A Stellar Brokerage: VT Markets

Positioned in the heart of Sydney, Australia, VT Markets draws from over eight years of proficiency and insights in international finance, to provide straightforward and clear access to worldwide markets and to aid clients in achieving their financial ambitions. With a commitment to simplicity and transparency, VT Markets has been recognized with numerous industry awards that highlight their exceptional service.

Comprehensive Regulatory Oversight

The operations of VT Markets are supervised by both the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) in South Africa. Additionally, it is registered in St. Vincent and the Grenadines. This extensive regulatory framework underpins VT Markets’ commitment to transparency and safe trading practices.

Cutting-edge Trading Platforms

VT Markets takes pride in offering modern trading platforms. As specified on VT Markets’ online portal, clients can utilize the industry-renowned MetaTrader 4 and MetaTrader 5 platforms. VT Markets avails MT4 across PC, mobile, and web through WebTrader. MT4 has a reputation for ultra-fast order execution, unrestricted trading, minimal spreads, and the ability to trade over 200 Forex pairs, commodities, indices, and CFD shares.

The next iteration, MetaTrader 5, can be accessed on both PC and mobile, with improvements such as superior trade management, a wider array of trading assets, more built-in analytical tools, and MQL5 algorithmic trading. In collaboration with TradingView, they also offer the Webtrader Plus. The provision of such industry-leading platforms confirms VT Markets’ robust reliability.

Weighing the Pros and Cons

Positive aspects of VT Markets include regulatory recognition in a Tier-2 jurisdiction, the complete MetaTrader suite complemented by premium tools from Trading Central, reasonable trading costs, a user-friendly proprietary mobile app (VT Pro), indemnity insurance that complements regulatory protection, and support for third-party features such as Acceage trading signals and ZuluTrade copy trading.

However, there are a few limitations. For instance, VT Markets' offshore entity in Saint Vincent and the Grenadines offers no regulatory protection to clients. Also, the reduction in the number of licenses has led to a decline in the broker's Trust Score. Comparatively, the range of tradable symbols at VT Markets is fewer than at other platforms like Saxo Bank, IG, or CMC Markets. Moreover, the educational content, though improving, is still less than that of competitors, and access to Trading Central tools demands a minimum deposit of $500.

Understanding the Costs and Tools

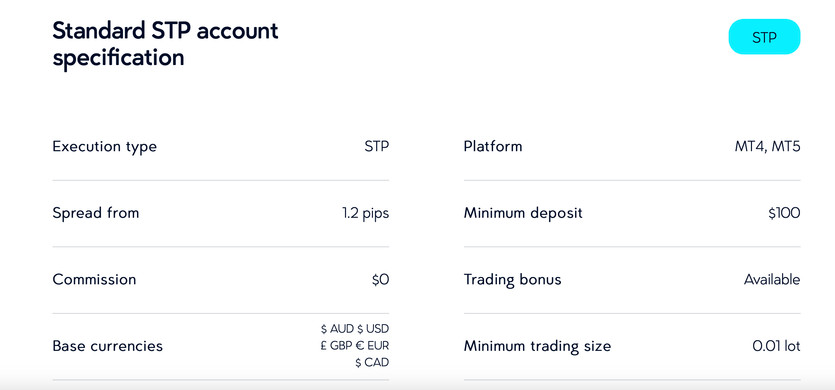

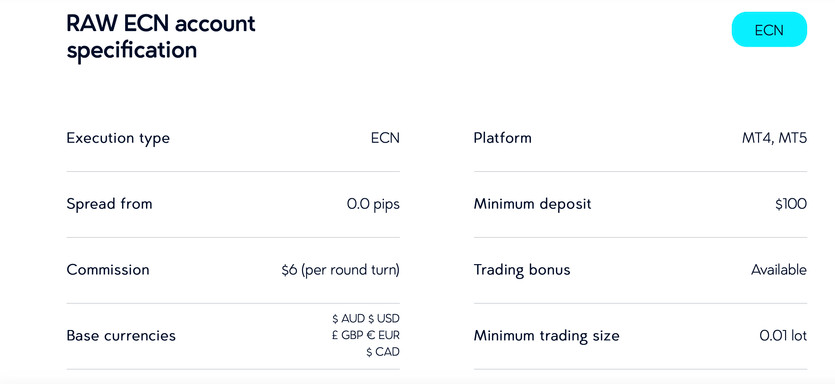

The trading cost at VT Markets hinges on the choice between the Raw ECN or the Standard STP account. While the Standard STP account doesn't charge a commission, its spreads are higher compared to the Raw ECN account. Both accounts, however, necessitate a minimum deposit of $200.

VT Markets presents both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, compatible with Windows and Mac. With a deposit of $500 or more, traders can access various MT4 plugins as part of the Pro Trading Tools suite from Trading Central.

Research Resources

VT Markets offers a concise yet insightful collection of research content through its Daily Market Analysis series, supplemented by third-party content from Trading Central. The quality of these resources is high, but the offerings are limited to a single daily article.

Account Types: