At first glance, the Calm River strategy is very simple, since it uses only two moving averages. At the same time, the strategy is very effective and methodical. The goals are small, but true and happen with a high probability.

Many systems based on moving averages do not show the desired result, and their signals are often false. However, due to its peculiarity, the Calm River system works a little differently. Signals are caught without delay and are rarely false. But keep in mind that this system only works in a trending market.

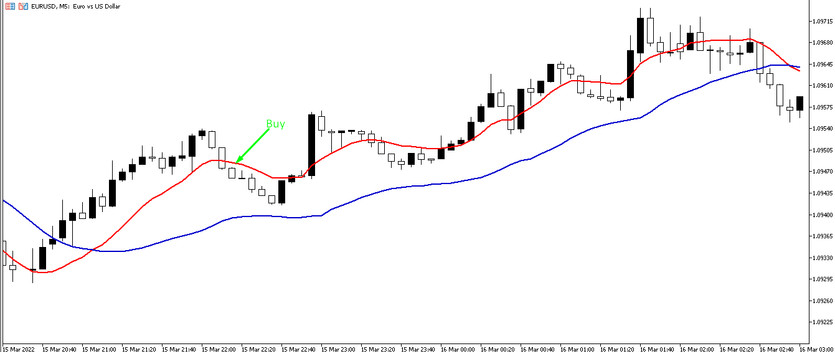

Both lines should be directed in the same direction, be as parallel as possible and have a smooth shape. In the Calm River strategy, lines are used as indicators with which the price should interact. The entry signal will be a price rebound from the moving average, provided that the latter maintains a trend position.

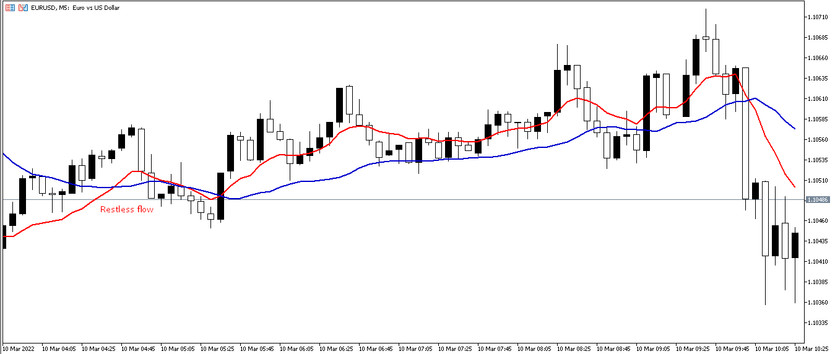

One of the advantages of this system is that it can use any currency pairs. The optimal strategy interval is M5, while it can be used on other time intervals. There are two price flows according to the calm river system: calm and restless

Trading with the Calm River system

To trade using this system, you need to set two exponential moving averages with periods of 20 and 50. After that, you need to wait for a parallel movement between them in one direction. At the same time, to make a buy trade, the price must be higher than the moving ones, and MA 50 is lower than MA 20. At the same time, the averages do not cross often, and both are directed upwards.

To make a sell trade , the opposite is true: the price is below the moving averages, above it is MA20, above it is MA50. At the same time, the averages do not intersect often, and both are directed downwards. This is how the presence of a trend is determined. Next, the desired signal is expected.

The signal comes on a rollback when the price is between the two lines. It is important that the price does not stay in this position for a long time; according to the strategy, no more than three Japanese candlesticks are allowed with closing between two lines. If there are more closures, the price is between the lines, then the entry is made, despite the fact that everything indicates a rise in price along the trend.

When making a trade using the Calm River system, you need to open two orders with the same lot size. The latter is calculated taking into account allowable losses of 1-2% per trade. A stop-loss order is placed beyond the extremum, which is behind or between two lines. Take profit is set only for one order and it is equal to the stop loss size. The second order is placed at breakeven as soon as possible, then the stop loss moves beyond the next extremes as they appear until the reverse close.

Conclusion

The Calm River strategy is an extraordinary trading system that shows excellent results. The main thing is its correct use and control of money management. The strategy is trendy, so you should not forget about using trending currency pairs.