Whenever we are discussing the Japanese Yen and its trading characteristics in the Fx market, the first thing that comes to mind is risk sentiment. The USDJPY pair is the major Fx pair that is most famous for its sensitivity to risk. Risk on and risk off changes in the market are often the main drivers of the USDJPY exchange rate.

Risk appetite drives this currency pair up and a risk aversion mood can quickly send it tumbling lower. For the same reasons, USDJPY is also most of the time positively correlated with US stock indices such as the S&P 500 and with US bond yields such as the 10-year treasuries.

USDJPY is usually not the most volatile currency pair in Fx. In fact, it is one of the least volatile major currency pairs which makes it suitable for trading some specific strategies. However, its volatility can change suddenly due to risk-on – risk-off changes in market sentiment which can lead to sharp and unpredictable movements in some situations. During times of risk aversion, the volatility of USDJPY rises substantially. The good news is that these situations where the markets are falling can also be profitable for Forex traders.

The price action on USDJPY is generally gradual. Reversals can be sharp but most often they happen at an already established support or resistance zone and often come in the form of some pattern such as double top/bottoms, head and shoulders etc. This pair can trade in a sideways market often and for prolonged periods of time.

USDJPY 1-hour chart - Normal volatility is low and support/resistance hold well. However, the volatility of USDJPY increases significantly when important fundamental news is released!

The risk sensitivity causes the USDJPY price action to behave in a way similar to stocks – meaning the price is rising slowly in uptrends but comes down quickly in downtrends. This has to do with the fear effect of markets and how panic causes prices to come down more quickly than optimism causes them to rise. In this regard, although correlated with global stock markets in general, USDJPY is most closely correlated with US stocks.

When considering these USDJPY behaviors, it’s important to be aware of the reasons for the trend. If it’s caused by global factors (such as stock markets falling or major countries entering a recession) then the above-described behavior is likely to prove true. But, currencies are often driven by central bank policies and other events as well, so in such cases, USDJPY could also rise just as quickly and powerfully due to reasons other than risk appetite (the BOJ quantitative easing program starting in 2013 is an example of this).

Trading USDJPY:

Long trade entries:

There are 3 typical situations that often occur on USDJPY which provide bullish trading opportunities:

- Support/resistance zones and breakouts tend to work well in USDJPY. Thus, look to enter at established support zones on confirmation signals such as a bullish pattern or other bullish signals. You can also use the break, re-test continuation strategy on USDJPY quite successfully to trade breakouts. You can read more about it here .

- The other situation that can work well for taking long trades on USDJPY is to buy a dip after a sharp sell-off on a strong bullish reversal candlestick. As discussed earlier sharp sell-offs in USDJPY are usually triggered by a risk-off event in the market, but after the dust settles USDJPY often reverses the bearish move fully – providing great buying opportunities. You can use this strategy explained here quite successfully to exploit sharp reversals in USDJPY.

- Joining established trends in USDJPY can also work well in a risk-on environment. Once bullish trends start they can last for quite a while– allowing many traders to profit on the move. Uptrends usually progress at a steady pace for days without a big retracement. Sometimes, for these reasons it can be difficult to find a dip to buy in USDJPY, hence looking to just join in can be a better approach in such situations.

Long trade - stops and targets:

Placing stops and targets very much depends on the reasons for entering the trades and whether USDJPY is trending or ranging in that situation. Usually, it’s best to place stops behind a strong support area and target an important resistance to the upside.

USDJPY 1-hour timeframe - Typical risk-on bullish price action on USDJPY intraday charts

Although the acceleration in the middle of the chart looks sharp, the tallest candle is about 27 pips only, which is very low compared to highly-volatile days in Forex. Also, notice how there is almost no big retracement in the whole move from left to right which can leave dip-buyers frustrated.

Short trade entry: Short trade - stops and targets:

- Breakouts of important support levels rarely occur without a strong reason. It will be either JPY strength (usually due to risk-off) or USD weakness. In either case, fake-outs are not frequent on USDJPY, so once a bearish breakout has occurred further continuation is likely.

- Look to join accelerating bearish momentum. Risk aversion is the most often cause of sharp bearish moves in USDJPY, but often such moves don’t last long. Hence, it’s wise to be quick and take profits as soon as some support area or the bearish target is reached.

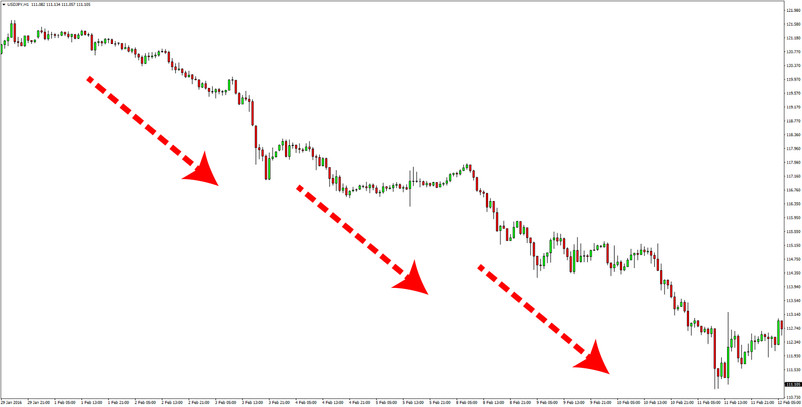

- When downtrends gather momentum the price action exhibits the typical characteristics of a trending market, so trend-trading strategies can be used to join. Bearish trends on USDJPY, however, tend to be more volatile and faster than bullish trends.

Look to place stops above a resistance area, or if it’s a trending market trailing the stop lower would also be an appropriate risk-management strategy. Key support areas lower can be used as targets.

USDJPY 1-hour chart - Risk-off downtrends tend to be much steeper and much more volatile on the USDJPY pair

Conclusion

The intraday charts that are presented in this article shown the nature of USDJPY price action in different situations. These differences in USDJPY price behavior have been in existence for a long time and are likely to stay for longer as well.

Due to the nature of the currency pair and the fundamentals that underpin it different trading strategies can be used successfully. USDJPY is affected by all the usual factors that currencies are affected and additionally by risk sentiment. In many ways, trading price action on USDJPY requires to be aware of the fundamental reasons that caused the price to move.