The Wedge Pattern system can be used for positional or intraday trading in the Forex market, depending on the time period used. This system consists of only three components, and this is what makes it very simple and easy to implement. These components are the rising wedge, the falling wedge, and candlestick formations.

It is preferable to use a 4-hour time period to work on this system because most candlestick formations are not sensitive at lower time periods. Before applying wedges, candlestick formations are used to identify tops and bottoms.

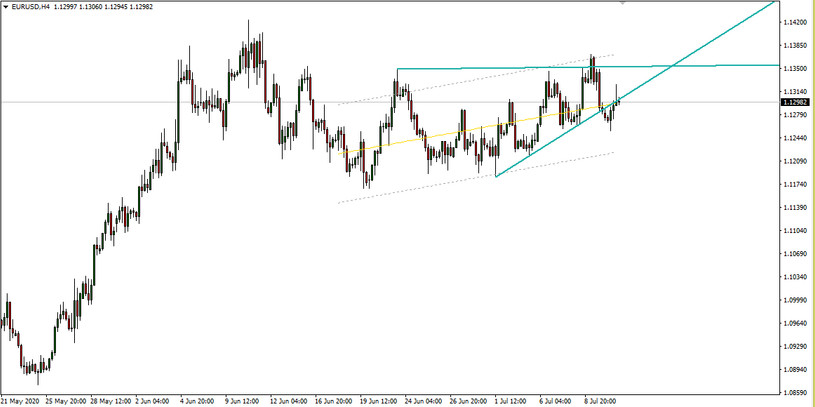

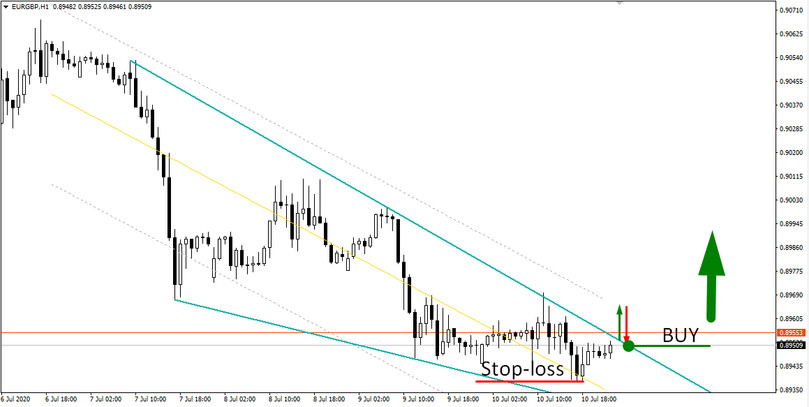

After identifying the peaks and bottoms, they are connected by trend lines and form shapes, according to which the patterns of Falling Wedge and Rising Wedge are determined. These patterns are very similar to the triangle shape. The difference is that in the triangle, the lower trend line is directed up, and the upper - down. In the Rising Wedge pattern, both trend lines are directed upwards, and in the Falling Wedge pattern - down.

For the facilitation of the trader’s work, the Wedges indicator has been created, which automatically draws trend lines. The direction of these lines can identify the corresponding pattern. You can download this indicator on our website in the Indicators section.

Conditions for opening long positions

The main idea of the system is to enter the market after breaking the trend line. There are two login methods. The first is that the position opens at the close of the breakout candle. However, losses can be gained if the trend continues after that. According to the second method, you should wait for the price to return to the broken trend line and then enter. But in this case, you can skip the profitable entry. Therefore, you should pay attention to what candlestick patterns are formed after the break of the trend line. In this strategy, the entry into a BUY trade is made when the price breaks the top line of the downward wedge and then rolls back to the wedge border. It is on the upper boundary of the descending wedge that a BUY deal is opened.

Conditions for opening short positions

The same goes for SELL deals. The ascending wedge indicated by the Wedges indicator breaks through the price at the lower boundary, and then the price returns to this boundary. After this event, a sell deal is opened.

Stop Loss and Take Profit

Stoploss is set at the extremes of the wedge. Depending on the shape of the wedge, the stop loss will vary in size, and based on this size, the value of the trailing stop step should be determined. Thus, in the case of a properly open position, the profit from the trade will be fixed by a trailing stop.

Conclusion

The Wedge Pattern strategy is simple and easy to use, and thanks to the Wedges indicator, it helps to determine the correct forms of ascending and descending wedges, thereby avoiding the subjective appearance of a wedge. Putting this strategy into practice, do not forget about competent money management and a risk control system.