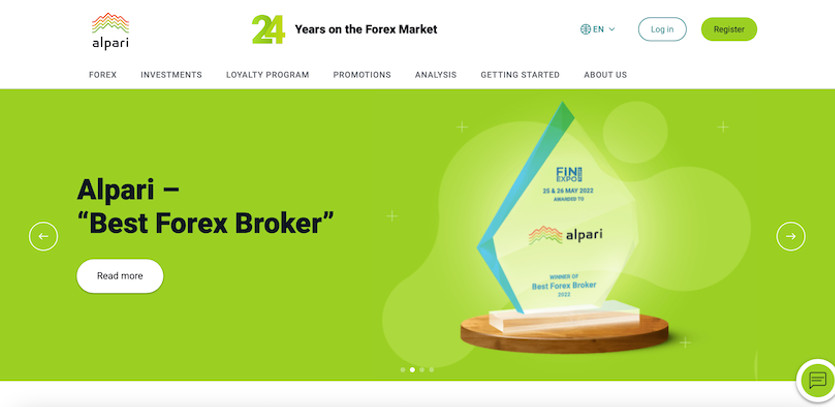

Established in 1998, Alpari International has carved a niche for itself as a leading online broker with over 20 years of market experience, serving clients from 150 countries. It recorded an impressive trading turnover exceeding $1.3 trillion in 2017, making it a recognized name worldwide. With over 2 million clients, Alpari’s popularity can be attributed to its hassle-free account opening process, zero-fee deposits, and swift withdrawal facilities.

Alpari's competitive spreads and prompt execution have turned it into a hub for investors looking to trade diverse products across the global financial markets. Its platform caters to seasoned traders, supporting the industry-standard MetaTrader 4 and the newer MetaTrader 5. The innovative CopyTrader feature is a boon for investors preferring a more passive approach to fund management and for fund managers eager to share their strategies and receive rewards for fruitful outcomes.

Alpari: The Ideal Choice for Whom?

Professional investors and seasoned traders in search of a reliable and simple-to-use platform to trade a variety of assets will find Alpari’s dedication to providing excellent execution and favorable pricing terms compelling. High leverage up to 1000:1 and flexible spreads as low as 0 pips are enticing for professionals who demand no requotes and market execution, and Alpari International has tailored its services to meet these needs.

CopyTrade, a tool that replicates the strategies of experienced money managers, allows both Strategy Managers and their followers to profit from market movements. While Alpari CopyTrade is attractive for novice traders, those interested in learning to trade may find educational resources somewhat limited.

Standout Features of Alpari

- Competitive Spreads: All Alpari International account types offer low starting variable spreads. The Pro account even promises institutional spreads starting from 0.0 pips for those maintaining a minimum account balance of $250,000.

- Swap-Free Accounts: Alpari International provides swap-free account options at no additional cost, catering to traders who incorporate strategies that discount swap fees or those requiring swap for religious reasons.

- Hedging/Scalping Permitted: Alpari International doesn't restrict clients from speculating on minor price fluctuations in available assets using scalping strategies or taking offsetting positions in assets using hedging strategies.

- Swift Withdrawals: The firm supports over 20 withdrawal methods, including credit and debit cards, bank wire transfers, e-wallets, local payment services, and even cryptocurrency, with most requests processed within 24 hours.

- Outstanding Liquidity: Alpari’s ties with leading liquidity providers and banks offer clients access to some of the finest and fastest market execution available, assured by non-dealing desk (NDD) execution and straight-through processing for ECN and Pro accounts.

Compliance & Regulation at Alpari

Alpari International operates as a licensed investment dealer, which allows it to deliver brokerage services globally (with a few exceptions), courtesy of its license from the Financial Services Commission of Mauritius. The company maintains strict adherence to Know Your Customer and Anti-Money Laundering policies. Alpari International’s membership with the Financial Commission since 2013 ensures that traders can claim up to EUR 20,000 from the Compensation Fund if a dispute is settled in their favor.

Pricing Structure of Alpari

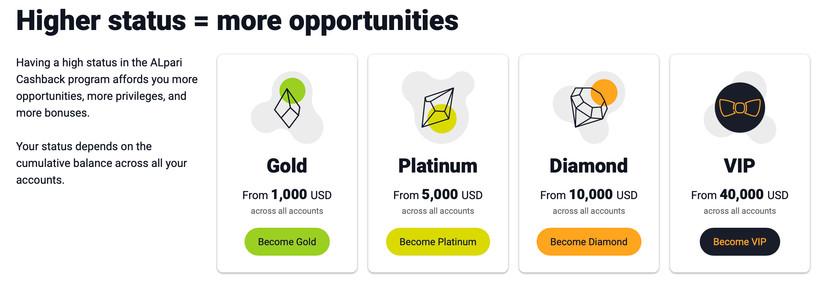

Alpari International's array of account types caters to a broad spectrum of investors. Novices can open a Micro Account with a mere $5 deposit. The Standard Account, featuring lower spreads and higher leverage, requires a minimum deposit of $100. More proficient users seeking faster trade execution without requotes can open an ECN account for as low as $500. Lastly, the Pro Account suits professional and institutional traders seeking direct market access who can maintain a minimum account balance of $25,000.

There are no commissions on deposit methods, but withdrawals may incur small fees based on the method used. An inactivity fee of 5 USD/EUR/GBP is levied on users who haven’t transacted for 6 months. Although the firm only supports variable spreads, they can go as low as zero pips.

Trustworthiness & Security at Alpari

Trustworthiness & Security at Alpari

Alpari International is particularly committed to providing reliable execution, and thanks to its relationships with top liquidity providers and the inclusion of a no-dealing desk model, traders can benefit from direct market access. Client funds are stored in segregated accounts separate from Alpari International’s operational funds in reputable banks.

For any queries or guidance, Alpari's customer service representatives are reachable via multiple channels in 8 different languages. Assistance is available 24/5 during market hours and even on weekends for select hours. Alpari’s membership with the Financial Commission further bolsters its reliability and security for customers.

Alpari User Experience

Opening an account with Alpari International is a smooth and swift process. Post-registration, users can conveniently deposit funds thanks to the extensive range of payment options, and withdrawals are typically processed within 24 hours. Navigating the MyAlpari dashboard is intuitive and straightforward, providing easy access to account settings, deposits, withdrawals, and the MT4 or MT5 WebTrader platforms.

Alpari International caters to beginners with a dedicated 'Forex Trading for Beginners' section. Experienced traders will appreciate the familiar MT4 and the advanced functionality of the MT5 platform.

Wrapping Up: Alpari Overview

Alpari International’s low entry barriers, high-quality execution, and straightforward platform design make it an excellent choice for professional traders and institutional investors. The inclusion of VPS hosting, support for EAs, and Alpari CopyTrader add to its appeal. Although oversight by a single regulatory body might be a concern for some, its membership with an independent self-regulatory organization provides additional reassurances. With its competitive spreads, reliable execution, swift funding options, and straightforward design, Alpari International emerges as an attractive brokerage option.