Candle formations are among the most used trading indicators, on the basis of which decisions are often made by long-term and top world traders.

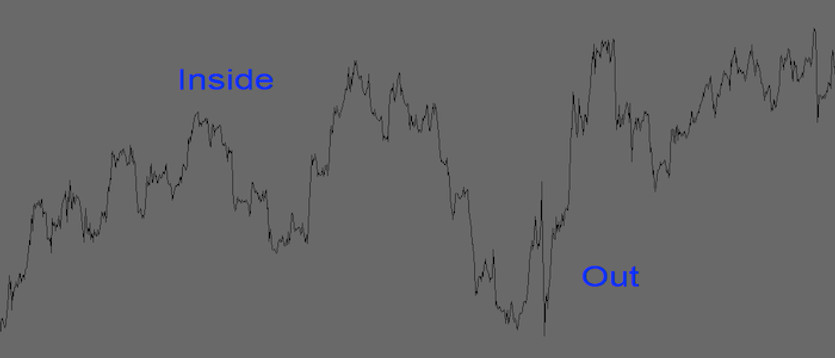

A strategy based on the InsideOut formation is not at all complicated, on the contrary, it is possible to start trading with this strategy right after a few minutes and moreover, it is also a strategy that is not very demanding on financial capital, which is a factor that tends to be a big weakness of other similar strategies.

Strategy entry rules

Entering long positions

- Creating an inside candle

- breaking the high candle that preceded the inside candle

Entering short positions

- creation of an inside candle

- breaking the low candle that preceded the inside candle

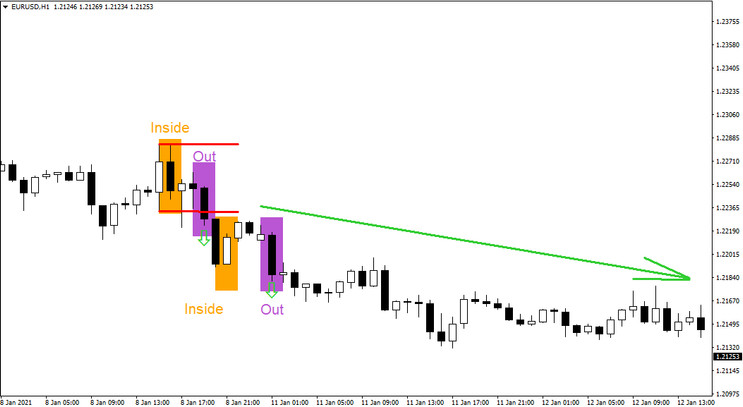

The chart below shows a not so common situation, when the first inside candle was formed (first orange rectangle), followed shortly after by a breakout of the low candle that preceded the inside candle (entry short signal - see rules above). And soon this situation repeated itself again, so the market offered a double chance for success right away.

The stop-loss is always placed above the high (for short entries) or below the low (for long entries) of the candle preceding the inside candle. The Take-Profit is handled either by a ratio method to the Stop-Loss (1:1,2:1,...), or the Stop-Loss itself may also shift over time.

The InsideOut strategy can achieve long-term success rates in excess of 85%, not only in highly stable markets, but also in the riskiest instruments.