Keltner & MA H1 Trading Strategy is a universal classic system based on the Keltner Channel and MA indicators. The strategy has been successfully applied by many traders for a long time. It is suitable for almost all trading assets on the H1 timeframe. You can download and install indicators that implement this strategy on our website in the Indicators section.

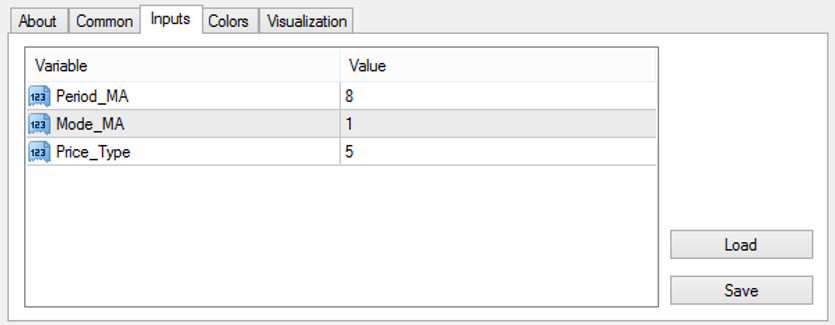

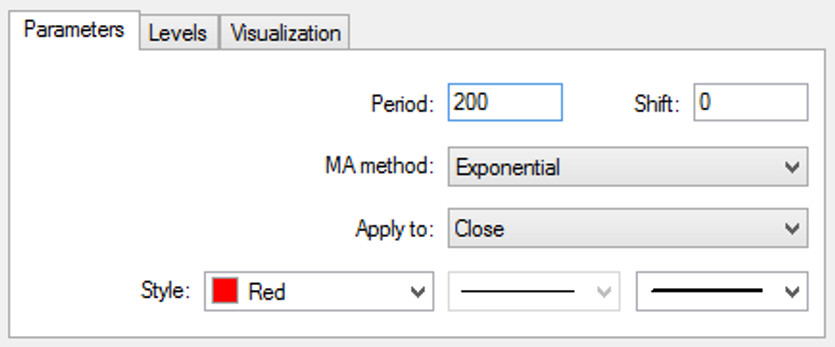

Indicator Settings

Applying both indicators to the chart of the trading asset on which you will use this strategy, set the following values:

For the Keltner Channels indicator, the parameter values will be equal - Period_MA = 8, Mode_MA = 1, Price_Type = 5.

In the Moving Average indicator, set the value of the Period parameter to 200, and change the MA Method parameter to Exponential.

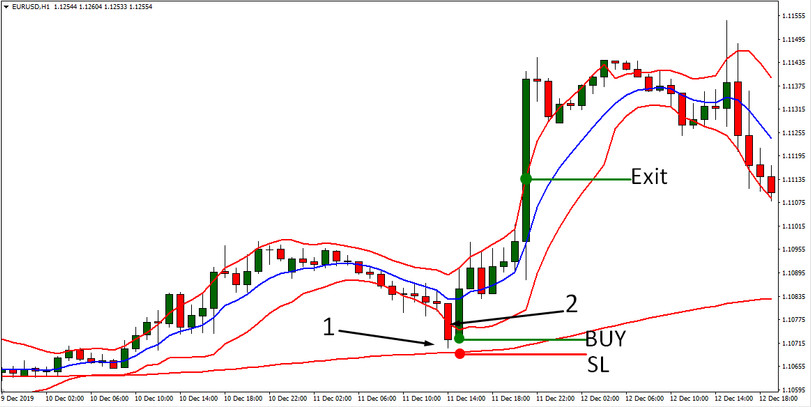

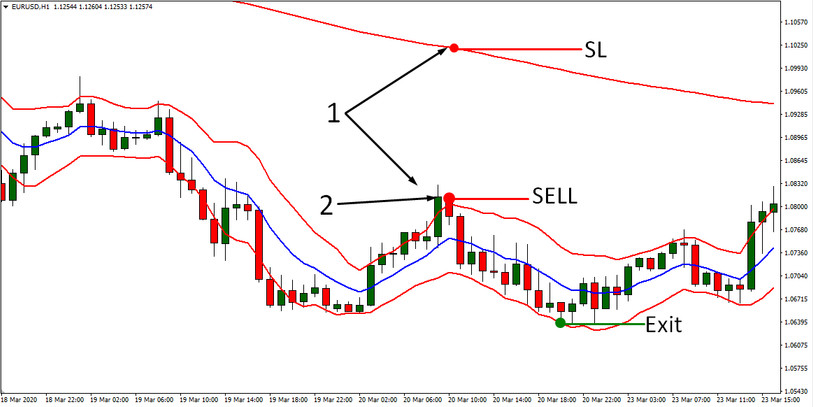

The first thing you should pay attention to when working with this strategy is the position of the current price relative to the Moving Average line. If the price is above the MA curve, only purchases are considered. If the current price is below this line, only sales are considered.

Conditions for opening long positions

1. The MA line with a period of 200 is above the current price, and they do not touch each other.

2. At the same time, the price breaks the lower border of the Keltner channel and goes beyond it. If the current H1 candle closes below the lower border of the channel, a BUY deal is opened.

Conditions for opening short positions

1. The MA line with a period of 200 is below the current price and does not apply to it.

2. The price breaks the upper border of the Keltner channel, and the H1 candle closes above this border.

Stop Loss and Take Profit

The location of the stop loss is traditionally considered the Moving Average line. Set a stop loss in the place where this line is located at the time of opening the transaction. Take Profit is not set by default. A deal should be closed when the price touches the opposite boundary of the Keltner channel. A BUY deal must be closed when the price touches the upper boundary of the channel, and a SELL deal is closed when the price reaches the lower boundary of the channel.

Conclusion

A higher-order moving average than that used in the calculation of the Keltner channel itself provides an additional signal filter. The simplicity and originality of this strategy, in combination with time-tested results, makes it possible for even newcomers to use it effectively. At the same time, do not forget about a clear system of risk control and competent money management.