The TrendLion trading strategy belongs to the so-called long-term investment systems. Long-term trading systems that operate on longer timeframes are generally low-risk systems, and this one is no exception. They do not bring exorbitant interest to traders, but in the long term, they show a stable average income. Serious investors and traders prefer these types of trading formats since their main priority is the lowest risks.

This strategy is implemented using two indicators: Gold Lion Trend and Exponential Moving Average.

Download the Golden Lion Trend indicator 100% For FREE here

TrendLion D1 system. Long-term trading with a stable result

As you can see, depending on the current market situation, the Gold Lion Trend indicator assigns certain colors to price candles. For example, during a strong bearish trend, the bars turn pink, and during a strong bullish momentum, they turn light blue.

In addition, when the strength of the trend reaches its maximum, the Golden Lion Trend turns bright red or blue (if we observe down and up impulses, respectively).

Indicator settings

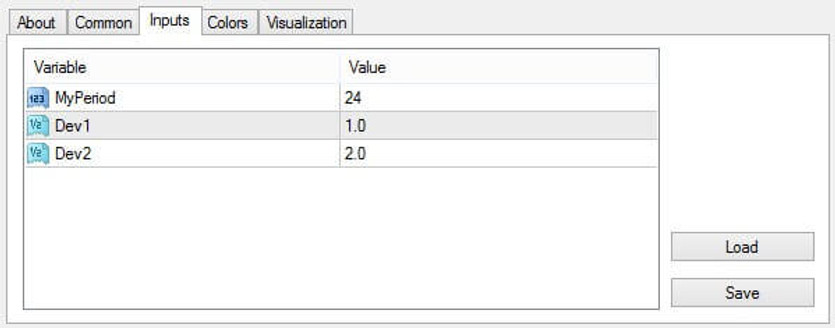

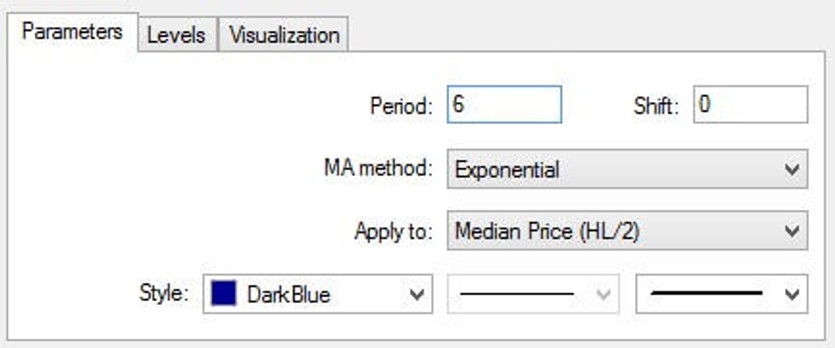

Having applied both of the above indicators to the chart of a trading asset on the D1 timeframe, set the following parameter values for them.

Gold Lion Trend indicator is installed with default values.

TrendLion D1 system. Gold Lion Trend Indicator

Set the following values for the moving average indicator: Period = 6, MA_Method = Exponential, ApplyTo = MedianPrice.

TrendLion D1 system. MT4 Indicator settings

Since the indicators included in the system work in the same way in both bullish and bearish markets, this strategy allows you to trade in both directions. The only thing that should be remembered is that all operations are opened strictly on the daily timeframe, but on the lower-order charts, the Trendlion strategy shows inefficiency.

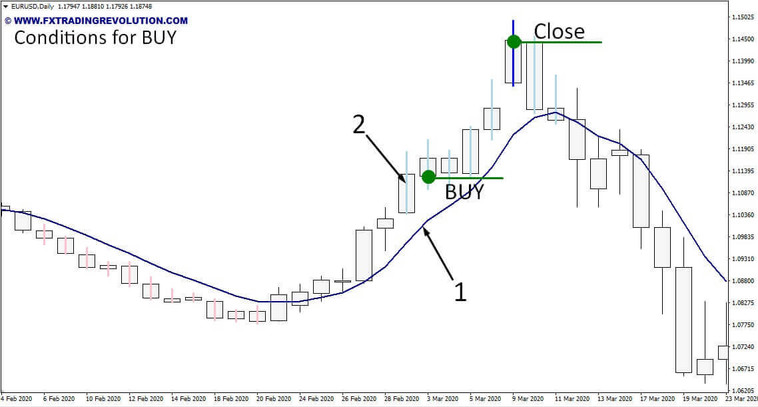

Conditions for opening long positions

To buy a currency pair, you must wait until the following conditions are met:

TrendLion D1 system. Buy deal

As you can see, the indicator signal helps to eliminate most of the false entry points, which are traditionally formed in flat, that is why the strategy template turned out to be so elementary (it does not contain additional complex filters).

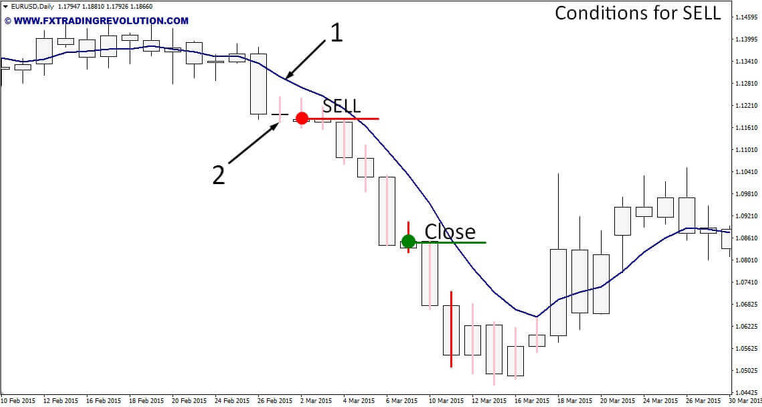

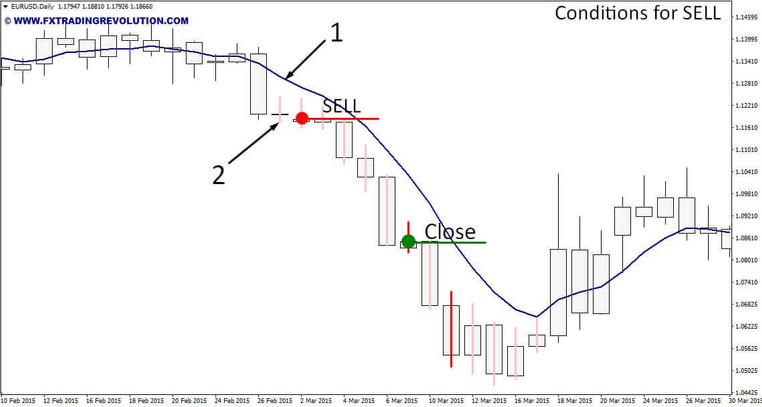

Conditions for opening short positions

TrendLion D1 system. SELL deal

Stop-loss and Take-profit

After the position has been opened, you should immediately set a stop loss in the amount of 300 points (five-digit). This stop loss value is suitable for all major pairs with five digits after an integer. If you are going to use the Trendlion Forex strategy on other pairs, the volatility of which in pips is significantly different, it is reasonable to recalculate the value of the protective order using the ratio of 20-day ATRs.

As for the take profit, there are no fixed targets in the system; instead, the strategy proposes to accompany positions manually, in particular, it is advisable to close the financial result from the operation in one of three scenarios.

The first approach involves closing the deal at the moment when the EMA (6) changes direction to the opposite. That is, if a long position was opened, we fix the result on a downward reversal, but if we traded for a fall in the price of an asset, the deal becomes irrelevant after the EMA turns up.

The second method uses the Golden Lion Trend signals; namely, BUY is fixed at the moment a bright blue bar appears, and SELL loses its relevance if a red candle appears on the chart.

Sometimes it happens that there are no significant deviations from the norm in the market, so the third method of position tracking was developed for the Trendlion forex strategy - using a trailing stop. In particular, when the floating profit reaches 300 pips, a standard trawl is triggered in 50 pips increments.

Thus, depending on the currency pair and his experience, the trader can choose the most suitable option. If all of the listed methods seem to be beneficial in their own way, it is reasonable to split the position into three equal orders, each of which is followed according to the rules set out above.

Conclusion

Summing up the assessment of this strategy, we can note its main advantages:

First, this strategy is easy to learn;

secondly, it practically does not require attention to itself (it is enough to spend about 30 minutes a day);

thirdly, this approach can be combined with signals from other systems without fear of overestimating the risks.

The disadvantages (like all similar ones) include a small number of signals. But applying this system to a large number of trading assets, this disadvantage can be easily eliminated. At the same time, you should remember about the additional load on the deposit with each new asset. Consider this when building your money management system.