TEMA Reversal Capture Trading Strategy is a simple, simple system that can be applied to any trading asset on the H4 timeframe. This strategy can be attributed to medium-term trading strategies since the retention time of most trades is approximately several days. Sometimes it can be a week or even more. The system is implemented using the TEMA indicator, which is a modified version of the moving average.

You can download TEMA MT4 indicator in the Indicators section of our website.

Here, the work of the strategy on the EURUSD currency pair will be demonstrated. You can apply it to any other asset, following the rules for opening positions in this system.

Indicator setting

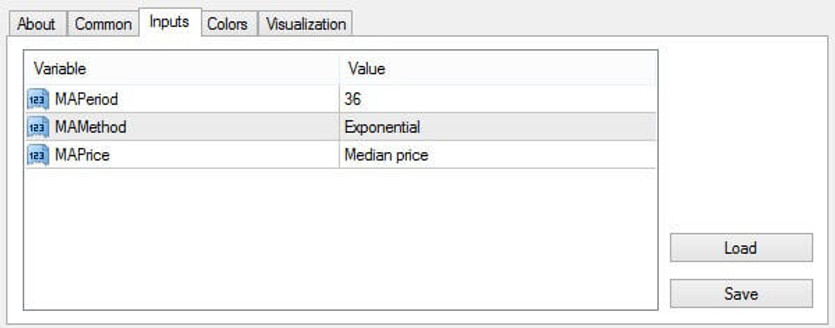

Apply the TEMA indicator to the EURUSD trading asset chart on the H4 timeframe. Set the following parameters for it:

- MAPeriod = 36, MAMethod = Exponential, MAPrice = MedianPrice.

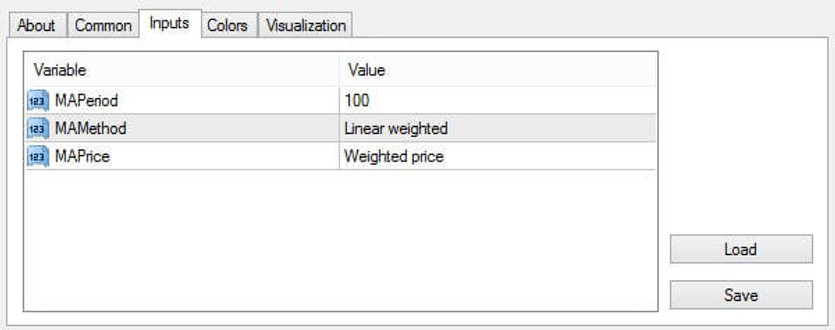

Then apply another TEMA indicator to this chart with the following parameter values:

- MAPeriod = 100, MAMethod = Linear weighted, MAPrice = Weighted price.

Thus, the chart should display two lines of two TEMA indicators with different parameter settings. In order not to confuse both lines, change the color of the line of the second indicator to any other (in our example, it is green).

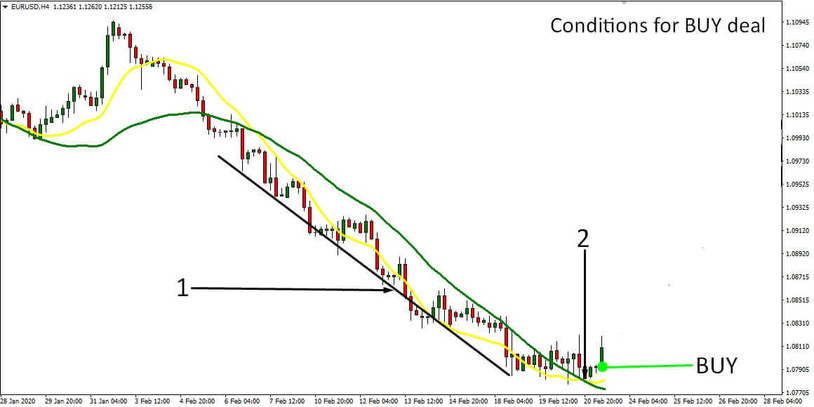

Conditions for opening long positions

Conditions for opening short positions

- The same conditions are valid for opening short positions.

- The lines of both indicators crossed. In this case, before the intersection event, a distinct upward trend is visible on the price chart, the duration of which is the last 50 H4 candles or more.

Stoploss and Takeprofit

Stoploss is set at a distance of 1000 points from the deal opening price. Note that this value is calculated for the EURUSD currency pair. For other currency pairs, stop loss is selected individually, equivalent to the indicated points.

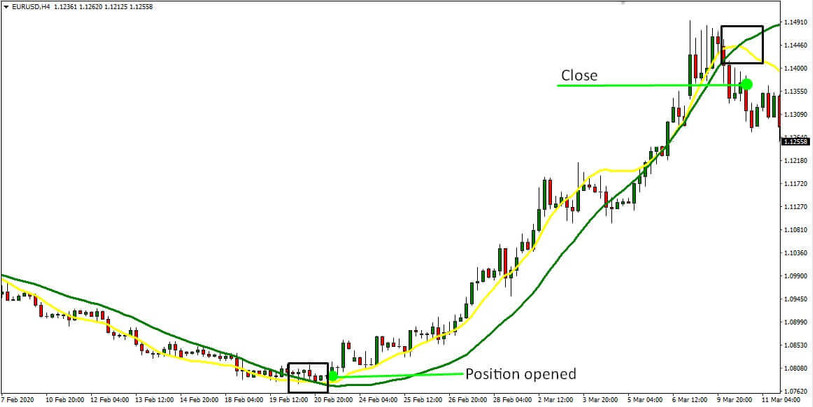

A trade is closed when the lines of both indicators intersect again.

Conclusion

Strategy TEMA Reversal Capture H4 is a medium-term trading system. It involves searching for and capturing a reversal of the medium-term trend or capturing the correction of a long-term trend. This means that with a positive outcome of the deal, the profit will amount to several thousand points. But also note that when closing at a stop loss, the loss on the deal will be a thousand points. Based on this, select the position volume that will correspond to these values.