The head and shoulders pattern is a popular trading pattern that captures the imagination of those who aren't even traders. Perhaps this is because it's so easy to recognize or because of its name. Here’s how to use the head and shoulders pattern to make profitable trades.

What Is A Head And Shoulders Pattern?

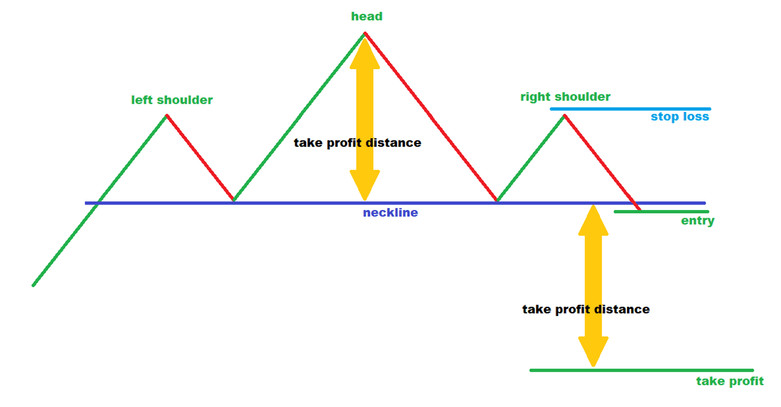

The head and shoulders pattern is a technical analysis pattern composed of three peaks. The first peak, called the left shoulder, is following by a second, much larger peak known as the head. The second peak (the head) is followed by a third peak of a similar size to the first peak. This third peak is known as the right shoulder.

The significance of the head and shoulders pattern is that the first peak results when the move that produces it fails to surpass that price level. There is then a retreat in price, following by a much larger upward move, which fails at a much higher level. This is then followed by another fall in price back to the same level as the first retreat. The right shoulder then rises but is once again stopped at the same price level as the first peak.

This failure of the peaks to surpass the price levels formed by the smaller peaks and the large peak suggests a reversal in the trend. The price level to which the down moves of each of the peaks retreat is called the baseline or neckline and is very important to identify in order to use the head and shoulders pattern effectively.

Trading The Head And Shoulders Pattern

It may be tempting to jump the gun after the head has formed, but it is vitally important to wait until the complete pattern has materialized. The last peak is vital to the formation and the retreat confirms that the third push of the pattern has truly failed. Without this confirmation, the statistical advantage inherent in the pattern is lost and you are essentially gambling.

The illustration above shows an ideal version of the head and shoulders pattern. Once the third peak begins to form, you can begin to plan your trade. The entry point will be when the neckline is broken by the downward move. The stop loss is set beyond the right shoulder. The take profit should be set at the point where the distance between the entry and the take profit is the same distance as that between the head and the bottom of either shoulder (your choice).

More conservative traders may allow the price to break the neckline and then wait for a pullback to touch the neckline. This is to ensure that the price doesn’t resume the trend that was in force when the head and shoulders pattern began.

Real-world head and shoulders patterns do not look like this. The lines will be distorted with market noise. Many times, the valleys on either side of the head will not perfectly match, but as long the pattern is there and meets the rules described above, it is significant.

The inverse head and shoulders is traded exactly the same way, except everything is upside down. For the inverse, the head and shoulders are actually valleys instead of peaks and the pattern suggests the reversal of a downtrend.

Conclusion

The head and shoulders pattern is easy to identify and pretty straightforward to trade. They can be very profitable and fun to trade.