Unveiling Tickmill: A Rising Star in Online Trading

Established in 2014, Tickmill has earned recognition as a trustworthy online trading platform offering a range of user-friendly services. Orchestrated by seasoned professionals, Tickmill's mission is to prioritize clients' needs, which is evident from its array of accolades, such as “Europe’s Most Reliable Broker” by Global Brands Magazine in 2017, “Best Forex Execution Broker” at the UK Forex Awards in 2018, and “Most Transparent Broker” from Forex Awards in 2019.

This globally acclaimed platform owes its fame largely to its superior trading environment, focusing on speedy execution, unrivaled spreads starting from 0.0 pips, no-dealing desk operation, zero requotes, and welcoming all trading approaches. The service model has found favor with investors, with 2018 seeing over 130 million trades executed across over 200,000 registered accounts. Further, Tickmill underscores the importance of knowledge and education through abundant resources, enabling clients to step into financial markets with the required confidence and assurance.

The Pros and Cons of Tickmill

Pros

- Commendable spreads starting as low as 0.0 pips

- No-dealing desk trading execution with zero requotes

- Acceptance of all trading methods, including scalping and algorithms

- Extensive educational resources and analytical materials

- Multilingual customer support via various channels

Cons

- Absence of an in-house trading platform

- Limited diversity of tradeable assets

- Inaccessibility for US-Based investors

Tickmill: A Trading Platform for All

Tickmill, curated by expert professionals, meets the needs of both beginner and seasoned investors with its thoughtfully designed ecosystem. The platform’s accessibility is an asset for newcomers, who will find the affordable trading conditions, intuitive trading platforms, and abundant educational resources particularly useful. Added tools like one-click trading, Autochartist, and fundamental and technical analyses further enhance their abilities and boost confidence.

Advanced traders will value the freedom to apply any trading method, including arbitrage, hedging, scalping, and algorithmic strategies, without restrictions. While the MetaTrader 4 may not satisfy some tech-savvy traders, access to the FIX API and Prime brokerage model ensures that sophisticated and institutional investors have suitable options.

Exploring Tickmill's Salient Features

- Competitive Spreads: Pro and VIP Account users enjoy low variable spreads, starting from 0.0 pips for major Forex pairs.

- Commission-Free Trading: All account holders enjoy commission-free trading for CFDs tracking major global stock indices, oil futures, and bonds.

- Ultra-Fast Execution: On average, trades are executed within 0.15 seconds, with FIX API access available for swift execution for traders with algorithmic strategies.

- No Requotes: Tickmill guarantees no requotes, ensuring smooth trading even during periods of intense market volatility.

- Freedom of Strategy: Tickmill embraces all trading strategies, providing a custom-built trading environment for all types of investors.

Examining Tickmill's Regulatory Compliance

Licensed in three key jurisdictions (the UK’s Financial Conduct Authority, the Cyprus Securities and Exchange Commission, and the Seychelles Financial Services Authority), Tickmill's commitment to offering a highly accessible online trading platform is unquestionable. In addition, Tickmill complies with standard security measures and practices Know Your Client (KYC) and Anti-Money Laundering (AML) checks.

A Closer Look at Tickmill's Pricing

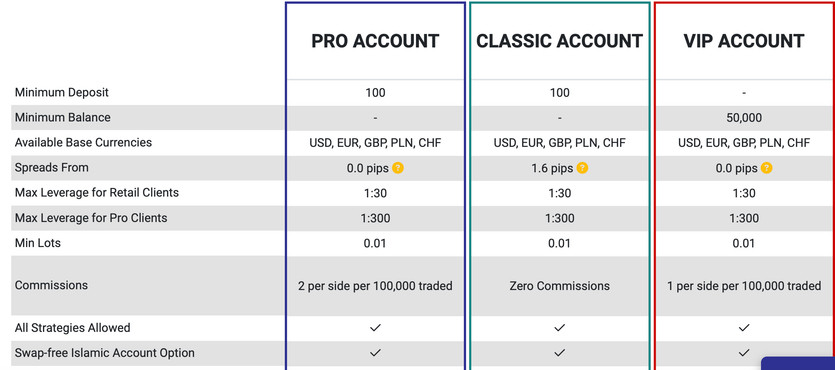

Tickmill offers clarity on its conditions and fees, particularly for deposits and withdrawals. For trading spreads and applicable swaps, Tickmill provides full transparency, posting the to view the answer latest rates on its website. Further, they offer three types of accounts, each tailored to different trading needs and experiences.

-

Classic Account: This commission-free account type has a minimum deposit of $100. Spreads start from 1.6 pips, and it offers maximum leverage of 1:500.

-

Pro Account: With a minimum deposit of $100, the Pro account offers spreads from 0.0 pips. It charges a commission of $2 per side per $100,000 traded and also offers a maximum leverage of 1:500.

-

VIP Account: The VIP account requires a significantly higher minimum deposit of $50,000. It offers spreads starting from 0.0 pips and a commission of $1 per side per $100,000 traded. Like other accounts, it also provides a maximum leverage of 1:500.

Tickmill’s Trading Tools

Tickmill offers a suite of impressive trading tools to its users, including one-click trading, Autochartist, economic calendar, and Myfxbook’s copy trading service, among others. The platform supports MetaTrader 4, renowned for its reliability and wide range of features such as advanced charting capabilities, customizable indicators, and algorithmic trading functionality. Although there is no proprietary platform, MT4 satisfies most traders' requirements, especially when combined with the suite of supplementary tools.

An Eye on Tickmill's Customer Support

Tickmill’s customer support is available in multiple languages, including English, Spanish, Russian, Indonesian, Chinese, Polish, and Arabic. It offers support through various channels, including email, live chat, and phone. The multilingual support team is known for their helpful and timely responses.

Conclusion

Tickmill has proven its worth as a reliable and competitive online trading platform that caters to both novice and seasoned traders. Its focus on client needs, prompt execution, exceptional spreads, comprehensive educational resources, and regulatory compliance build a firm foundation for a trusted trading environment.

Despite a few limitations, such as a lack of diversity in tradeable assets and inaccessibility to US investors, the benefits Tickmill offers far outweigh its shortcomings. By constantly striving to improve their service quality and maintaining a client-centric approach, Tickmill positions itself as a strong contender in the competitive world of online trading platforms.