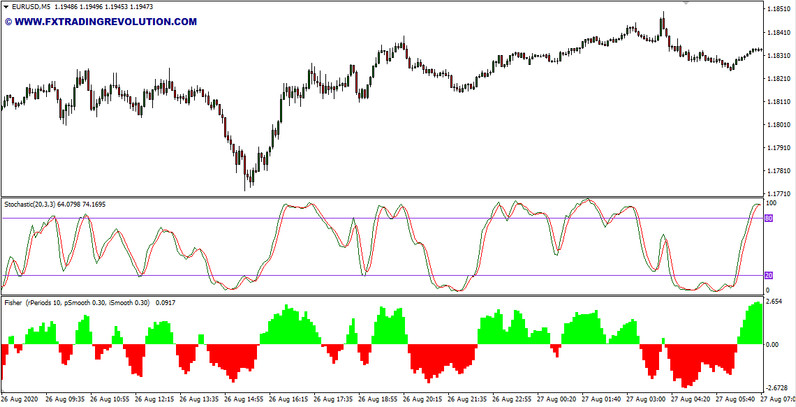

Forex strategy Stochastic-Fisher is based on two popular indicators - Stochastic and Fisher. Used correctly, they not only provide a high percentage of accurate signals to enter a trade but also effectively filter out and eliminate deficiencies for each other. Both of these indicators can be downloaded for free on our website in the Indicators section.

Strategy settings

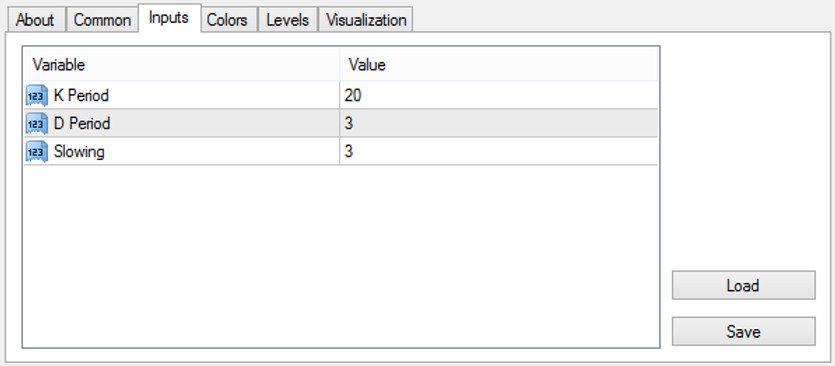

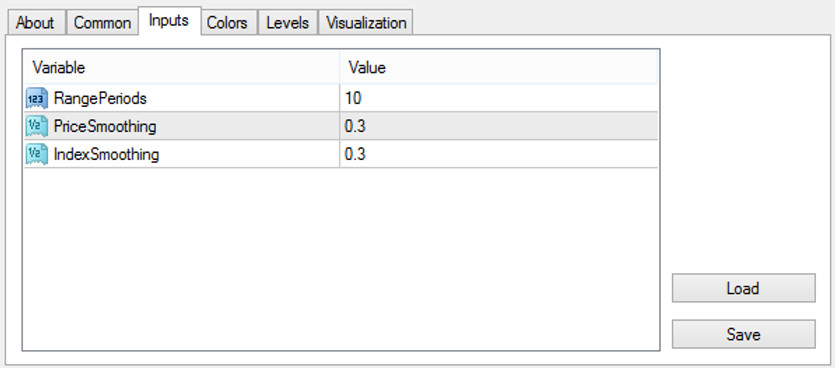

Having installed both indicators on the chart of the traded asset, assign the following parameter values to these indicators:

Stochastic indicator - KPeriod = 20, DPeriod = 3, Slowing = 3;

Leave the Fisher indicator with the default values;

The standard timeframe of the chart is one minute (M1).

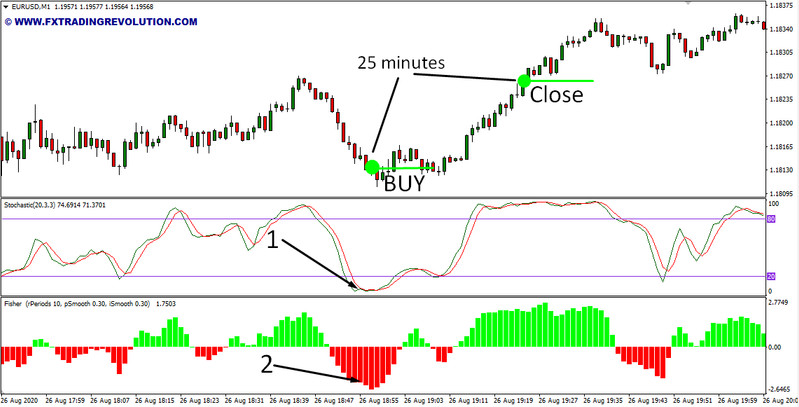

Conditions for opening a long position

1. The Fisher indicator's histogram is in the -2000 zone or below.

2. Stochastic signal lines crossed below the value of 20 (the green line is at the top, and the red one is at the bottom).

When these conditions are met, a buy trade is opened.

Conditions for opening a short position

The same conditions, but with opposite meanings for sell trades:

1. The value of the bar of the Fisher indicator's histogram is equal to or greater than 2000.

2. Stochastic signal lines crossed above the value of 80 (the green line is at the bottom, and the red one is at the top).

Stoploss and TakeProfit

The Stochastic-Fisher system uses the concept of "deal's term." This means that the deal must be closed at the end of the specified time. In this case, each of the open trades, according to this strategy, must be closed after twenty five minutes from the moment of its opening, regardless of whether the trade is in profit or at a loss at the moment.

Conclusion

The Stochastic-Fisher strategy has no complications or special tricks. Therefore, everyone can deal with it. Its main advantages are:

Clear and simple rules;

Dynamic trading;

The ability to use on binary options – due to the absence of a spread on options, this strategy shows more profitable results.

This system uses classic techniques and proven methods, so every novice trader should definitely study it and try it out.