The Turtle trading system was originally used on Western futures markets and was known only to its authors. The general public learned about her only through a coincidence. An interesting story is associated with this strategy about two professional traders who decided to make a very original bet.

In particular, Richard Denis, one of these two financiers, argued that absolutely any person could be trained to trade since speculation involves the mechanical processing of incoming system signals. His opponent William Eckhard did not agree and began to argue that speculation requires a certain mindset. In order to resolve the dispute, the friends made a playful bet for $ 1, which Richard eventually won.

To resolving the dispute, a group of people was recruited, who were given a ready-made trading strategy and allowed to work with liquid assets according to its rules. This experimental squad included representatives of completely different professions and social strata since it would not be entirely correct to select analysts and other figures from Wall Street for such experiments.

Thus, if people without special education and certain talents were able to get income on futures, it can be assumed that the Forex Turtle strategy will also be useful for novice forex traders. However, this assumption is also true for other strategies of the foreign exchange market.

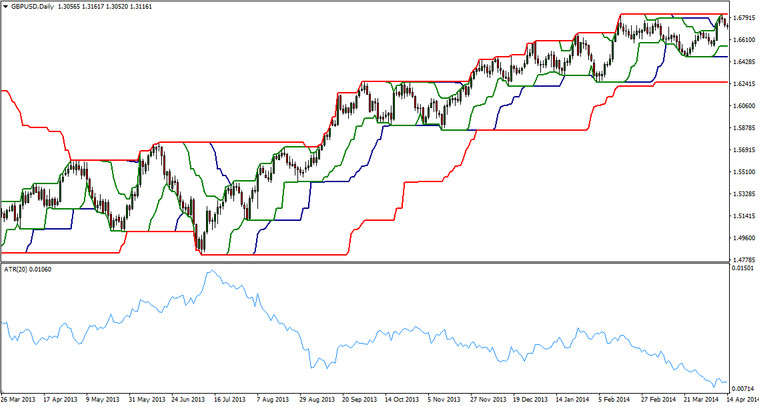

To trading using this technique, only two indicators will be enough - the Donchian channel and ATR. The first one shows the price range for the selected time interval, and the second one measures the volatility of the exchange rate.

Long-term trading strategy Turtle. Proven Forex classics (modified)

As part of the Turtle strategy, you need to set an indicator set with the following settings on the daily timeframe:

Donchian channel with Periods value equal to 10;

Long-term trading strategy Turtle. Donchian channel settings

Donchian Channel with a period of 20;

Donchian Channel with a period of 55;

ATR indicator with a period value of 20.

Long-term trading strategy Turtle. ATR settings

The algorithm for making deals within the framework of this technique is inextricably linked with the mechanism of the Donchian channel. You can find full description and download this indicator in the Indicators section. Donchian Channel shows the price range for the selected period. For example, its upper border corresponds to the local maximum, and the lower bar plays the role of the projection of the last minimum.

Accordingly, if the price breaks through one of the Donchian Channel boundaries, its markup is rebuilt. The same thing happens after the old extremes lose their relevance.

Within the framework of the Turtle strategy, transactions are divided into two groups - medium-term and long-term.

Medium-term buy and sell deals

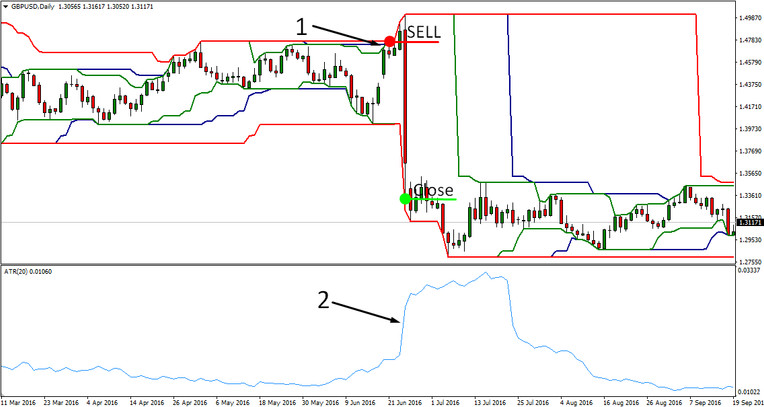

1. The price touched or broke through the 20-day channel. Pierce

2. The ATR indicator value is equal to or higher than 0.01.

3. The previous deal was closed with a loss;

If the previous operation brought profit, the next entry should either be ignored or wait for the breakdown of the 55-day channel.

The fact is that the statistics collected for currency pairs have shown that a powerful trend is often followed by a false signal, after the closure of which by stop-loss the previous trend resumes. Taking this circumstance into account, the authors of the "Turtle" strategy decided to minimize the possible negative consequences (they left the patterns with a positive expectation).

Long-term buy and sell deals

Long-term trades are much easier to manage; in particular, they are opened when you touch the 55-day channel without additional filters.

Long-term trading strategy Turtle. Conditions for sell

Stop-loss and take-profit

As for the exit points, there are two possible scenarios, the first of which involves closing a deal via the younger Donchian Channel, namely:

If the order was opened on the 20-day channel, it is closed after the reverse breakout of the Donchian Channel, calculated in 10 candles;

If a trade was made on the 55-day Donchian Channel, it is fixed at the moment of the breakdown of the 20-period channel.

Conclusion

In conclusion, it should be noted that the system considered today is quite flexible, i.e., it can be modernized based on your own ideas about the market, for example, good results can be obtained when it is transferred to Renko charts (although in this case, you will have to abandon ATR). Thus, a simple and proficient strategy Turtle, if used carefully, can become a good source of constant stable income.