The Swiss franc has traditionally been considered a reliable defensive asset, so long-term trading systems focused on weekly and daily charts are great for this currency. This strategy is considered a prime example of a conservative approach to trading.

So why do weekly charts and the Swiss franc go well together? First, defensive assets, which include CHF, are in flat most of the time.

Such assets are considered a safe haven in Forex. The US dollar versus the Swiss franc is one such pair. In part, it is for this reason that they are in investment demand, since investing in volatile instruments in the long term is simply unwise. Of course, there are exceptions everywhere. (For reference: on January 15, 2015, as a result of exchange manipulations, the USDCHF pair exploded by almost 20,000 points, taking with it tens of thousands of deposits whose positions stood against the pair's downtrend. This event happened in a matter of seconds, and it took months to recover)

Secondly, the USDCHF pair indirectly takes into account the factors affecting the US dollar, which has significantly lost ground over the past decade, and global trends can be estimated exclusively on the D1 and W1 charts.

The main advantage of this system is to minimize labor costs. For this strategy, it is enough to spend only about 5 minutes a day, since signals on large timeframes rarely appear.

The strategy is traded with the NeuroTrend Indicator . You can download it FOR FREE here .

Two charts are used to implement the strategy:

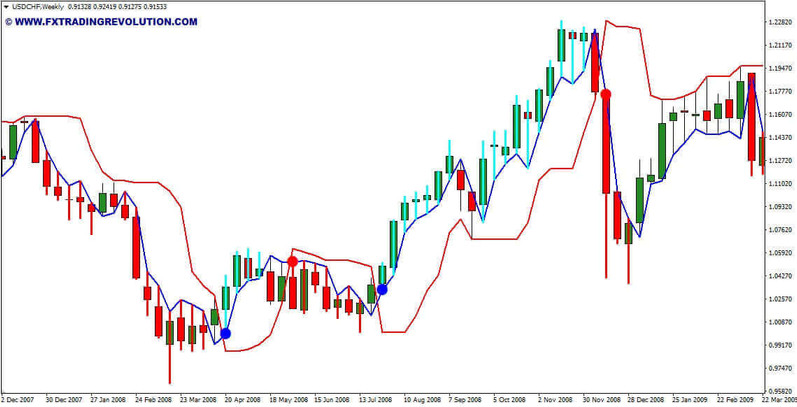

USDCHF W1 Strategy - Conservative method. First chart

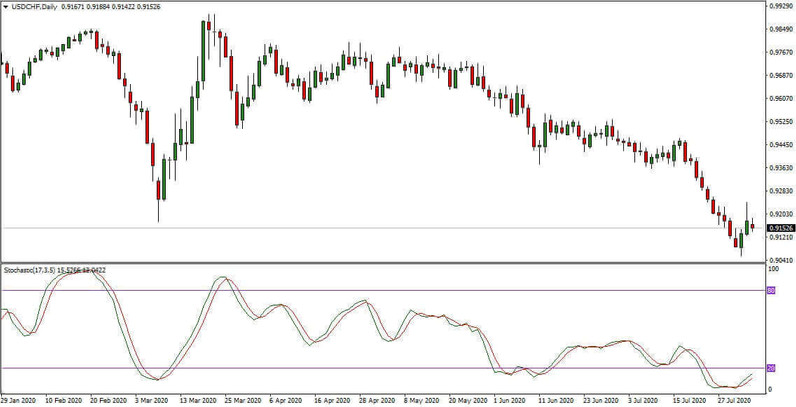

USDCHF W1 Strategy - Conservative method. Second chart

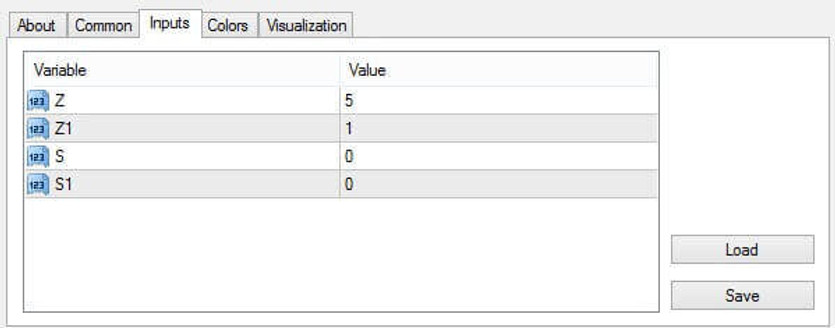

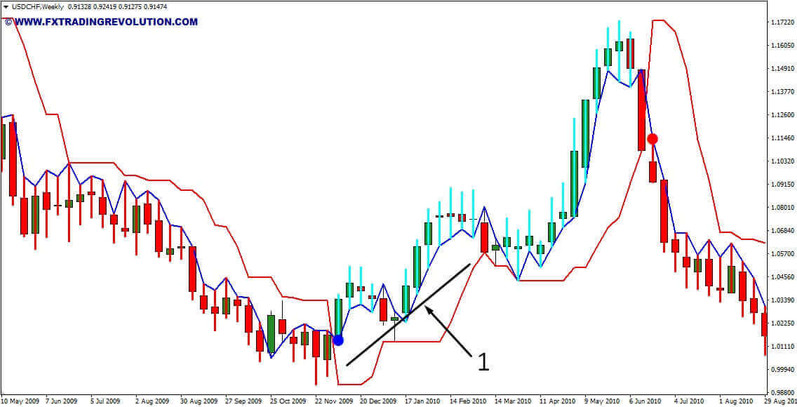

On the first chart, select the W1 timeframe and set the NeuroTrend indicator on it with the settings 5,1,0,0.

USDCHF W1 Strategy. NeuroTrend Indicator

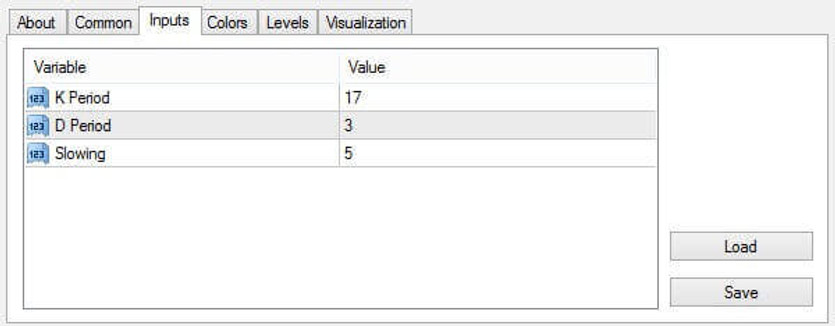

In the second window, open the D1 timeframe and attach the Stochastic oscillator to it with the values of parameters 17, 3, and 5.

USDCHF W1 Strategy. Stochastic settings

Rules for opening long positions

To open a long position on the USDCHF strategy on the weekly chart, you must wait until the following conditions are met:

1. The current weekly candle is above the NeuroTrend red line.

USDCHF W1 Strategy - Conservative BUY method

2. On the D1 chart, the Stochastic indicator reached level 50, after which its fast line crossed the slow one from the bottom up.

USDCHF W1 Strategy - Conservative BUY method

If these conditions are met, a medium-term buy trade is opened.

Rules for opening short positions

Short positions are opened in the same way, only in this case, the candle is below NeuroTrend, and the Fast line of the Stochastic indicator crosses the Slow one from top to bottom.

Of course, in both cases, it is advisable to open trades after the close of the signal candles, since otherwise there is a chance to catch a false pattern.

Stop Loss and Take Profit

Taking into account the fact that the USDCHF strategy on the weekly chart is low-risk, no stop-loss is set for trades; instead, the financial result is fixed after the stochastic reaches overbought/oversold areas, in particular:

Buy is closed if the oscillator lines crossed in the opposite direction while being above level 75;

The sell is fixed after the fast Stochastic line crossed the slow one in the range from 0 to 25.

Conclusion

Here it may seem that the algorithm of the system is too simple to be profitable because most are used to inventing complex systems. But if you follow the rules listed above exactly, the result from operations is unexpectedly effective, which once again confirms the advantage of a conservative approach.