The beginning of trading sessions are some of the most important milestones of any trading day. They tend to be so important that many experienced traders trade according to them, so do some investment companies and banking institutions.

The early trading sessions are especially important because they usually decide the direction the market will continue to take, which is such crucial information that traders should never overlook or underestimate it in any way.

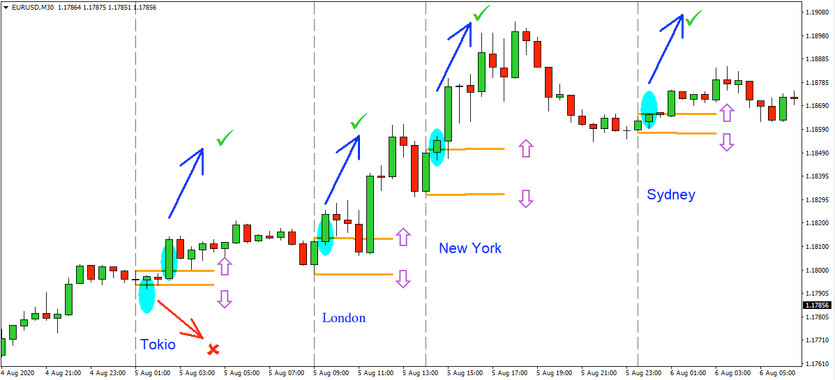

Beginnings of trading sessions

Tokyo - 01:00SET

London - 09:00SET

New York - 14:00SET

Sydney - 23:00SET

Today's strategy is not very complicated, as all that is needed is to wait for the start of any trading session, more precisely to wait for the 1st 30-minute candle to be generated (see chart below) and then place pending entry orders on its High (maximum) and Low (minimum) (We place pending buy orders on the "High" level and vice versa we place pending sell orders on the "Low").

In the chart below, you can see a practical example of trading in all four trading sessions, where in the first Tokyo session the market offered two trading opportunities, but unfortunately the very first trading opportunity turned out to be a loss (in any strategy you have to take into account losing trades). However, in the following cases, the strategy only saw opportunities with positive developments, which only proves how highly effective this unique strategy is in the end.

Our strategy today achieves the best results in the forex markets, specifically in the major currency pairs, where success rates regularly exceed 80%, allowing traders to choose from some of the more aggressive trading approaches.