This is a scalping strategy based on the one minute chart. To successfully follow this strategy, you need a set of three standards Indicators, two Moving Averages with the settings below, and a MACD with the default settings.

MACD Settings

Use default settings (12, 26, 9)

First Moving Average

- Period: 200

- Method: Exponential Moving Average

- Applied price: Close

- Color: Aqua

Second Moving Average

- Period: 3

- Method: Exponential Moving Average

- Applied price: Close

- Color: Green

If you would like, we also prepared a template for the MetaTrader 4 that you can download here.

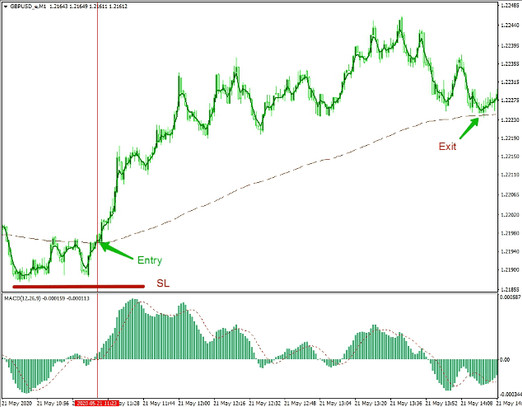

Conditions For Long Positions:

For buy positions, watch for a cross of the two moving averages. If the 200 Exponential Moving Average slides below the 3 Exponential Moving Average, check and ensure that the bars of MACD are above 0, or the main MACD is above 0. Enter a long position immediately after the cross on the close of the current candle.

How To Place SL And TP For Buy Positions:

In this case, your stop loss should be placed below the recent swing low, as shown below. On the other hand, the take profit is not fixed, which means you hold onto the trade until the situation that the price begins to touch or cross below the 200 Exponential Moving Average - exit the buy position in such case.

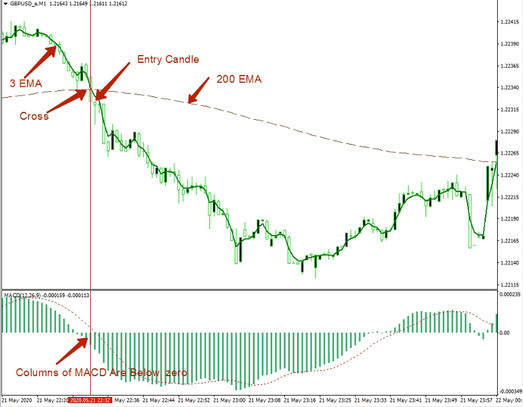

Conditions For Short Positions:

For sell positions, watch for a cross of the two moving averages. If the 200 Exponential Moving Average slides above the 3 Exponential Moving Average, check and ensure that the bars of MACD are below 0, or the Main MACD is below 0. Enter a short position immediately after the cross on the current candle close.

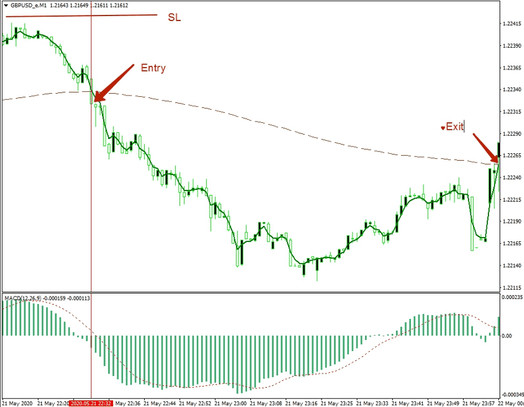

How To Place SL And TP For Short Trades:

In this case, your stop loss should be placed above the recent swing high, as shown below. On the other hand, the take profit is not fixed, which means you hold onto the trade until the situation that the price begins to touch or cross above the 200 Exponential Moving Average - we exit the sell position.

Conclusion

Although this method looks very promising, you need to have your lot size determined by the amount you expect to risk (e.g., 2% of your account balance) and the number of pips between entry and swing high or swing low (for placing stop-loss). Never fix your lot size or stop loss with this strategy.

If you have to use the fixed take profit, place it at least twice the number of pips you place the stop loss. Then, before you enter a sell position, ensure a higher timeframe, such as 30 minutes, is bearish too. The same rule applies to buy orders, and the 30 minutes chart should also look bullish.