at first glance, is not full coverage. Conversely, in the second case (green shading), it is full coverage and it is therefore very important that the signal is always determined correctly for the sake of long-term consistency.

Full coverage is a strategy where a long-term success rate of more than 60% can be achieved. However, the resulting success rate here depends not only on the chosen instrument and time frame, but of course also on the overall trading experience, which can increase/decrease it by tens of percent.