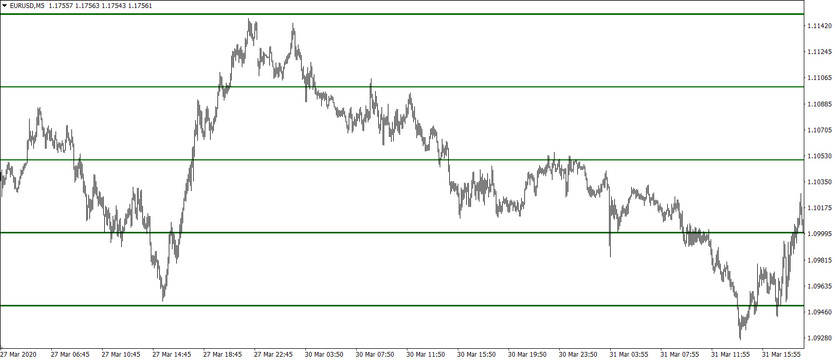

Market Maker's Shadow strategy aims to profit from the natural market movements that occur after the breakout of round levels. The system is simple and undemanding, so it can be used with the same success to trade on almost any trading instrument.

The strategy's main idea is to monitor price behavior near round levels, which are psychologically significant price values for the market.

First of all, you should understand the concept of round levels. The round levels are, in fact, ordinary numbers. For example, for the EURUSD currency pair, these can be price values - 1.12000, 1.12500, 1.13000, and so on. Interesting events always take place near such price values, since most traders focus on round numbers.

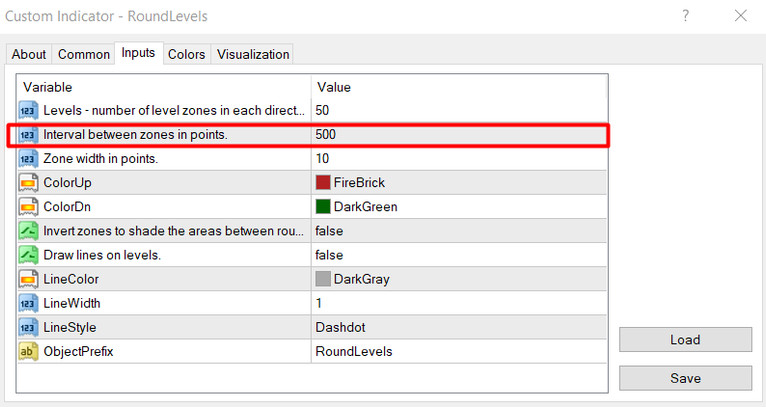

For facilitating the task of determining round levels, there are a special indicator Round Levels, which you can download on our website in the Indicators section.

The strategy is based on the idea that after the breakout of the round level and, at the same time, the activation of a large number of orders, a rollback will necessarily form. As a rule, a pullback occurs at a distance of 300 points (five-digit) from the round level's breakout.

Rules for Buy Deals

If the price has broken the level from top to bottom, then at a distance of 300 points from the level, place a pending Buy Limit order. Also, set a take profit of 70 (or 100) points and a stop loss of 210 points. Since initially, we place two orders - one above the level, the other below, then when one of the orders is triggered, we delete the second.

Rules for Sell Deals

Likewise, for the level breakout upwards: place a Sell Limit pending order at a distance of 300 points from the level. Also, set a take profit of 70 (or 100) points and a stop loss of 210 points. Since initially, we place two orders - one above the level, the other below. When one of the orders is triggered, we delete the second.

Despite the fact that the stop-loss is higher than the take profit, in this case, the loss is more than compensated for by a much larger number of profitable trades. The reason for setting a large stop loss is simple. The fact is that there is too much trading noise within the day. Therefore, as in the case of many other intraday strategies, such a stop loss is simply necessary here.

Conclusion

Watch for profit and loss taking levels. A short 70 pips take profit gives more profitable trades, but a 100 pips take profit increases the total profitability. In any case, the stop loss should be set above the take profit level so that the intraday trading noise does not knock out short stop-loss orders. Nevertheless, even this ratio of the stop order to profit order gives a significant profit. The strategy itself is quite simple and using an auxiliary advisor, a minimum of actions is required from you. The percentage of profitable trades can reach 85%