Everyone knows that there are trends in the market that most trading systems are dedicated to taking. And also, there are periods of calm in the market when nothing happens. They, as a rule, are one of the most dangerous periods for a trader, since it is here that the largest number of false signals are generated. In this strategy, on the contrary, the priority is such periods when nothing happens on the market; that is, a consolidation zone is formed.

The reason for the consolidation is similar to the reasons for the appearance of the internal bar. In general, the principle of the Monday Breakout strategy is very similar to this Price Action pattern. The lull is formed during a period of the temporary agreement in price between buyers and sellers - a truce between bulls and bears. But, since the war never stops, sooner or later, one of the parties will win, which will result in some kind of movement. During such a “truce,” you can try to enter the market and follow the established trend, against it, or wait for which side to win.

One of the most stable areas of consolidation, beyond which signals the beginning of a trend movement, is the Monday period from the beginning of the Australian session to the beginning of the European trading session. Flat occurring in this time interval can be considered as directing and determining the future price movement.

The Monday Breakout strategy is based on this observation and is especially suitable for trading on EURUSD and GBPUSD currency pairs.

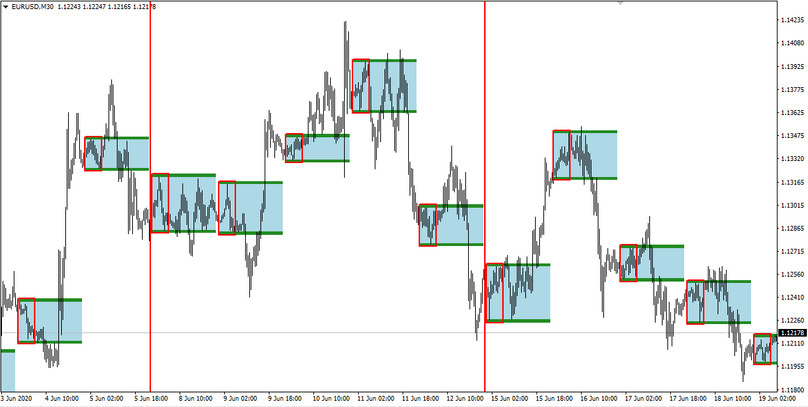

The Breakout indicator that defines the boundaries of the flat and the period defined in the indicator settings acts as an assistant in the implementation of this strategy. You can download this useful tool on our website in the Indicators section.

Indicator settings

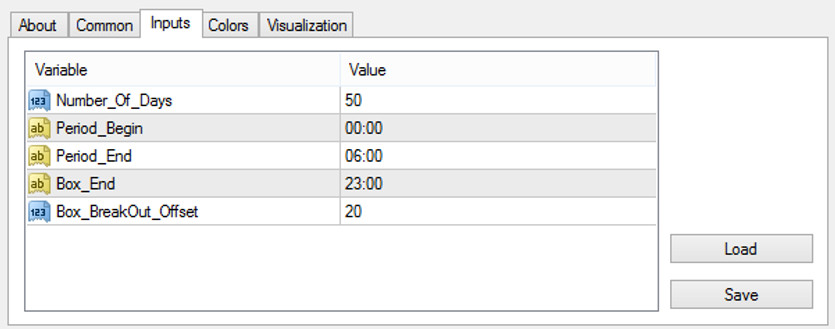

For the indicator to work in this system, set the following parameter values:

Set the parameter Number_Of_Days with a value of 50. This is an optional parameter; its value only shows the borders of the flat at the number of days equal to the set value.

Set Period_Begin to 00:00.

Set Period_End to 06:00.

Set the value of the Box_End parameter to 23:00, and set the Box_Breakout_Offset parameter to 20.

Please note that no matter what timeframe you apply this indicator to - it will perform its task of determining the session period equally on any timeframe.

Conditions for opening positions

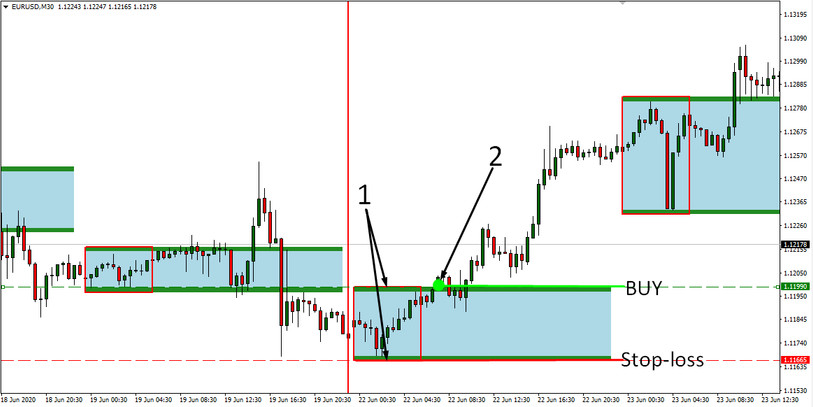

1. At the very beginning of the European trading session on Monday, when the Breakout indicator has fully formed a red rectangle indicating the Austrian and Asian sessions, pay attention to the price range of this rectangle. Depending on the currency pair being traded, this range should not exceed 400 points for EURUSD and 500 points for GBPUSD.

2. The price boundaries indicated by the Breakout indicator in the form of a red rectangle are levels during the breakdown of which the probability of trend movement in this direction increases. If a breakout occurs, a deal is opened. When the upper border of the flat is broken, a BUY deal is opened, and when the lower border is broken through, a sell deal is opened.

Stop Loss and Take Profit

After opening a deal, the stop loss should be set at the opposite border of the channel. Instead of setting take profit, this strategy uses a trailing stop, the step of which should be set equal to the distance from the price to the stop loss. Thus, with a successfully opened deal, the trailing stop will fix the profit several times higher than the potential loss on the deal.

Conclusion

Monday Breakout Strategy is a time-tested classic system that has been successfully used for many years. Its main disadvantage is the small number of generated trades since it can be applied only on Monday, i.e., once a week. Nevertheless, its competent use, together with good money management, can compensate for the lack of a good number of deals with their quality.