Pin Bar candles are a very popular type of trading candles among traders, on the basis of which a plethora of high quality and professional trading strategies are based.

On the one hand, Pin Bars can look very similar over time, but their importance can vary considerably, because in the case of Pin Bar strategies, their positioning also plays a significant role, which is also the alpha and omega for our trading strategy today.

What are Pin Bars

These are candles that have a long wick on one side and a relatively short body without a wick on the other, or in some cases they may have a body ending in a small wick.

Pin Bar Strategy

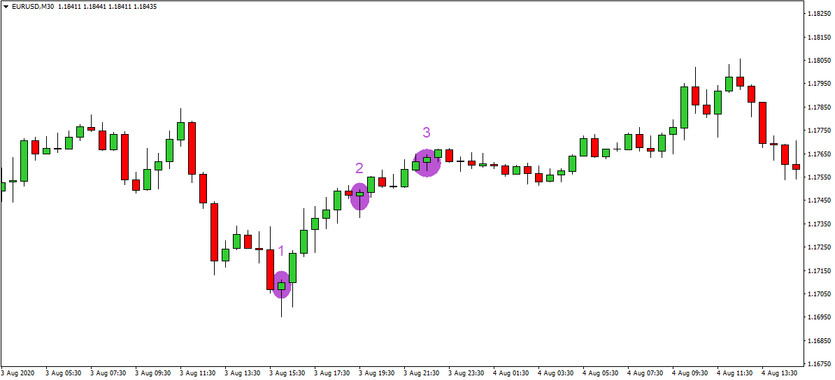

Today's Pin Bar strategy is based on searching for important reversal Pin Bar candles (the first candles on the charts below), after which traders usually enter trading positions. On the chart below, you can see several relatively identical types of buying Pin Bar candles which, across the similarities, have different meanings. In the first case, a Buying Pin Bar candle has formed after a relatively long selling trend, indicating that the buying side has finally gained the upper hand here and a trend change is likely to occur. The second Pin Bar, on the other hand, says that the buying side has regained strength after losing strength and the established market is thus likely to continue. In the third case, several buying Pin Bars have been formed in a row, which tells traders that there is uncertainty in the market and hence it is not clear whether the current trend will continue or not.

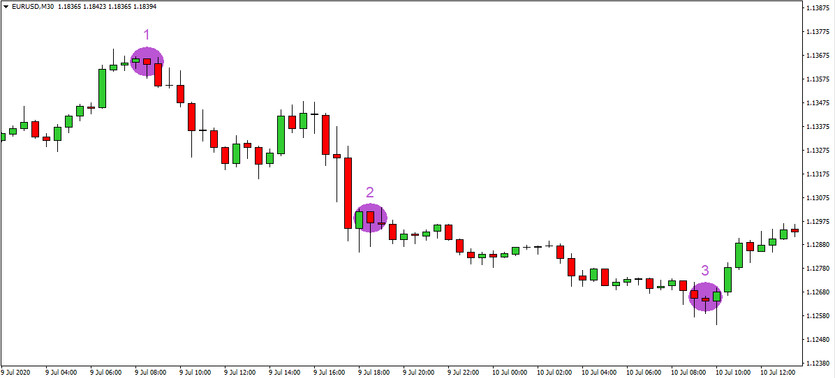

Here on the chart below you can see 3 types of Pin Bars, which also differ from each other in their positioning, which is a very important factor to pay attention to in a trading strategy. While the first Sell Pin Bar clearly indicates that a trend reversal is likely to occur (the candle was formed after a long buying session=>it therefore indicates that strength is running out on the buy side and conversely strength is increasing on the sell side), in the second case, although the Pin Bar formed again, but it was after a relatively strong selling session, which means that this candle, on the contrary, warns that the sell side has run out of strength at the moment and we need to wait to see if the strength will grow again or if the trend will change. In the third case, after a Sell Pin Bar has been generated, a Buy Pin Bar is also generated, which is usually a very strong indicator that the market will change direction, which it eventually did (note: the sequence of the two Pin Bars is important here, i.e. the first Sell and the second Buy).

Today's strategy is based on searching for and entering after reversal Pin Bars, as these candles not only offer traders the opportunity to make a large appreciation, but on the other hand, the risk of losses is also reduced in these cases, which is always a very important positive factor for any trading strategy.

Today's Pin Bar strategy achieves the best results in the markets when it comes to Pin Bars that have formed after particularly long trends. And if the markets often experience just such conditions, then it is usually possible to achieve success rates of even around a fascinating 75% with the Pin Bar strategy.