Poker FX strategy is a very simple and straightforward trading system. This strategy will be especially convenient for those who have little time to trade since it uses the W1 timeframe.

The essence of the idea of trading with the Forex Poker strategy is that after every noticeable movement in the market, a rollback necessarily occurs. It does not happen that the chart only goes up or down. After any strong movement, a rollback necessarily occurs, which sometimes does not seem obvious on the price chart. If you look closely at any seemingly flat and recoilless chart on the W1 timeframe and pay attention to the tails of the candlesticks, you will notice that this is a pullback of 1500-3000 points in five-digit terms.

The trader's task will be to track the moment when the traded pair gets into overbought or oversold conditions and is ready to roll back. At this point, you need to enter a trade in its direction. The overbought or oversold condition of an asset is determined using the WPR indicator, which you can download on our website in the Indicators section.

Strategy settings

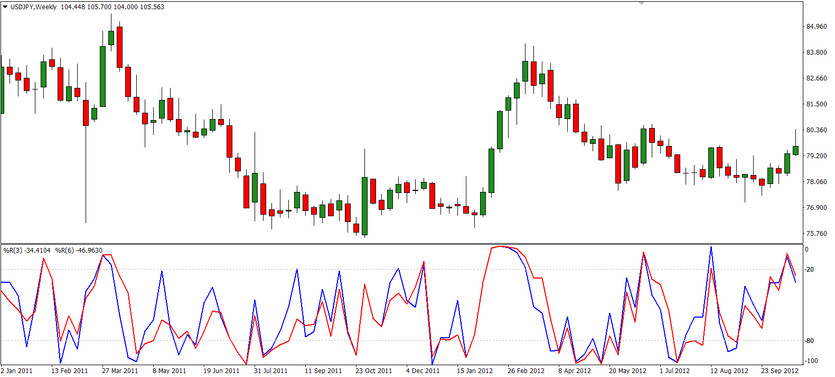

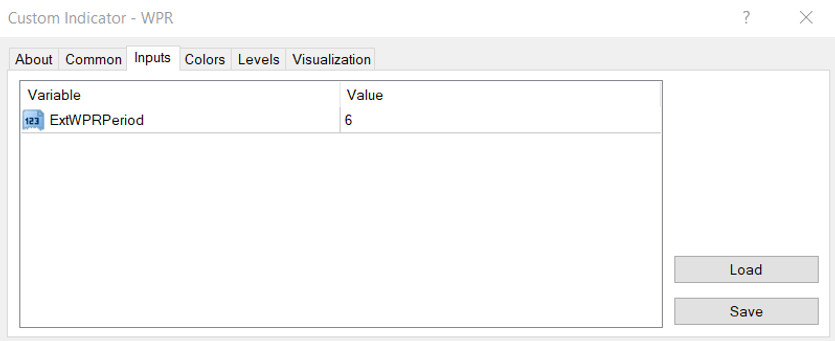

The Poker trading system uses only one indicator - Williams' Percent Range. This indicator shows the overbought/oversold condition based on the current closing price position in the range between the low and the high prices for previous periods. Set it on the weekly chart of the currency pair twice, one on top of the other, using a different line color.

For the first indicator, set the ExtWPRPeriod parameter to 3, and for the second - 6.

So, on the weekend, you need to evaluate the weekly charts of the selected currency pairs and note the readings of the WPR indicator. If it has a poker - a straight line with a bend or at least one of the lines is in the overbought/oversold zone - this is a suitable asset. In this case, both an acute and an obtuse angle of the poker are suitable. If not, this is not an appropriate currency pair. Then you should pay attention to the type of candlestick, the last one on the chart. The deal will reverse its direction. If the candlestick is bullish, then we sell, and if it is bearish, we buy.

Rules for opening long positions

The poker is bent upward on both WPR indicators;

Either both lines of the WPR indicator are in the oversold zone;

A clear bearish candle has been formed on the chart.

Rules for opening short positions

The poker is bent down on both WPR indicators;

Either both lines of the WPR indicator are in the overbought zone;

A clear bullish candle has been formed on the chart.

Stoploss and TakeProfit

The Poker FX strategy does not use a stop-loss. It is recommended to set a fixed take profit of 500 points in order to fix the profit. Or just close all deals at the end of the week. Closing all trades at the end of the week is actually the preferred option as it does not limit potential profits.

It should also be borne in mind that the absence of stop loss should be compensated for by money management conservatism. The recommended risk per trade should be 0.01 lots for every $ 3000.

Conclusion

The Poker FX strategy is very easy to learn and allows you to trade successfully for those who have little time to trade in Forex. This strategy has proven itself well and has many followers among traders. Perhaps it is not suitable for everyone due to the lack of stop-losses and trading on weekly charts, but the main thing is that the strategy is working, and with its help, traders successfully trade and make money on the market.