Puria, created about ten years ago, is rightfully considered one of the best trading systems that reveal the potential of moving averages. Over the time since its inception, many of its variants have appeared. However, the current dynamics of the foreign exchange market largely coincide with the characteristics of that time, so it is worth returning to the original values of the trading system.

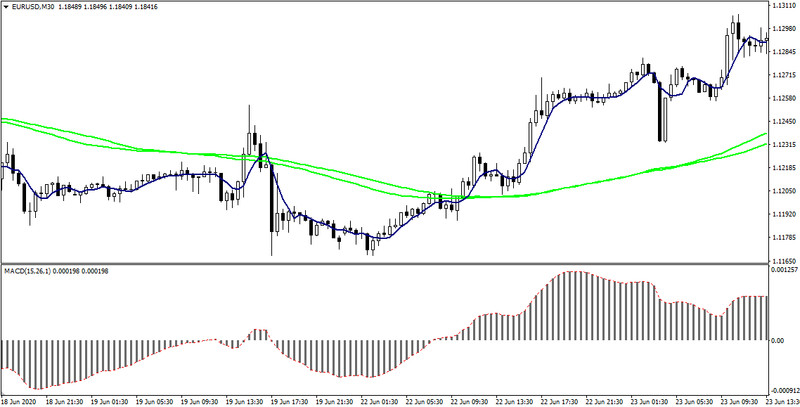

The strategy can be used on both majors and cross pairs. The optimal timeframe for use on major currency pairs is the M30 period when used on cross pairs - H1.

The Puria method uses the following indicators: MACD and three Moving Averages. All indicators can be found in the Metatrader terminal.

Strategy settings

Having applied all the indicated indicators to the chart of the traded currency pair, define the following parameter settings for them:

For two moving averages, set the MA method to Simple (default). The Period parameter for the first indicator is 75 for the second 85.

Make the third MA indicator exponential with a period of 5.

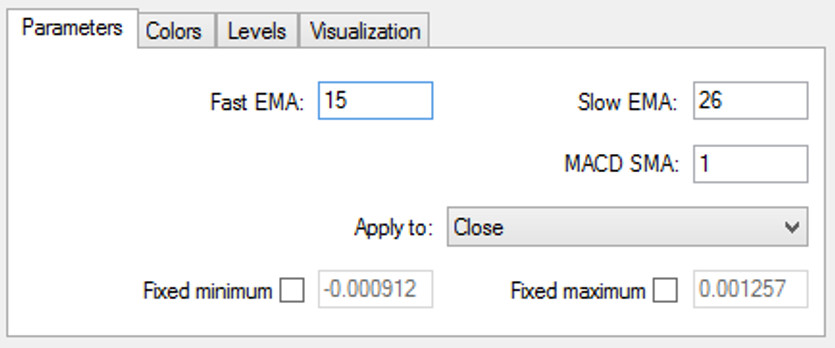

For the MACD indicator Fast EMA = 15, Slow EMA = 26, and MACD SMA = 1.

Trading signals are based on the principle of intraday trading in the direction of the medium-term trend. It is determined by two large-period moving averages. Two indicators are needed to avoid flat signals. MACD serves as an additional trend filter.

Despite the intraday entries, the trader gets the opportunity to hold positions in the medium-term with strong trends, making a profit of up to several thousand points (five-digit).

Conditions for opening long positions

1. The line of the Exponential Moving Average indicator (5) crosses and rises above MA (75) and MA (85).

2. Histogram of the MACD indicator at this time is in the positive zone.

If these conditions are met, a buy trade is executed at the opening of the next candle.

Conditions for opening short positions

1. The EMA indicator crosses MA75 and MA85 from top to bottom and turns out to be below them.

2. The MACD histogram acquires negative values.

Stoploss and TakeProfit

General trading rules suggest placing a stop-loss behind the extremum of the first candlestick before the trade (or the signal candlestick of the deal itself), provided that its tail is behind the lines of Slow MAs:

Above MA line (85) for shorts;

Below the MA line (85) for a long.

The deal can be complemented by a trailing stop, which is moved along the lines of the MA indicator (85).

It is recommended to set take profit based on stop loss values, increasing it twice.

Conclusion

One of the strengths of the Puria strategy is the reliable and simple rules for opening a position, thanks to which it can be used by novice traders. The trading system works on standard indicators; therefore, it is available in any Forex terminal.

It will not be difficult for professional traders to modernize the strategy by adding indicators that cut off flat areas (volatility, Bollinger bands, etc.). This can significantly increase the profitability of the system.