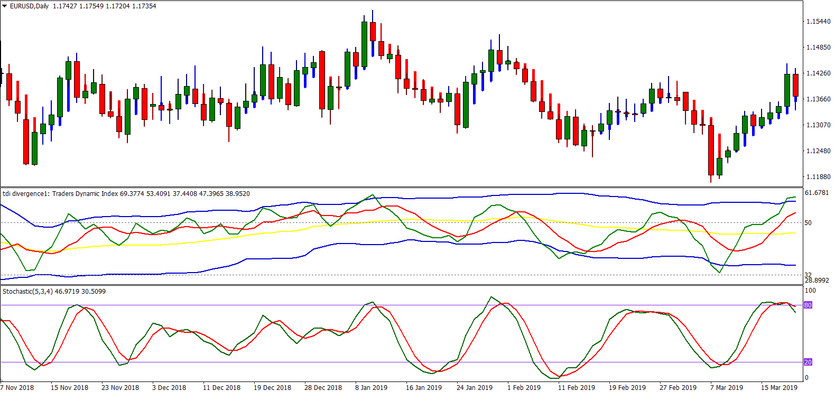

The TDI system is a trading strategy based on the Traders Dynamic Index indicator of the same name. In addition to this instrument, it also uses indicators such as Heiken Ashi and Stochastic. The system can work on any instrument, be it currency pairs, stocks, or indices. In fact, any trending instrument will work. Choosing a larger TF allows you to spend less time in front of the monitor. For D1, for example, you need to check for a signal once a day.

This system is suitable for those who are looking for calm and conservative trading.

First of all, you should determine the presence of a strong trend in the traded asset. Then, after confirming the presence of a trend, you should wait for a corrective impulse. The corrective impulse is found using the TDI indicator. After that, the continuation of the main strong impulse is determined, again, using the TDI.

The Stochastic indicator should determine the very first trend impulse. Stochastic is, as you know, an oscillator, and it has levels - 20 and 80. Usually, these levels are called oversold and overbought levels. If you are at least a little familiar with Stochastic and its basic rules of use, you know that if the price is in the overbought zone, only sales are usually considered. That is, it is believed that there is no point in buying. Conversely, when the indicator falls below 20, it signifies a buy signal into the oversold zone.

In this system, on the contrary, a return signal is used. When level 80 is reached, purchases will be considered, and when approaching 20, sales will be considered. We can say that it is not quite a standard technique. That is, in this case, if the momentum is directed upwards and Stochastic is above 80, then we expect a very small pullback and further continuation of the first strong impulse.

The momentum must be strong enough so that it can break through the higher levels and take out stop-losses of other players by activating their orders.

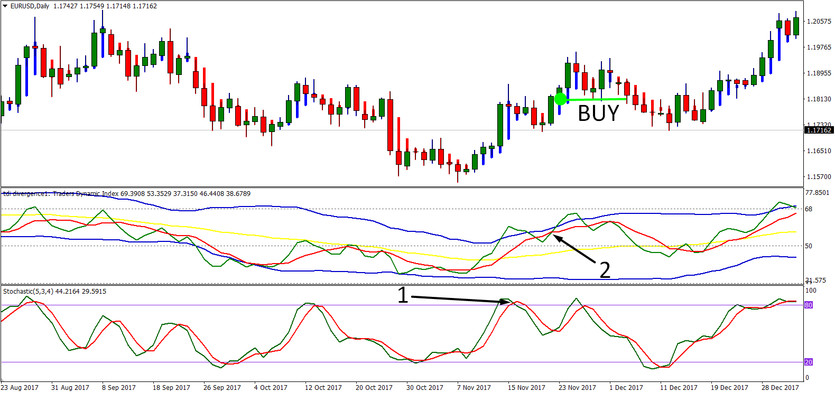

Buy signals

According to the rules of this trading strategy, a signal to buy is the occurrence of the following conditions:

1. Both Stochastic lines are above the 80 level, that is, they are in the overbought zone.

2. The green TDI line crosses the red one from the bottom up or touches it from the bottom, while both lines are above the yellow one.

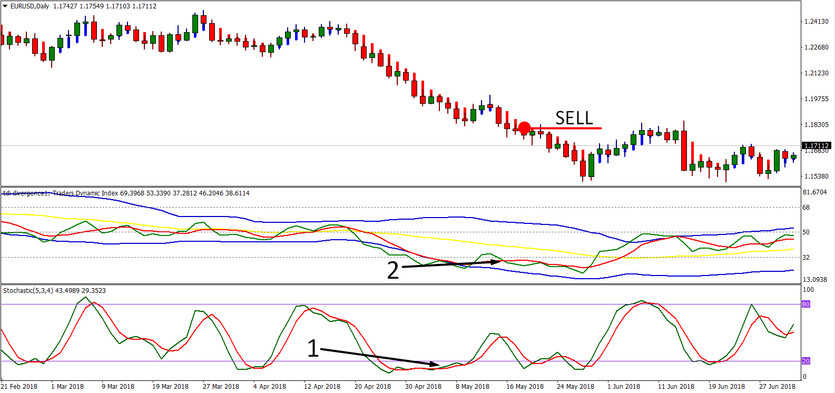

Sell signals

1. Stochastic should be below level 20, that is, in the oversold zone.

2. After that, the green TDI line must cross the red one from top to bottom, and both lines must be below the yellow one. Or, the green line should bounce off the red one without crossing it.

Addition

Here it is important to clarify what counts as a bounce and what is not. In this case, you need to fix the situation when the green line came close to the red one and bounced off. This will be considered a bounce. That is, the lines did not intersect, but came close enough to each other, after which the green one abruptly changed direction.

Stoploss and TakeProfit

Since this strategy is considered conservative, therefore, the volume for each trade should be minimal. This reduces risks and allows you to keep a position without a stop loss.

You should exit the deal when the following conditions occur:

A different color Heiken Ashi candle appeared;

The reverse crossing of the TDI lines has occurred;

Stochastic left level 20 (for sale deals) or 80 (for buy deals).

Conclusion

The TDI System strategy is simple, built on clear principles. Its application in practice should not cause difficulties, given the high timeframe. Because the simpler the strategy, the harder it is to break it over time. In other words, the more likely it is to withstand over time, and the much less likely it is for simple human error. After all, the simpler the mechanism, the more difficult it is to break it.

The strategy is also notable for the fact that it uses methods different from the Stochastic stereotypes, which allows it not to be in the majority group, that is, the crowd.