All professional business strategies have a common denominator - rationality. More precisely, it means that they are built on rational bases.

However, there are also strategies that may seem to be hardly based on rational foundations, but the opposite is often true. This is also the case with today's strategy, where trading by the morning hours may seem to be nonsense, however, it is the morning hours in which the forex markets are formed and consequently are usually the stimulus for future developments. And this is actually really a highly rational base.

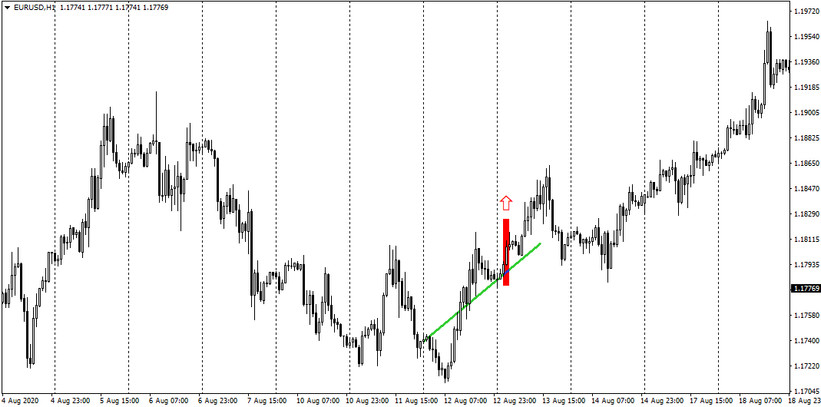

Today's strategy is based on two very simple factors, the first is to link the opening value of the current day to the opening value of the previous day and stretch this line further into the future (see green line below), secondly you need to know the closing value of the 3am candle (the red underlined candle, on the chart below). And it is this closing value that ultimately determines which direction the market is likely to go on any given day.

We can see that on the chart below there was a situation where a possible trend line, due to previous resistances, would have signaled a downtrend. However today's strategy clearly signaled an upward direction - more specifically the closing value located above the plotted directional line (green line), which eventually occurred.

Even in the next case below, today's strategy was not wrong. However, here we can see that after the market went in the signaled direction, it subsequently reversed and headed back. And these are the situations where experience and skillful setting of Stop-Losses and Profit-Targets determine success.

With the strategy called "Third Hour Decides" it is possible to achieve a success rate of more than 60%, but the final success rate is determined not only by the instrument traded, but also by the trading orders regarding profits and losses.