This system can be used to trade any Forex assets on the H1 timeframe. It is very simple and effective. This strategy has been implemented using the trend following indicator WATR. The Simple Moving Average is also used here as a filter.

WATR&MA Strategy. Simple and effective trend following approach

Indicator settings

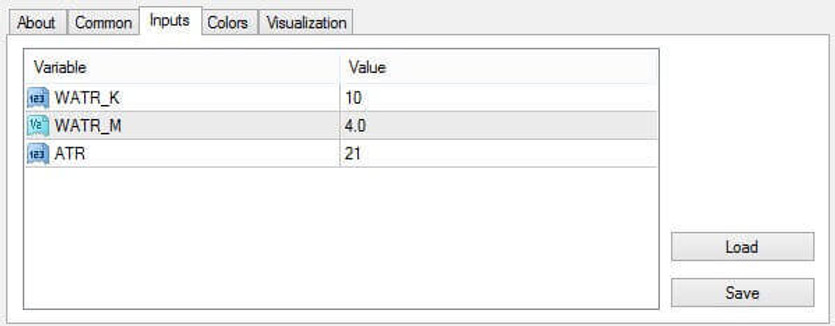

Download the WATR indicator on our resource in the Indicators section. After installing it and restarting the MetaTrader 4 terminal, apply this indicator to the chart of the trading asset on which you are going to apply this strategy. The WATR indicator parameters should be left by default, having the following values: WATR_K = 10, WATR_M = 4.0, ATR = 21.

WATR&MA Strategy. WATR Settings

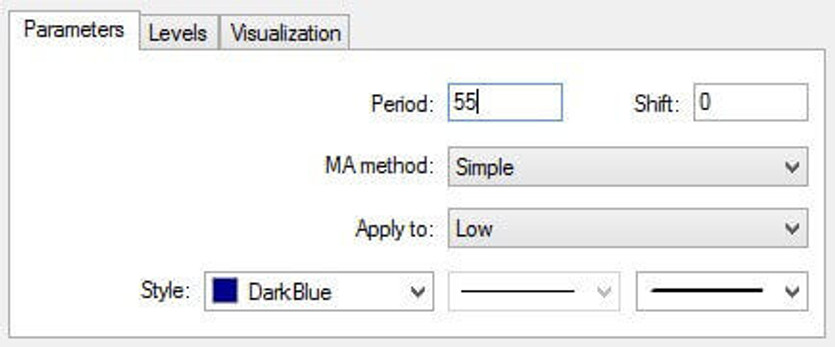

Next, plot the MA indicator with a period of 55.

WATR&MA Strategy. MA Settings

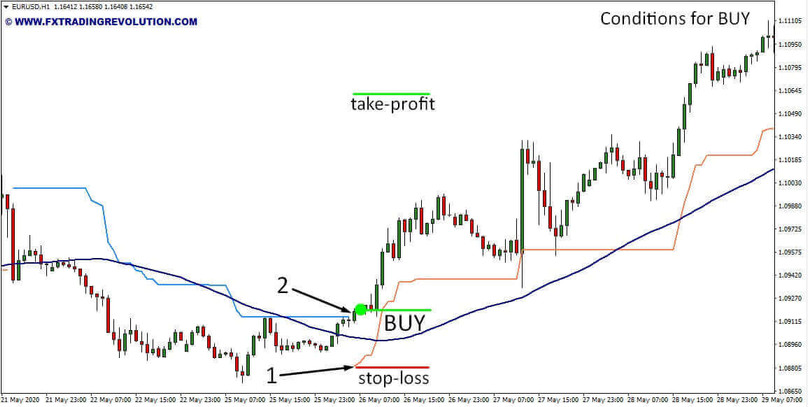

Conditions for opening long positions

1. The blue line of the WATR indicator is interrupted, and an orange line appears instead.

2. After waiting for the close of the candlestick on which the orange line appeared, make sure that the closing of this candlestick is above the blue line of the indicator.

If these conditions are met, a long position is opened.

WATR&MA Strategy. Conditions for long positions

Conditions for opening short positions

The same conditions apply for sales.

1. The orange line of the indicator has changed to a blue line.

2. The close of the candlestick on which the lines have changed is below the orange line of the indicator.

WATR&MA Strategy. Conditions for short positions

Stoploss and TakeProfit

Stoploss when opening sell or buy trades is placed on the line that appears: for a BUY trade, the stop loss is placed on the appeared orange line, and for SELL on the blue line. Take profit is proportional to stop loss and should be three times higher.

Conclusion

As you can see, the WATR & MA strategy is a very simple but effective trading system. It does not require any additional calculations and allows you to quickly find the necessary conditions for opening deals.