Trading Strategy Mass Index & MA trading strategy is a universal system that can be applied to any asset in the 4-hour interval. It is based on the readings of two technical indicators Mass Index and MA.

The Mass Index indicator is available for download in the Indicators section of our website.

Indicator settings

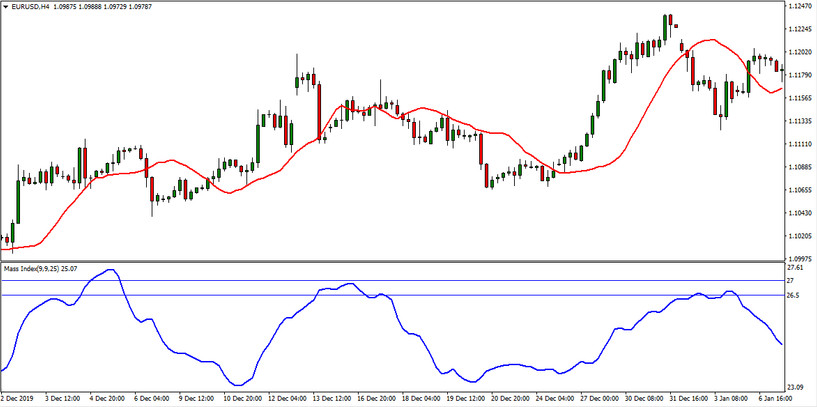

- Mass Index indicator with standard values of 9, 9, 25.

- Moving_Average indicator with a value of 10 for the Period parameter and 5 for the Shift parameter.

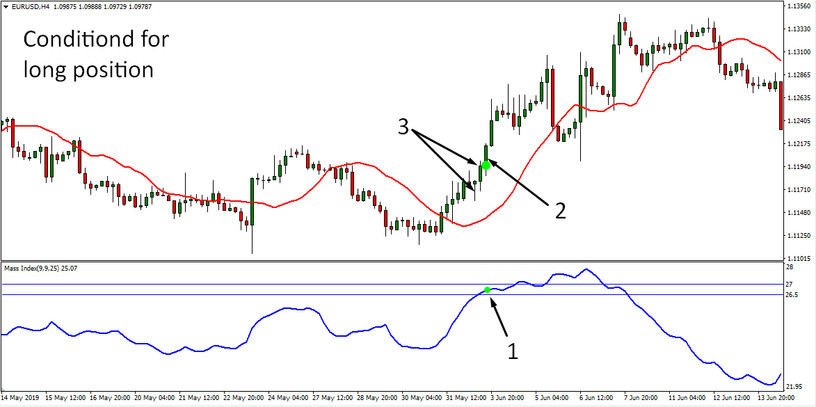

Conditions for opening long positions

Under these conditions, a BUY deal is opened. After opening a deal, wait until the H4 candle closes and set stop-loss and take-profit based on its size. Stoploss set at a distance of the size of a closed candle from the price. If, for example, the size of a candle from Low to High is 336 points, then the stop loss is set at a distance of 336 points from the deal opening price. Take Profit is equal to two candle sizes. In the above example, a take-profit is set at a distance of 672 points from the deal opening price.

Conditions for opening short positions

The signals for opening short positions in this system are the same as when opening long positions.

Stoploss and TakeProfit are also set at a ratio of 2 to 1 and depend on the size of the candle on which the deal is opened.

Conclusion

Like most H4 strategies, this strategy generates a small number of signals on each trading instrument. This is perhaps the biggest drawback of this strategy. It is also worth noting that when applying it, it is especially important to comply with money management. We recommend using small volumes of positions when working with this strategy because, according to its rules, stop loss is set only after the close of the H4 candle. Use the safety stop-loss before the candle on which the deal is opened closes, and you will know its size.