Price formations are one of the most powerful indicators in some currency pairs and other markets, which is why traders have been using them for decades.

Another reason why they are so popular is also their unique advantage, in which the formations offer traders trading opportunities without them having to search for any information about the current market situation and do even more lengthy trading analysis afterwards.

Formations - Three Big Brothers

The basis of the formation, as the name suggests, is three relatively large consecutive candles in the same direction. The important thing is that indeed these candles have relatively long bodies. Another feature that must not be overlooked is that the candle preceding the brothers is in the opposite direction, and at the same time this candle is shorter than each of the three brothers. And if this formation occurs in the market, then it is considered a strong trading signal to the opposite direction in terms of trading.

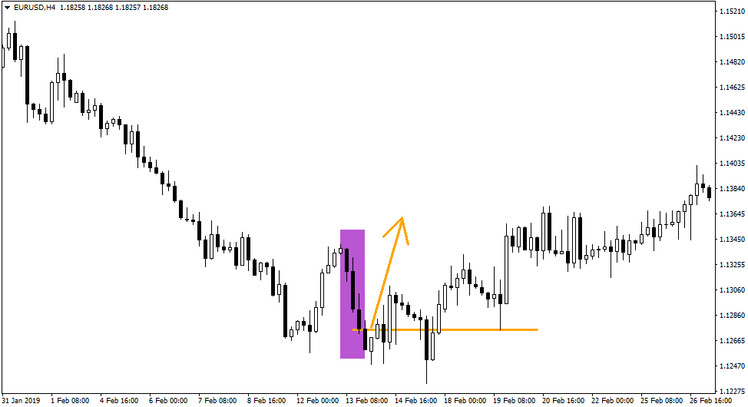

On the chart below you can see the price formation of the three big brothers descending, when after them another candle was formed in the same direction, but then the market reacted exactly as expected.

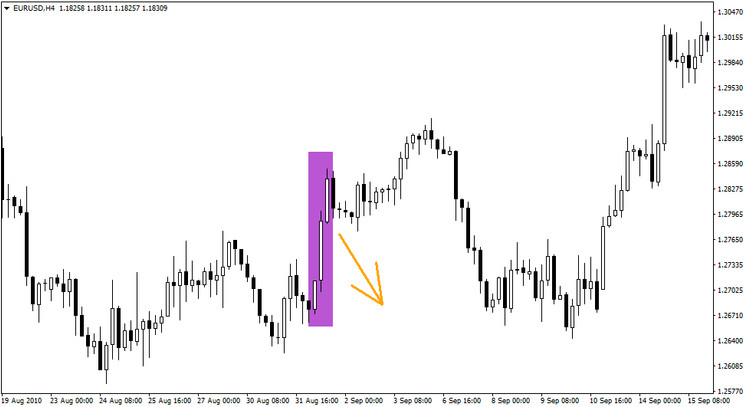

The reverse of course also occurs as can be seen in the chart below. However, it should be noted that the rising formation of the three big brothers is usually seen much less than is the case with the falling brothers.

The three big brothers are one of the formations that are very rarely seen in the markets, but when they do occur, the success rate of at least a minimal bounce in the opposite direction is above 80% and that is definitely worth the risk.