Silver is one of the main precious metals that has become popular not only in the jewelry industry but also in financial markets. This trading strategy was created to trade the XAGUSD asset on Forex. The strategy is simple and straightforward. It is implemented using a single OsMA indicator and involves searching for inputs by trend. You can find its description and download this indicator on our website in the Indicators section.

This indicator is used on the D1 timeframe. This means that the OsMA Silver D1 strategy can be attributed to medium-term trading systems since the average position holding time is about six days. Nevertheless, this does not diminish the qualities of this strategy, but rather the opposite. By correctly calculating the volume of deals that you will use using this system, you can achieve stable positive results.

Indicator settings.

Silver is a special trading asset. Bullish trends and their behavior are different from bearish trends and their behavior in this metal. Therefore, the indicator should be configured separately for purchase and for sale.

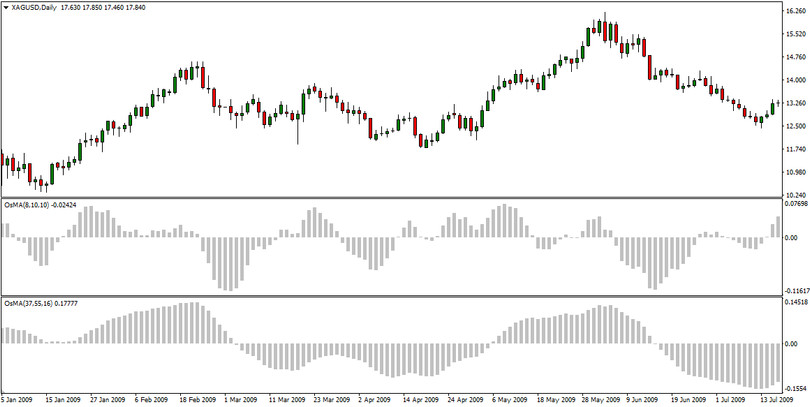

Apply it twice to the financial asset window XAGUSD timeframe D1.

To search for a buy signal, set the following parameters: FastEMA = 8, SlowEMA = 10, SignalSMA = 10.

To search for bearish signals, set 37, 55, 16, respectively.

Conditions for opening long positions.

1. An uptrend is clearly visible on the price chart.

2. In the OsMA indicator window that is configured to search for purchases, the histogram goes from the negative zone to the positive one. The transaction opens the next day after closing the previous day and fixing the bar graph in the negative zone.

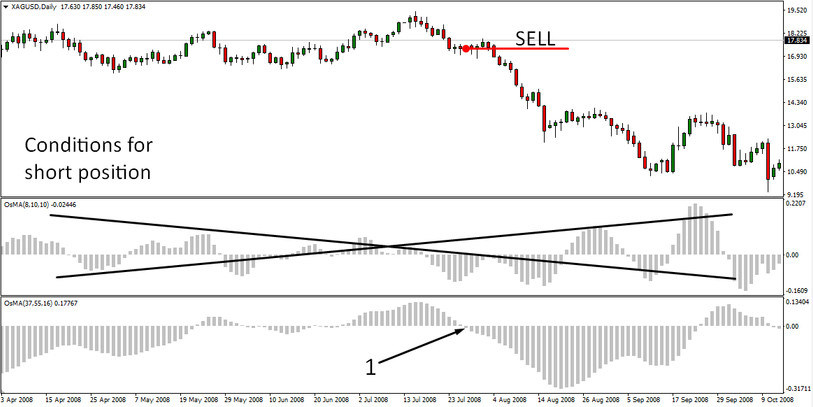

Conditions for opening short positions.

1. The histogram of the OsMA indicator configured to search for signals for sales from the positive zone goes into the negative.

As you can see, when opening short positions, the first condition that is in purchases is ignored. To enter a short position, it is not necessary to have a distinct downtrend.

Stoploss and TakeProfit.

In the OsMA Silver D1 strategy, stop loss and take profit are not set in advance. Closing of transactions is the reverse signal of the indicator. For example, for a long position, the signal for closing will be the transition of the histogram from the positive zone to the negative one. In this case, you should focus on the histogram of the indicator configured for purchases. And to close the deal for sale, the histogram of the indicator configured for the search for sales is taken.

Conclusion.

As can be seen from the description, this trading strategy is a leisurely and calm system. The most important condition for successful trading on it is the search for the optimal position volume. When selecting the position volume, you must take into account the size of your deposit and take into account the fact that the system does not provide for a predetermined stop loss. Try to choose the minimum volume and as low as a possible risk for your deposit. The quieter you go, the further you'll get.