One of the main advantages of intraday trading is the speed and greater number of trades compared to medium-term trading. This allows the trader to quickly navigate the setup of the trading system and much faster to understand the effectiveness of the strategies used.

Intraday strategies are very diverse in the direction of their trading logic. RSI Reverse M5 is an intraday trading strategy. It is universal and can be applied to most of the currency pairs available on the market. It is used on the 5-minute timeframe.

The strategy is based on the readings of two standard indicators: the RSI and a Moving Average. They are available in the latest builds of the Metatrader terminal, and you can download them for FREE in the Indicators section here.

Indicator settings

- RSI indicator input parameter with a value of 14 (default). Change the indicator levels as follows: level 30 to 20, level 70 to 80.

- Set the period of the Moving Average indicator to 55.

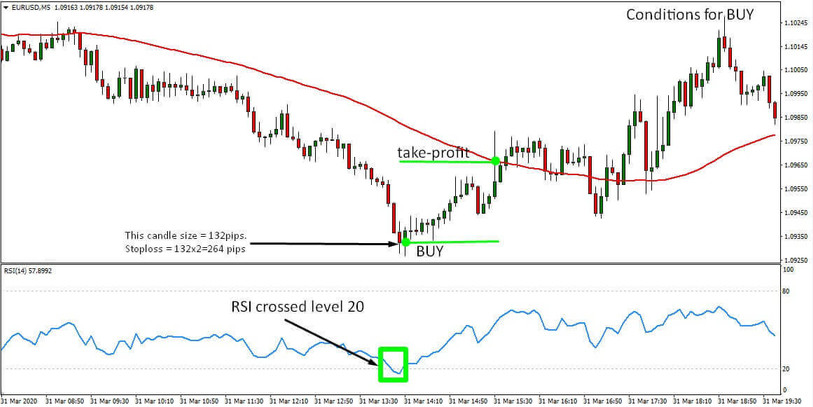

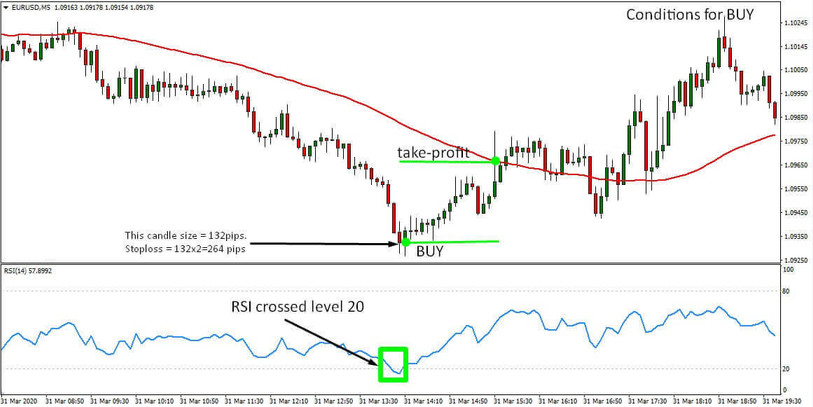

Terms for a BUY deal

- The Moving Average indicator serves as a signal to exit a position. When the price of a currency pair touches the moving average line from the bottom up, the deal should be closed.

With this strategy, it is recommended to place the stoploss at a distance of two sizes of the candle, which preceded the candle on which the transaction was initiated. In the above example, when the RSI line crossed level 20, the size of the candle is 132 points. So the stop loss in this situation is set at a distance of 264 points from the deal opening price.

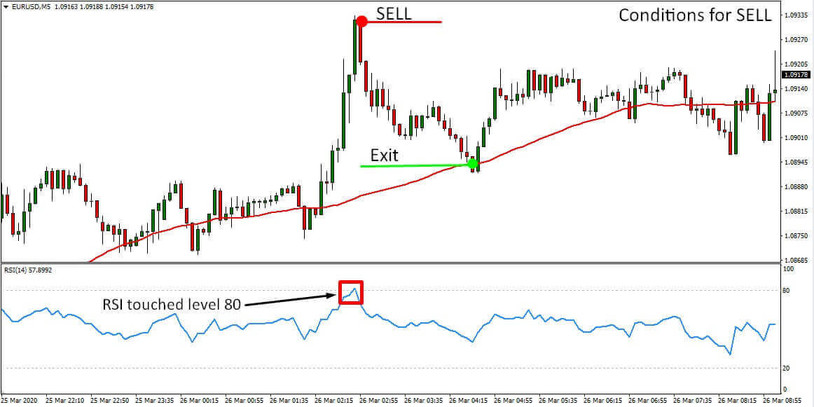

Terms for a SELL deal

The same conditions, but with the opposite values, must be observed when searching for a sell signal.

- The deal should be closed as soon as the price of the pair approaches the moving average from top to bottom and touches it.

The stoploss should be set at a distance of double the size of the candle preceding the opening of the position.

Conclusion

Before starting to use this scalping strategy on a live account, we recommend practicing a demo so that you can evaluate the results and dynamics of this system. Select the lot size based on your deposit so that it takes into account the probability of a series of losses that your deposit will sustain without serious consequences.

All scalping strategies involve working with small volumes of trades, as they are focused on quantity. Given the strict observance of the simple terms of the RSI Reverse M5 strategy, a series of profitable trades is likely to compensate for a series of losses.