Renowned financier Toby Crabel's contribution to trading is that he was able to simplify Wyckoff's complex theory to analyzing patterns based on Price Action. Without using volumes and relieving the trader from the need to analyze the trend, Crabel discovered a way to make money on shock days without predicting the direction of the trend and analyzing volumes.

Major currencies are the most liquid and technical instrument that is weakly subject to the local influence of political and economic events. This increases the likelihood of working out the predicted shock day in advance.

The only book ever published by Crabel has detailed the 7-day range strategy. It is rumored that after the publication of the circulation of his book, Crabel, having changed his mind, tried to buy the entire circulation back.

Like many researchers, Toby Crabel noticed a feature of the cyclical price movement of the market, described in the book as stretch and squeeze. At a certain period, a jump in volatility led to the formation of candles with a wide range, which often ended like candle stub. This is a daily candlestick with the smallest range of movement of quotes within the day.

Quite long visual observations of the market-led, the author of this strategy to open periodically repeating ranges, the appearance of a candlestick at the end of which, with a 70% probability, predicted a shock day.

The observation problem was that the found "candle stubs," although they were the harbingers of a shock day, did not always allow us to determine the direction of the price movement of that day. Crabel found a way out by being the first to apply the following technique:

The trader does not need to predict the future closing of the day; placing two opposite pending orders gives the quotes the opportunity to indicate the trend direction themselves.

Conditions for opening positions

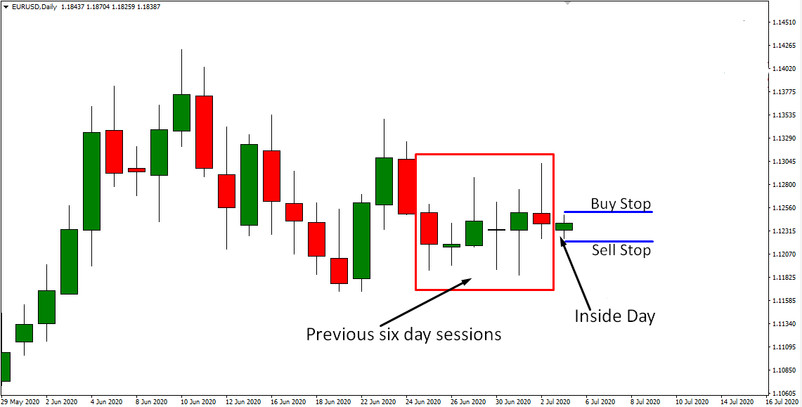

The main task of a trader in this strategy is to find a daily "candle stub" in a seven-day range. The author himself called such an "inside day" candle. An inside day is a session that has an abnormally low trading range. The calculation takes into account not only the body of the candle but also the tails - highs and lows. The following rules apply to designated inside days:

The range should be the narrowest in the previous six daily sessions;

Moreover, six daily candles should fluctuate within the average volatility values;

It is preferable that the found "candle stub" has the symmetrical shape of a classic candle.

If the above conditions are met, the trader places two pending orders at the end of the session:

Buy Stop - 5 points above the maximum;

Sell Stop - below the minimum by 5 points.

Stoploss and TakeProfit

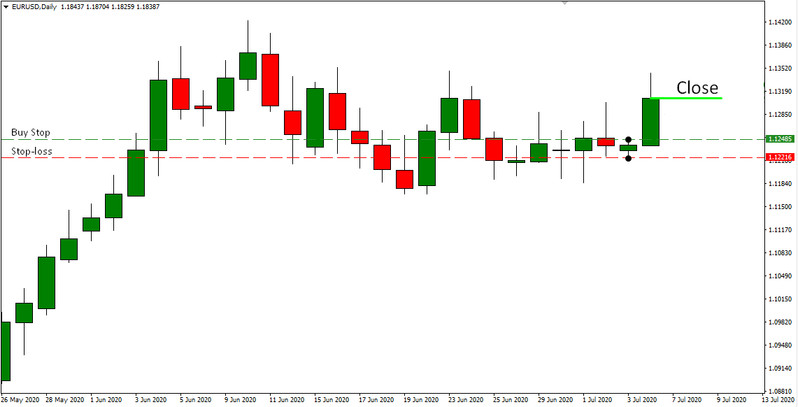

After triggering one of the two bi-directional pending orders, the second failed order is deleted, and stop-loss is set in its place. Take profit is not set - the position is closed after the end of the day trading session.

Conclusion

Despite the fact that the conditions of this strategy are quite simple, the events that lead to their implementation do not occur so often. This means that working with this system will not bring a large number of transactions. However, a correctly detected inside day over a seven-day period results in a 73% chance of a hit day.

The effectiveness of the strategy depends on the number of training: determine for yourself the shape and size of the inside candle for each pair - this will help to accurately find the signal on the chart.