The Serpentine trading strategy is a developed algorithm that is used to open certain trades in the direction of the current market movement. The strategy was based on effective indicators included in the standard Forex set. In combination with each other, confirming each other's signals, they determine the current trend, the direction of which determines the trade itself. Thus, before trading, the combination of indicators determines the trend and on the candle, on which the conditions of all indicators match, a trade is opened, but if at least one indicator does not generate a signal, the trading should not be started, it is recommended to wait for this signal.

The Serpentine strategy was created for the EURUSD and AUDUSD pair, while the timeframe is also limited by the choice of H4.

Strategy indicators

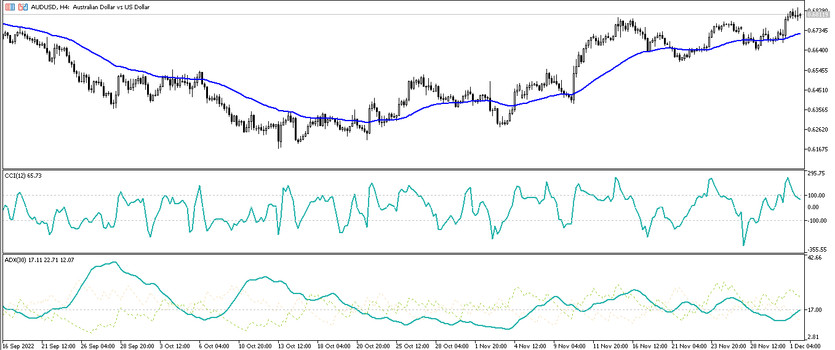

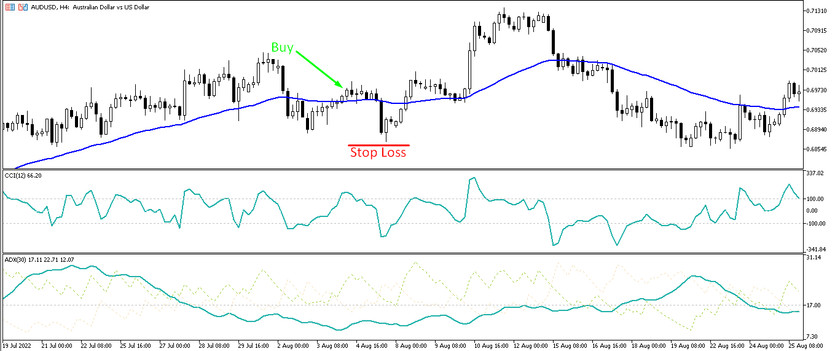

The Serpentine strategy includes three standard indicators, the effectiveness of which has been confirmed by time, and thus, working on the confirmation of each other's signals, they form a profitable trading strategy.

- SMA (24) - smoothed moving average with a period of 24.

- CCI - indicator of the technical analysis of the market with a period 17 and levels of 100 and -100.

- ADX - indicator with signal lines +D and -D, with a period of 30 and an added signal level of 30.

Trading with the Serpentine strategy

The algorithm for applying the indicator in practice is extremely simple. The main thing is to wait until the desired combination of conditions is obtained, which must match on a certain candle. If on a certain candle all three indicators confirm the presence of an uptrend, then a long position is opened, and if the indicators indicate a downward market movement, then short positions are opened accordingly. That is, a certain trade is opened taking into account the values of all three indicators on the signal candle.

Signal for Buy trades:

- The CCI indicator line should move smoothly up and cross its 100 level.

- The current price must be above the moving average.

- The ADX +D signal line should be above the -D line or above level 17, while the location of the main line does not matter much.

When a full combination of conditions is received, a long position can be opened on the signal candle. Stop loss should be set at an approximate extremum point or in the amount of 30 points. The trade should be closed after the appearance of at least one reverse condition from one of the indicators. At this point, it can be considered opening new trades due to a change in trend.

Signal for Sell trades:

- The line of the CCI indicator, moving smoothly down, crosses the level of -100.

- The current price must be below the SMA indicator.

- The signal lines of the ADX indicator crossed so that -D is above the +D line or level 17. However, the location of the main indicator line is not taken into account.

A sell trade can be opened on a signal candle immediately after receiving such conditions. A stop loss order should be placed at an approximate extremum point or in the amount of 30 points. A sell trade should be closed immediately after receiving at least one reverse condition from one of the indicators. Obtaining reverse conditions should be considered as a change in trend, which in turn allows considering the opening of new trades.

Conclusion

The Serpentine trading strategy is a very efficient and smart trading algorithm that helps to trade during a certain trend period. However, it is important to consider that the strategy is only suitable for two currency pairs and a timeframe, as the choice of other units may affect its functioning. In addition, it is very easy to use and suitable even for beginners. However, in order to get some practice, it is recommended to use a demo account beforehand.

You may also be interested The MAMB Trend trading strategy for the GPBUSD currency pair