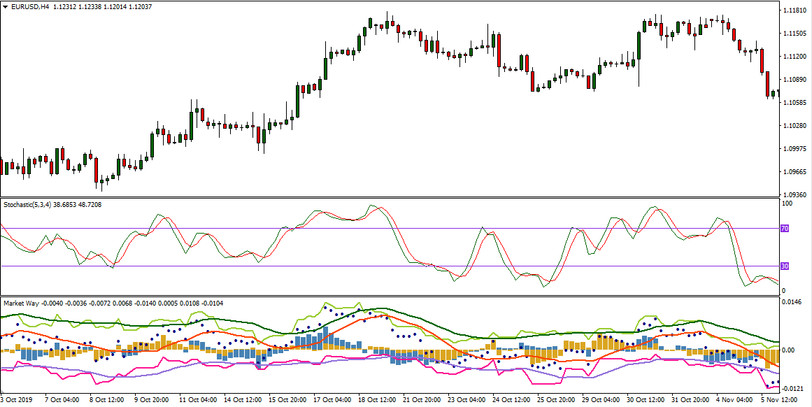

This strategy is intended for use on the H4 time interval for the EURUSD currency pair. For its functioning, it is required to install two tools in the MT4 trading terminal - the Market Way indicator and the Stochastic indicator. You can download them in the Indicators section.

The basis of this strategy is the idea of finding overbought and oversold markets, after which, with a high degree of probability, a price reversal is possible. Overbought and oversold are determined by the extremums of the values of these two indicators. The strategy shows good results in the long trading range.

Indicator settings

After downloading and installing both indicators in your MT4 terminal, apply them to the chart of the EURUSD currency pair on the H4 timeframe. Both indicators are displayed in separate windows.

Market Way indicator parameters are set by default - value 12 for all of these parameters.

In the Stochastic indicator in the Levels tab, change the level of 20 to 30 and the level of 80 to 70. Thus, we set new level values for this indicator.

Conditions for opening long positions

Pay attention to the lines of the Market Way indicator. There are 5 of them: MainSMA, BullSMA, BullAccumulation, BearSMA, and BearAccumulation. The position of each of these lines carries certain information about the current market situation. For open BUY deal, the following events must take place:

1. The MainSMA, BearSMA, and BearAccumulation lines of the Market Way indicator are below the value of -0.01.

2. At the same time, the lines of the Stochastic indicator are below level 30.

When these two conditions are met, a BUY deal is opened.

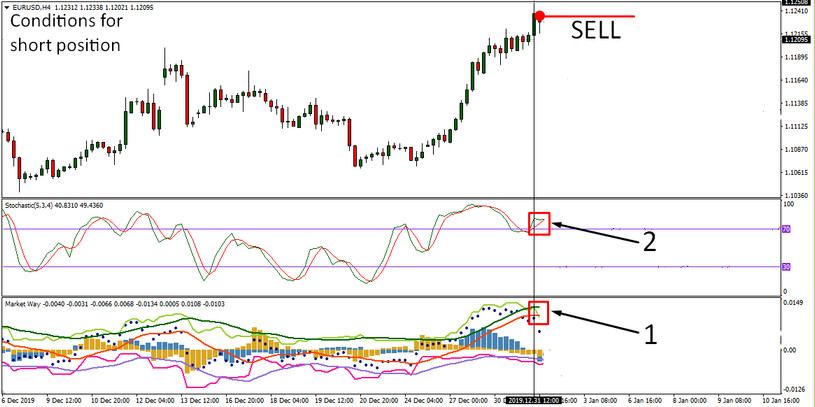

Conditions for opening short positions

1. The MainSMA, BullSMA, BullAccumulation lines of the Market Way indicator are equal to or higher than 0.01.

2. Both lines of the Stochastic indicator are above level 70.

Stop Loss and Take Profit

Stoploss is set at a distance of 200 points from the opening price. To taking profit, instead of take-profit, this strategy uses a trailing stop with a value of 100, which means that when the price moves in the direction indicated by the deal, the trailing stop will fix the profit following the price at a distance of 100 points from it.

Conclusion

In the course of applying this strategy, one regularity is manifested, which consists of the seriality of losses and profits. This means that receiving several unprofitable or several profitable trades in a row is the norm for this system. Thus, it can be assumed that to apply this strategy; a trader must have steady patience since several losses in a row are extremely difficult for any trader. Also, a long series of profitable trades should not affect the psychological state of the trader. In any situation, the risk control system should occupy a dominant position in your trade.

In conclusion, we can conclude that the MarketWay & Stochastic EURUSD H4 strategy is a profitable tool, and if you are a psychologically stable person, you can use this tactic in your trading.