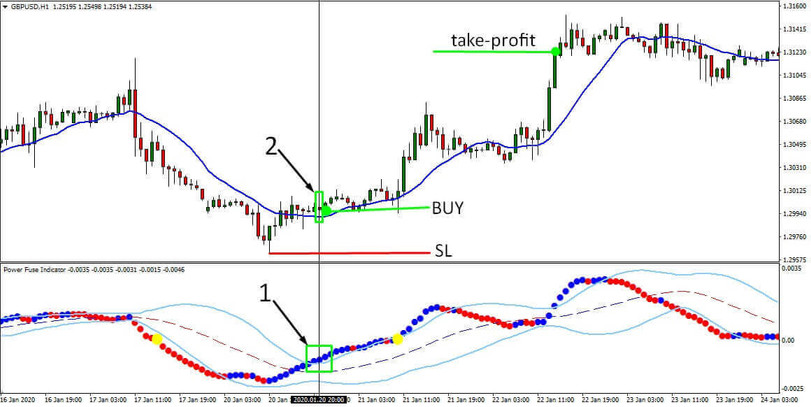

Power Fuse Strategy is a trading system based on the values of two technical indicators, which is applied to the GBPUSD currency pair on the H1 timeframe. The main signal source in this strategy is the Power Fuse hybrid indicator. An additional filter here is an indicator of a simple moving average, in combination with which the Power Fuse tool gives a greater percentage of positive results on trades.

The Power Fuse indicator is available for FREE Download in the Indicators section of our website.

Indicator settings

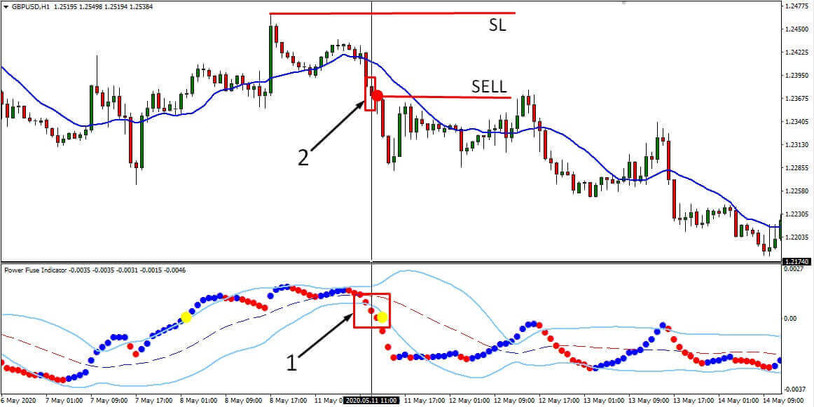

Apply both indicators to the window of the GBPUSD currency pair on the H1 timeframe. The Power Fuse indicator is displayed in a separate window under the price chart. The moving average indicator is displayed on the price chart as a line.

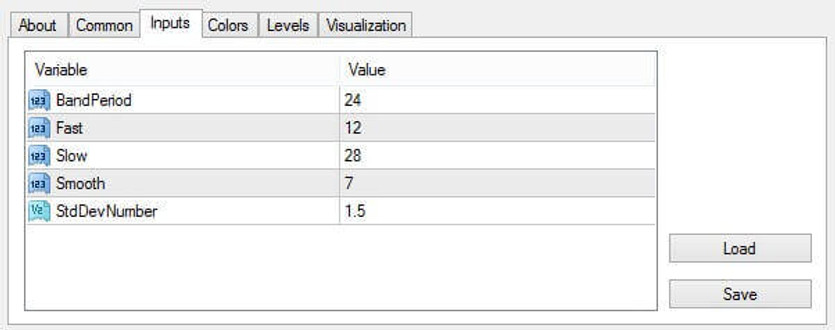

In the Power Fuse indicator settings, set the following parameter values:

- BandPeriod = 24

- Fast = 12

- Slow = 28

- Smoth = 7

- StdDevNumber = 1.5

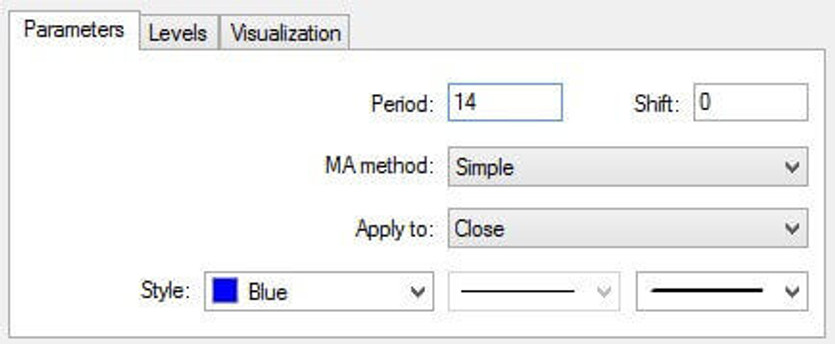

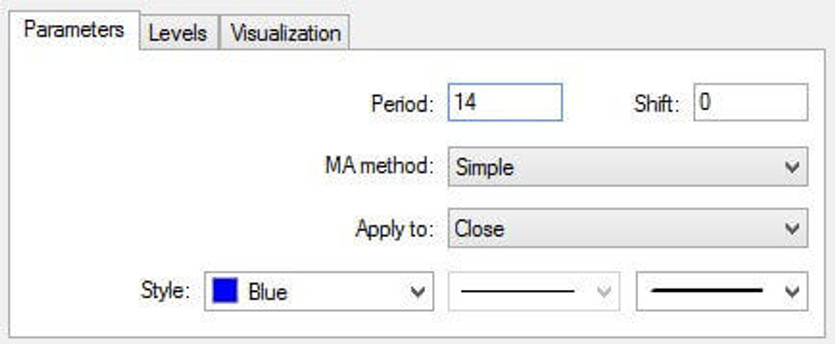

In the parameters of the moving average, set the value to 14 for the Period parameter.

Thus, both indicators are configured for the GBPUSD currency pair and are ready for use.

Conditions for opening long positions

The Power Fuse indicator line, consisting of red blue and yellow dots, is a modified visualization of the standard MACD indicator. Two solid light blue lines are the Bollinger Bands indicator. Here, a buy signal is considered the intersection by the MACD line of the upper line of the BB channel.

Conditions for opening short positions

There is also a small addition to this strategy. Pay attention to the size of the candle on which these conditions match. If, when the conditions of the signals for the indicators are satisfied, the size of the candlestick significantly exceeds the total average size of the candles visible on the chart, it is better to skip such a signal and not enter the trade. A candle that stands out for its size can indicate a sharply arising impulse that can quickly go out and go in the opposite direction. Therefore, if the described conditions for indicators appear on a large candlestick, skip this deal.

Stoploss and Takeprofit

Stoploss is recommended to be placed at the nearest extremums. If a closed candle on which there were conditions for entering the position itself is an extremum, set a stop-loss at the maximum/minimum (depending on the deal) of this candle.

Take Profit is calculated relative to Stop Loss and is three times larger than it. For example, if the stop-loss set at the nearest extremum is at a distance of 150 points from the deal opening price, then the take profit will be 450 points from the deal opening price.

Conclusion

Before you start trading on a live account, we recommend that you practice on demo accounts so that you can understand all the nuances of this strategy. The British pound is a very volatile trading asset, and you should take this into account when calculating the working volume for trades in this system.