Mouse Tail is a simple breakout strategy for GBPUSD that will take just a couple of minutes a day. You can even trade using this strategy from a smartphone since no indicators are used. At the same time, the strategy can be used for other instruments, but this issue needs to be worked out separately, selecting the system parameters individually for each instrument.

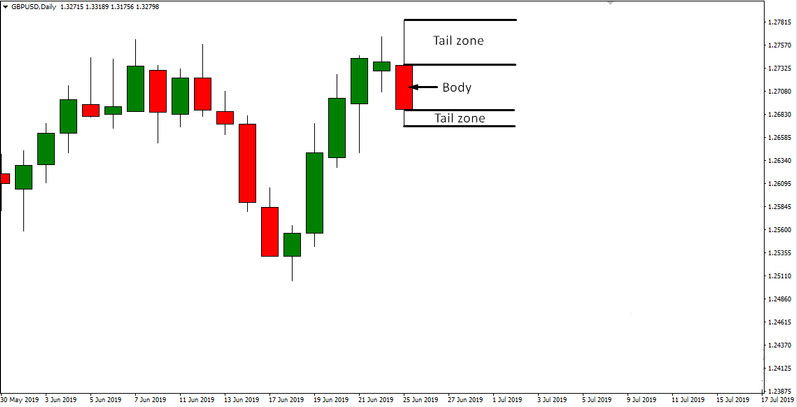

Once a famous American trader Avery Hawthorne shared an interesting observation - if the price enters the tail zone of the previous daily candle, then in 70-80% of cases, it leaves it. Typically, the price moves below the Low point for the lower shadow or above the High point for the upper shadow. Sometimes the price moves to the body area, but almost never stays in the tail area.

At the same time, there is a lot of liquidity and stop-losses in the candlestick body area. Market makers love to hunt for these stop-losses, so there is a fierce carnage in the body area. Therefore, trading towards the body is, of course, possible, but it requires a lot of skill and is far from safe. It's easy to get into an unnecessary trade and get a loss. For this reason, this system considers only the breakout of the High or Low of the previous daily candle.

And if you limit yourself only to the breakout of High / Low and do not expect too much from the market, you can get a very good profit.

Position opening rules

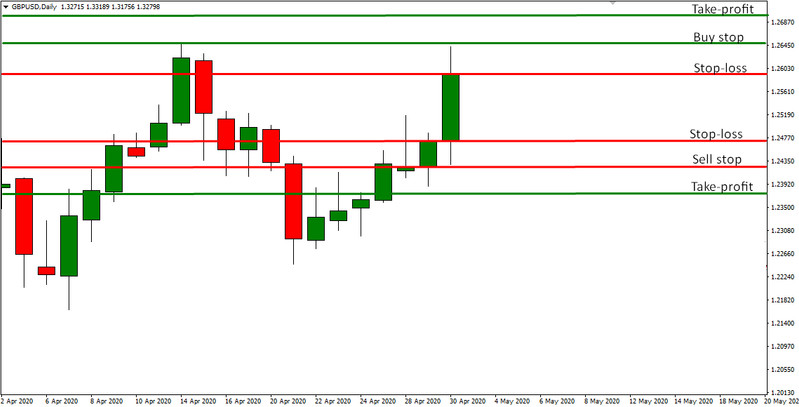

According to the rules of this strategy, pending stop orders are placed as follows:

Buy stop order is placed a couple of points above the High of the previous daily candle;

Sell stop order - a couple of points below the Low of the previous daily candle.

This gap of two to three points, firstly, helps to take into account the spread, and secondly, it protects against price movements that may try to collect liquidity at the Low and High points of the candlestick. This pair of points will not save you completely from accidental activation of orders, but it will provide quite good protection against unforeseen market movements.

Stoploss and TakeProfit

Stop-loss should be set at a distance equal to the tail of the previous candle plus two pips in case of widening spreads and unexpected market movements. Take profit is set at a distance equal to the corresponding tail of the previous candle.

As a rule, one of the pending orders is usually triggered. In rare cases, two. Moreover, on especially active days, both orders can work in a plus.

Supplements

1. In the event of a gap, that is, a gap between the closing price of the previous day and the opening of the next session, it is not recommended to open deals.

2. If the previous daily candlestick resembles a Doji candlestick in shape, it is not recommended to open trades.

3. If the previous candle has no or almost no tail, trade should be abandoned. Also, you do not need to trade if the tail is too long relative to the body of the candle.

At the end of the day, of course, all unworked orders must be deleted.

Conclusion

Mouse Tail is a very interesting strategy, especially when you consider the time it takes: it only takes a couple of minutes a day to trade. At the same time, with reasonable money management and strict adherence to trading rules, it brings a good profit.

It can also be adapted for other financial instruments, but it will almost certainly require adjustments related to the specifics of each individual instrument. The general principle is extremely interesting and has significant potential.