Forex strategy "Hack" is a logical and very exciting trading system, it uses the principle of trading in the direction of the older time interval. This system is suitable for all major currency pairs.

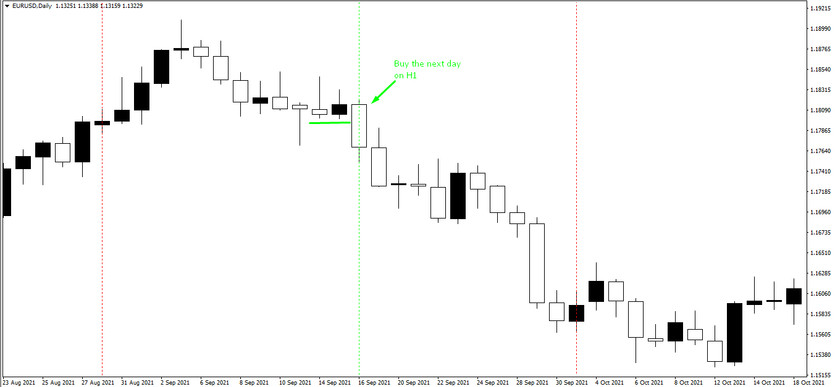

Conditions for Buy trade according to the Hack strategy:

1. On the daily interval, a bullish candle is formed, developing in place of at least the previous two.

2. The next day, a buy entry is sought on the hourly interval.

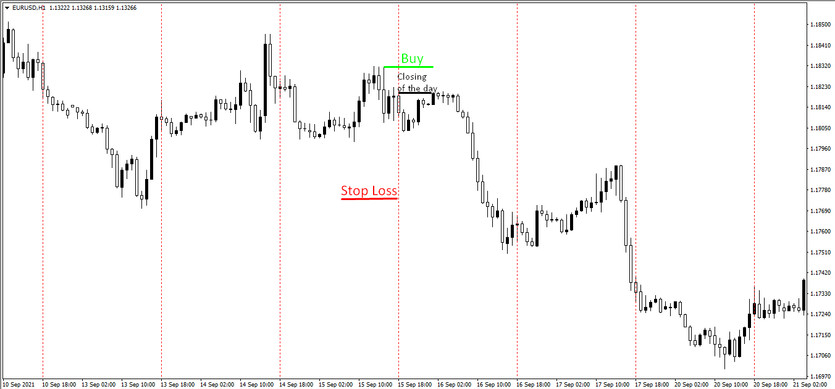

Entering options:

- A bullish candlestick formed in place of the previous two.

-After the appearance of the glider, 2 or 3 candles of growth are formed, they are formed in place of the required number of falling candles. The combination must be completely formed from the candles of the current day.

When candles appear, a buy trade occurs.

3. Stop loss is set below the low of the day. At the same time, a stop loss of no more than 50 and no less than 30 pips is indicated. For currency pairs with a certain stop size, 35 pips is indicated.

4. The trade is opened to breakeven after passing 45 points in the positive zone of observation.

5.Take profit is 3 times bigger than the stop loss.

6.After the close of the day during which it was made, the entry is the result of the amount of profit in points. If the current profit is greater than the stop loss, then its size is multiplied by 3 and a take profit is created according to this distribution, but not more than 150 points. If this difference is less than the definition of the stop loss value, then the take profit is not respected.

7. The trade is closed by price search if the day closes in the negative zone, exceeding 3 points.

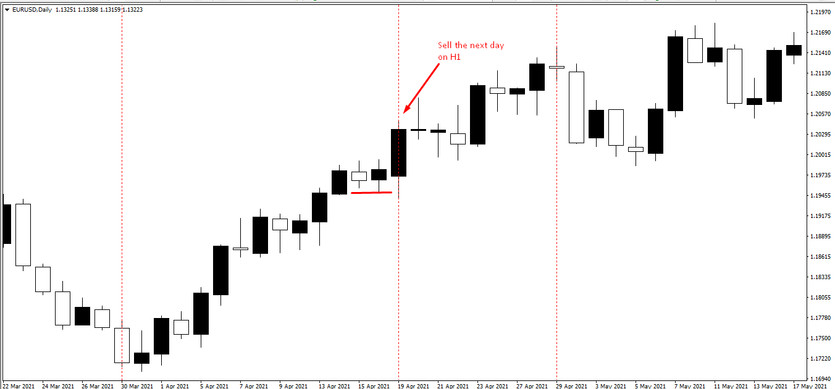

Conditions for Sell trade using the Hack system

1. On the D1 interval, a bearish candlestick is formed in place of the two previous ones.

2. The next day, on the hourly interval, a search for a sell entry is made.

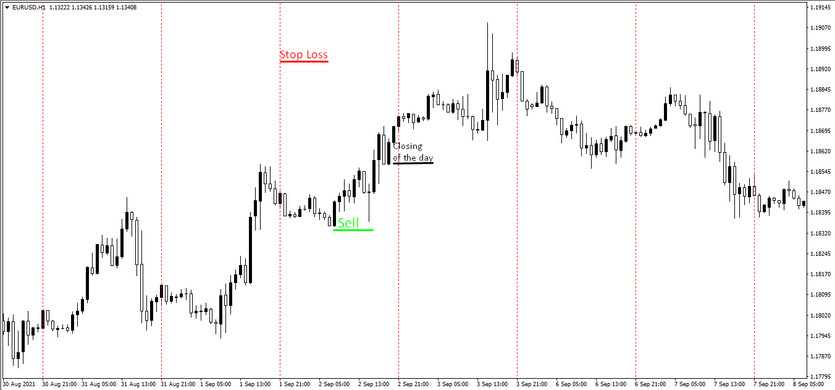

Entering options:

- A bearish candle formed in place of the previous two.

-After a steady growth, 2 or 3 falling candles are formed, forming in place of the corresponding number of growth candles. The combination must be completely formed from the candles of the current day.

When a certain combination of candles is formed, a sell trade is concluded.

3. Stop loss is set at the high of the day. In this case, the stop loss is no more than 50 points and no less than 30. For currency pairs with the pound, the minimum stop size is 35 points.

4. The trade is opened to breakeven after passing 45 points in the plus zone.

5.Take profit is 3 times bigger than the stop loss.

6. After closing the day during which the entry was made, you should measure the size of the current profit in points. If the current profit is greater than the stop loss, then its size is multiplied by 3 and the take profit is set at this distance, but not more than 150 points. If this distance is less than the initial stop loss value, then the take profit does not change.

7. The trade is closed at the current price if the day closes in the negative zone, exceeding 3 points.

Conclusion:

The Forex Hack strategy is convenient and easy to use and creates good prospects for trades. Using this strategy, do not forget to use the risk control system that matches your deposit.