The wedge strategy falls into the category of universal strategies, thanks to which traders can use it not only across time frames, but also across different chart types, including the very popular volume charts and the increasingly popular renko charts.

The trading wedges have built up such popularity over time that they are now sought after by many scalping traders who usually base their very highly profitable trading strategies on them.

Wedge strategies are not among the most complex, but certain rules must be followed to help increase long-term success and, in turn, can also reduce the number of bad entries.

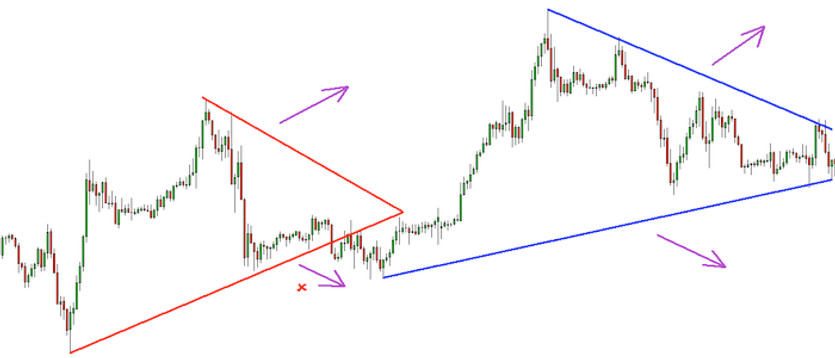

It is not difficult to trade with trading wedges, all that is needed for this strategy is to draw two converging trend lines and then just wait for the market to break one of the lines (see chart above)

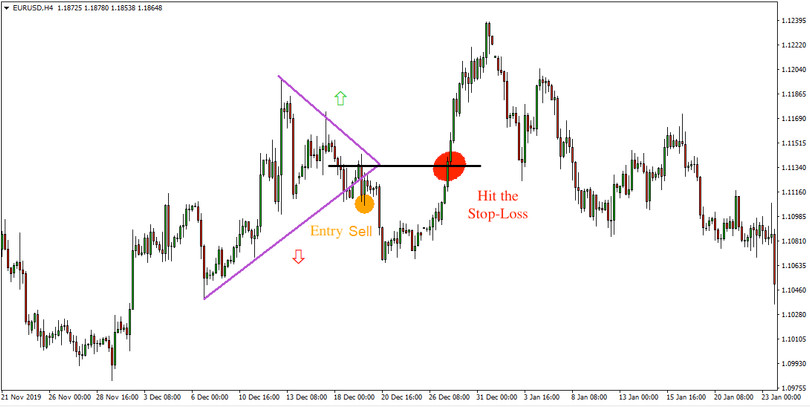

Note: For potential breakouts, it is better to give higher priority to the relatively longer candles (see chart above), which are some guarantee that the market has not merely tested the wedge boundary, as it did on the first breakout on the chart below. In the chart below, it can also be seen that after entering the position, the market later reversed and hit the prepared Stop-Loss, which we always place inside the constricting wedge (if the Stop-Loss had not been set, the losses would then have been up to several times).

Our strategy today tends to perform best in times of more volatile market conditions, so to speak, when markets are moving quickly up/down, and under these conditions its success rate can exceed 80%, which, with hindsight, is sufficient for its long-term sustainability.