At one time, the Smart Trader trading system was quite popular on Forex, but later traders gradually began to forget about it, as a result of which this technique was forgotten for many years.

Back in 2008, the retail segment of the foreign exchange market was fundamentally different from modern FOREX (spreads were higher, the order execution speed left much to be desired, brokers prevented clients from working, etc.), many traders preferred to work on large time frames.

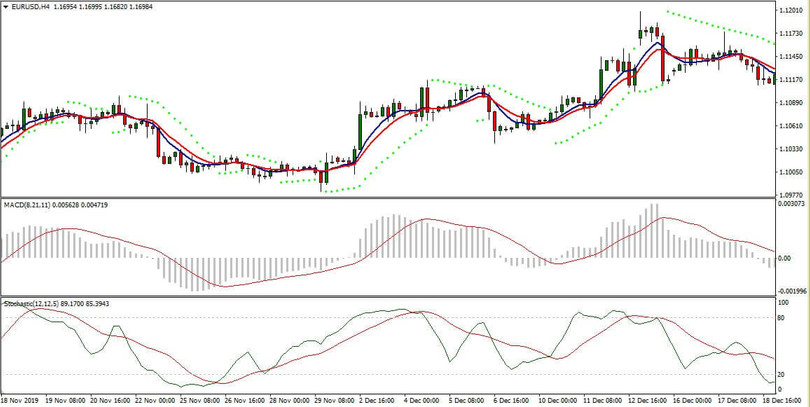

Against this background, the Smart Trader trading system appeared, which was optimized for a four-hour timeframe. Initially, the system was built for trading with the EURUSD currency pair, but later, it became clear that the system can be successfully applied to any currency pair.

The Smart Trader system consists of four technical indicators: two MA, Parabolic SAR, MACD, and Stochastic.

Indicator settings

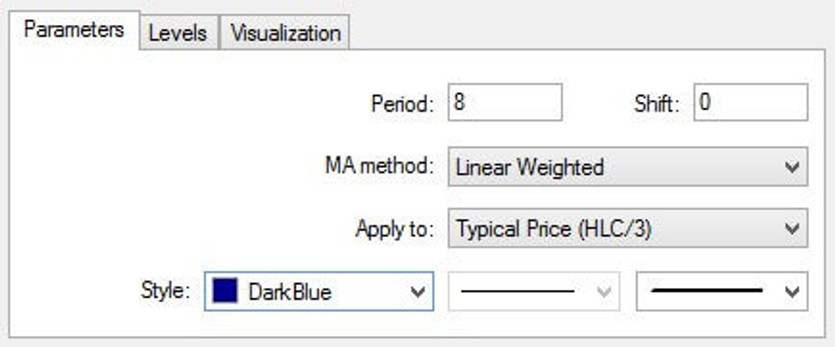

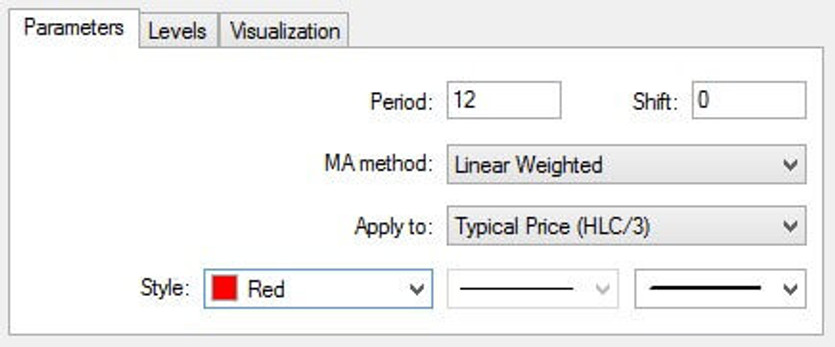

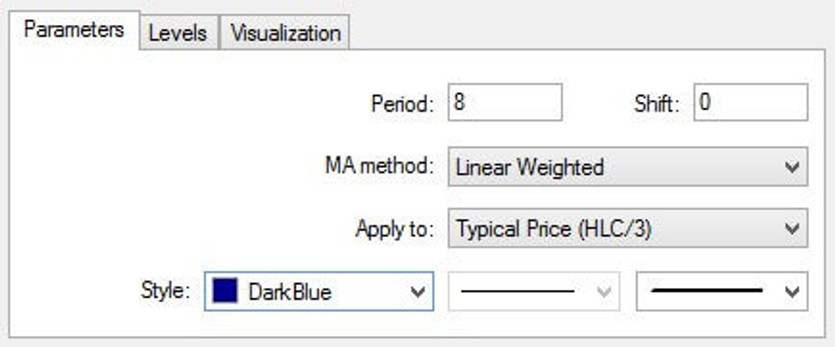

Apply the MA trading indicator twice to the chart and set the following parameter values:

- For the first MA - Period = 8, MA Method = Linear Weighted, ApplyTo = TypicalPrice (HLC/3);

- For the second MA - Period = 12, MA Method = Linear Weighted, ApplyTo = TypicalPrice (HLC / 3);

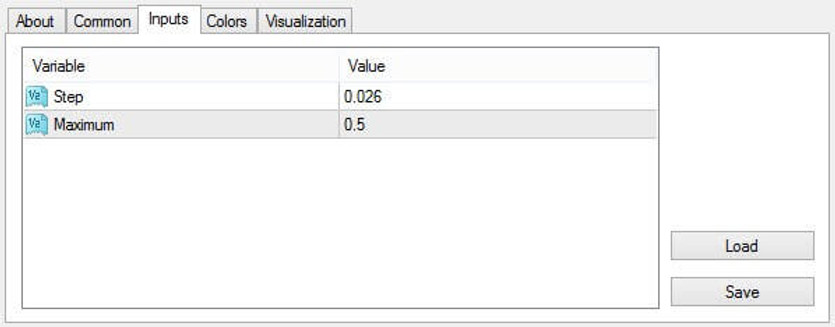

- Then, set the Parabolic SAR indicator with the following parameters: Step = 0.0026, Maximum = 0.5.

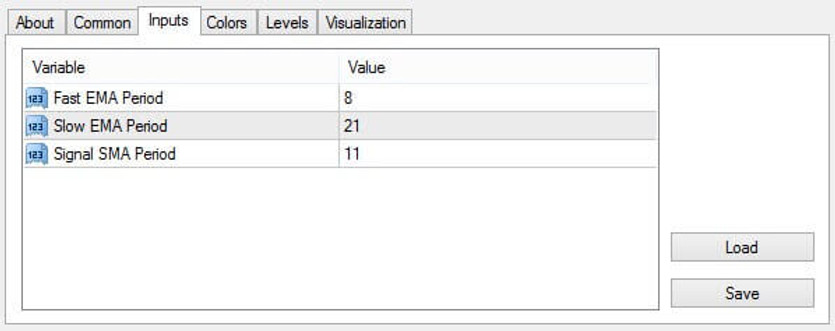

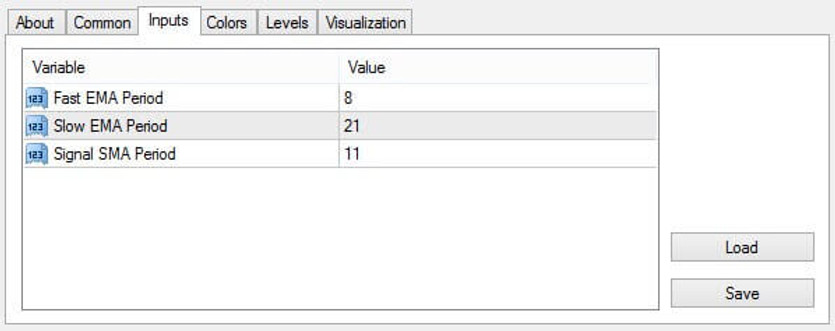

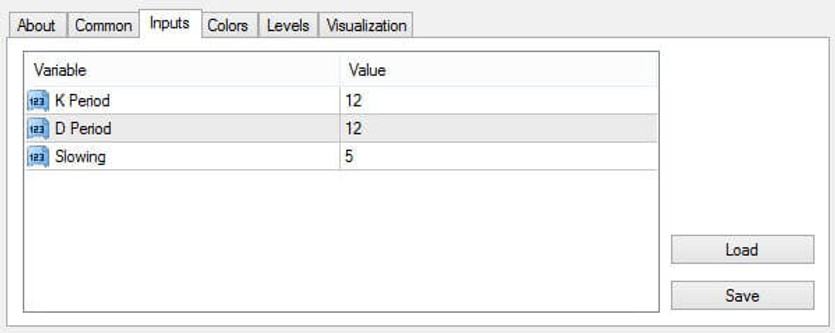

- Also, apply the MACD indicator with values 8, 21, and 11.

- The last indicator used in this strategy is Stochastic with the values 12, 12, 5.

Since the Smart Trader trading system was created for the H4 chart, its signals will appear quite rarely. On the other hand, experiments have shown that patterns can be searched not only on EURUSD but also on other currency pairs, so the total number of transactions in this strategy is sufficient to assess its profitability.

Conditions for opening long positions

According to the rules of this methodology, buy transactions are concluded subject to the following conditions:

Conditions for opening short positions

Sell deals are made according to the opposite principle, i.e., Smart Trader trading system should find the following patterns:

In addition, a position can be opened if, 20 hours (5 candles) after the crossing of the moving averages, the Parabolic SAR also changed direction.

The last rule of the Smart Trader trading system sounds a little confusing, so let's look at an example. Suppose that the market was in an uptrend, within which the trader opened positions at the crossing of the Moving Average.

This is a standard situation, so there is nothing to comment on, but sooner or later, the trend will change, i.e., the price will break through the parabolic counting.

And here a natural question already arises - is it allowed to open a sell order at this break? Yes, this can be done, but for this, the intersection point of the blue and red moving averages must be located no further than five candles from the current price.

Stoploss and TakeProfit

The Smart Trader trading system does not provide for fixed stop losses and take profits - the system advises to follow along with the market until a specific signal to exit a position appears.

In particular, the profit is followed by the following method:

First, you need to wait for the moment when the stochastic reaches the overbought/oversold area;

Once this has happened, you should hold a profitable order until both lines of this oscillator return to their normal range again.

A losing trade is always closed after the short-term trend reverses, i.e., when the Moving Average cross in the opposite direction.

Conclusion

As for money management and risks, the system assumes a trading volume equal to one-hundredth of a standard lot (0.01) for every $ 500 of the deposit.

This system is considered one of the most sustainable and profitable Forex trading strategies. By adapting to it and observing the conditions of money management, you can achieve excellent trading results.