The Trend Magic System strategy is a trading algorithm based on custom indicators, which in turn are modifications of standard forex indicators. The calculations of the indicators included in the strategy are based on determining the current trend and trading during this period. The indicators in the strategy work on confirming each other's signals, so when trading it is important to take into account the values of both indicators, which in turn determine the direction of the trend, taking into account which a certain trade can be opened.

The Trend Magic System strategy is suitable for use with any currency pair on any timeframe.

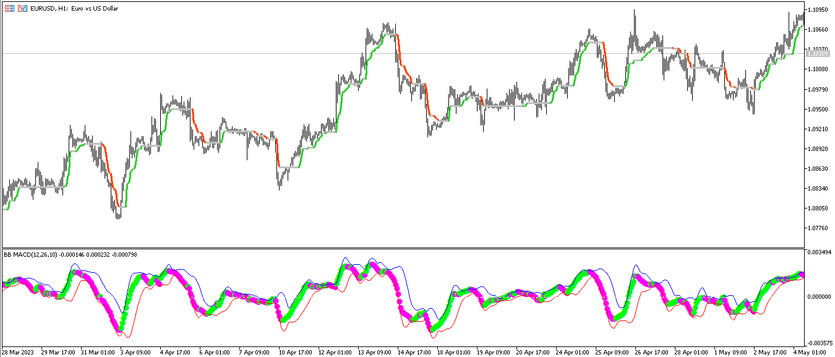

Strategy indicators

The Trend Magic System strategy includes only two indicators, and it should be borne in mind that each of them, in turn, consists of calculations from several indicators. The settings of the indicators remain unchanged, while their values may change when certain currency pairs and timeframes are selected.

- Trend Magic - trading indicator based on the interaction of CCI and ATR indicators. Its settings remain unchanged, i.e. 50 and 5.

- BB MACD -trend trading indicator, the calculations of which are based on the functioning of the Bollinger Bands and MACD indicators. Its settings also remain unchanged, that is, 12,26,10.

Trading with the Trend Magic strategy

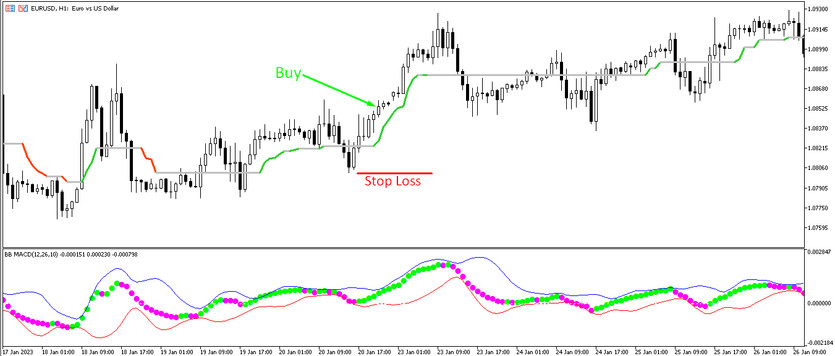

To open certain trades using the Trend Magic System trading strategy, it should be determined the direction of the current trend. To do this, it should be taken into account the values of both indicators included in its composition. If both indicators confirm the presence of an uptrend, long positions are opened, when a downtrend is determined, short positions are opened. In both cases, when the direction of the current trend changes, trades are closed. In this case, if one of the indicators is late with the signal, the trade should be temporarily not opened until the full combination of signals is received.

Conditions for Buy trades:

- The line of the Trend Magic indicator moves up and has a color with a growth value.

- The main line of the BB MACD is colored with a growth value and is moving up, approaching the upper border of the channel.

When a full combination of such conditions is received on a signal candle, a buy trade can be opened, due to the presence of an uptrend in the current market. Stop loss should be set at the point of a recent local extremum. If a return signal from at least one indicator is received, the trade should be closed. At this moment, the current trend may change, which in turn will allow considering the opening of new trades.

Conditions for Sell trades:

- The Trend Magic indicator has a color with a falling value and moves from top to bottom.

- BB MACD lines are moving down, while the line of dots has a color with a falling value and is getting closer to the lower border of the channel.

A sell trade can be opened immediately upon receipt of such conditions on a signal candle. At this moment, a downtrend is determined in the market. Stop loss is set at the point of a recent local minimum. The trade should be closed when the trend changes, namely when the opposite conditions from at least one of the indicators are received. At this point, it should be considered opening new trades.

Conclusion

The Trend Magic System trading strategy is based on the functioning of very accurate indicators, which, when interacting with each other, form a very effective strategy. It is very easy to use and suitable even for beginners. At the same time, it is recommended to practice on a demo account before trading on a real deposit, which will allow not only applying the strategy correctly, but also gaining the necessary trading skills.

You may also be interested The QQE RVI Universal trading strategy