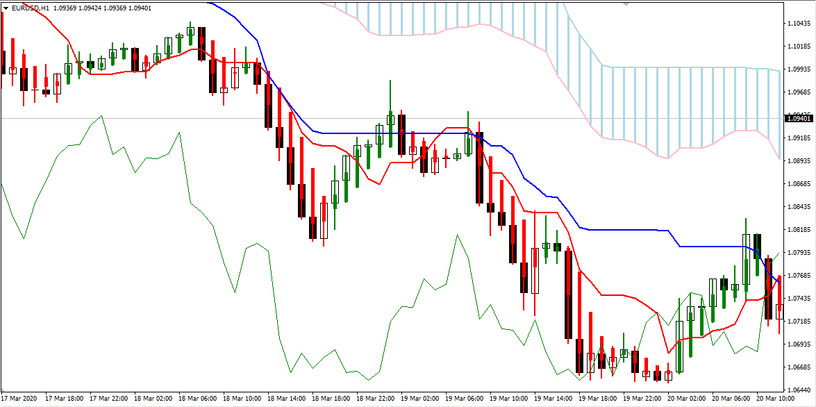

To use and work with the Ichimoku & Heiken Ashi strategy, you need to set two indicators that will serve as signals for opening deals.

- Ichimoku indicator . - It is considered one of the most advanced trend indicators in its category.

- Indicator Heiken_Ashi . - This is an indicator of the construction of Heiken Ashi candles, which visualize trends more clearly than ordinary Japanese candles.

You can learn more about these indicators, their construction methods, as well as download these indicators on our website in the Indicators section.

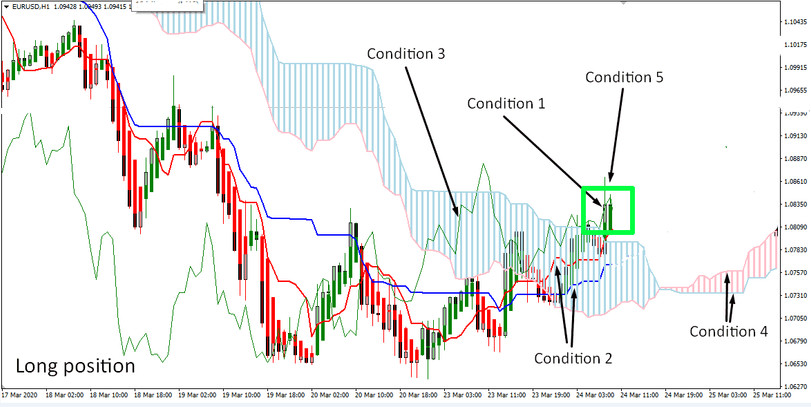

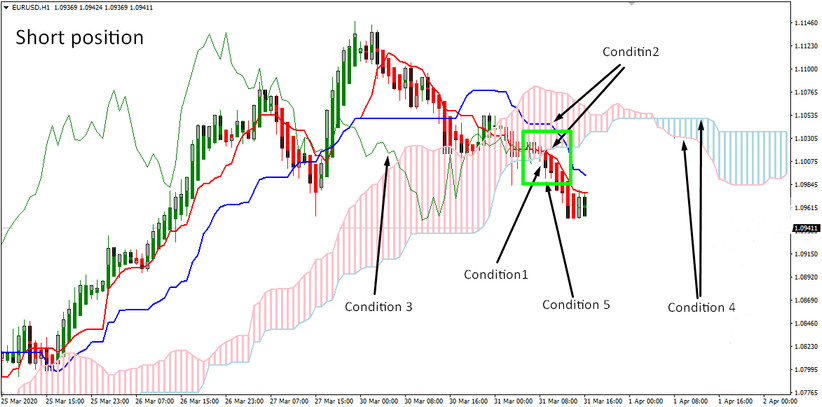

For this trading strategy, it is recommended to use the H1 timeframe. The strategy itself is suitable for most major currency pairs.

Having applied both indicators to the asset chart by which we will look for entries into deals, we can begin to search for conditions that satisfy the rules of the strategy.

Conditions for opening long positions:

Opening short positions is similar, but with the opposite values:

Closing positions in this strategy is supposed to be carried out in two ways - using a trailing stop or a return signal.

Conclusion

Subject to clear rules and conditions for deals, the strategy of Ishimoku & Heiken Ashi shows very good results. Practice abiding by these conditions and opening deals only in the presence of the above events.