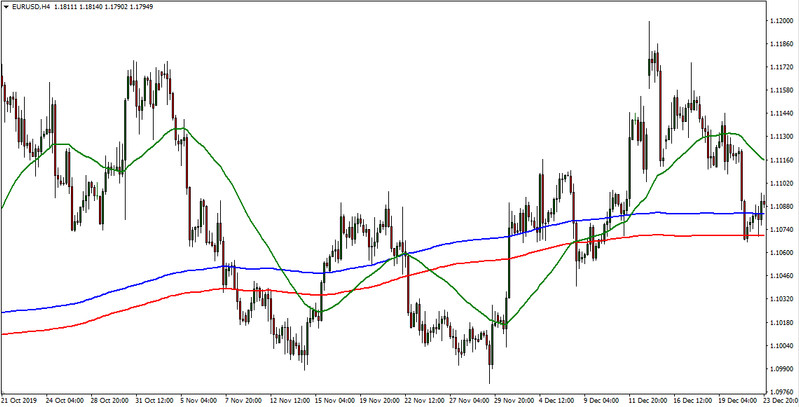

The famous Wild River trading system is a trending strategy designed for trading on the H4 timeframe. It can be applied to almost any trading asset and is attractive because it works on the basis of two standard indicators - Envelopes and MA. The strategy is simple and uncomplicated, which nevertheless does not affect its performance.

Strategy settings

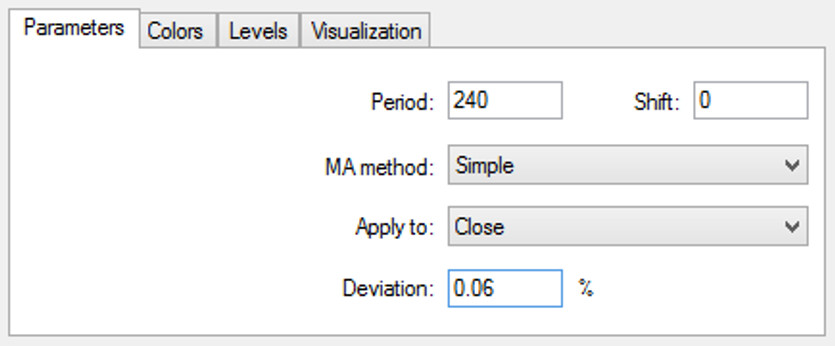

Install the two indicators mentioned above on the H4 timeframe on the trading asset chart. In the parameter settings of the first Envelopes indicator, set the following parameter values:

The period should be equal to 240 candles;

MA method - Simple;

The deviation is 0.06% (this value is intended to optimize the range between the upper and lower boundaries of the Envelopes).

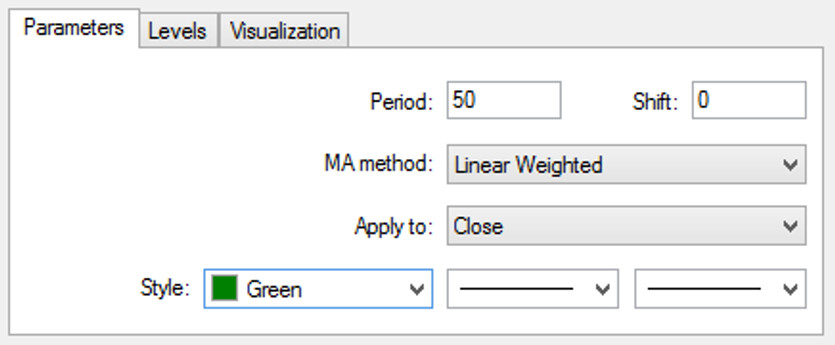

The second indicator required for the correct operation of the Wild River strategy is a moving average calculated over 50 candles by the linear weighting method.

Conditions for opening positions

The decision-making algorithm for this technique consists of several stages. First of all, in the direction of Envelopes, it is necessary to assess the long-term trend, in particular, if its lines are directed upwards - only purchases are relevant, if downwards - sales.

At the second stage, the Wild River strategy generates directly the buy/sell signal itself, which must meet the following criteria:

If the Envelopes was broken from the bottom up, after which two candles completely closed above its upper border, the possibility of opening a buy order is considered;

If the price has broken the Envelopes from top to bottom, and two new candles have closed below the lower bar of the indicator range, sell orders are relevant.

Here it is worth paying attention to the fact that the close of two candles above/below the Envelopes is understood as a situation when their open and close prices are strictly outside the Envelopes, i.e., the tails of the candles can still touch one of its borders, but the bodies of the candles should not cross them.

And at the last third stage of the analysis, the Wild River strategy filters the “draft” signal using the MA filter. In particular, it is allowed to open purchases of an asset only if it is directed upwards, and it is allowed to work to lower the price under the opposite conditions.

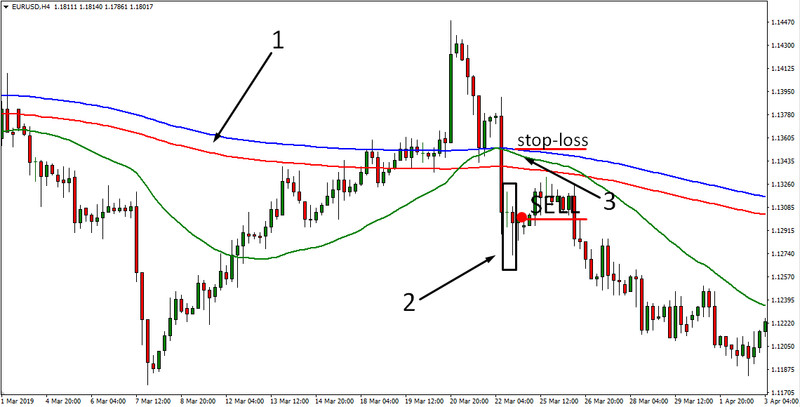

Example of opening a sell deal:

As you can see, the rules for interpreting MA values overlap with the analysis of the direction of the Envelopes itself, but there is one important difference between them:

the first indicator shows the medium-term trend;

the second tool is focused on finding long-term trends.

Stoploss and TakeProfit

Of course, entry points alone are not enough for successful trading, because it is still necessary to control risks and fix profits in time.

Given the fact that the breakdown of Envelopes often indicates, if not an actual reversal of the trend, then at least an attempt by aggressive players to implement this idea, the stop loss should be placed a few points below / above the Envelopes.

As for taking profit, it is recommended to calculate the take profit based on the stop loss and set it with a value that is three times higher than the stop loss.

Conclusion

In general, if you follow the basic rules of the system considered today and adhere to the main principles of money management, then you can make good money on its signals. But it should be noted that before using it in real money trading, we recommend practicing on a demo account.

The Wild River strategy, by its logic, is no different from other trend indicator systems and is a striking classic example of trend strategies.