US Dollar Fundamental Outlook: Omicron Variant Shakes Up Fx Market; Nonfarm Payrolls Is the Key Calendar Event

It was supposed to be a quiet Thanksgiving holiday, but instead, we got a volatile sell-off in risky assets. The reason was the news of a newly identified Covid variant that is supposedly much more infectious and possibly able to bypass vaccine immunity due to its multiple mutations in the spike protein. It is now officially called “Omicron” (renamed from “Nu” over the weekend), and the WHO classified it a “variant of concern.”

The reaction to the news was a classic risk-off dump with stocks and energy markets falling while the safe-havens outperformed in Forex. The established Fx dynamics that held up until the risk-off wave have been shaken up a little now. The dollar was at slightly overbought levels due to its recent rally (especially on a short-term basis), and this certainly played a role in keeping the dollar a relative underperformer versus the other safe-havens. At this stage, it looks like Omicron may have initiated a USD correction.

The focus for the dollar this week will also be on the new Covid situation, although a risk-averse environment can hardly cause serious damage since the greenback is also a safe-haven. On the calendar, traders’ attention will turn to the ISM manufacturing and services PMIs (Wed & Fri), Fed Chair Powell testimony before Congress (Tue & Wed), and most importantly, the Nonfarm Payrolls report (Fri).

The strong economy suggests solid Nonfarm payrolls should be in store (500k consensus forecast). If that’s the case, the dollar could resume its uptrend and likely reach new highs (EURUSD likely new lows), although this will also depend on the course of the new Omicron variant. On the other hand, If NFP is a miss, then the USD correction can extend and will, in this case, likely last at least into the next big Fx event – the December 15 Fed meeting.

Euro Fundamental Outlook: Risk-Off Reaction Provides Some Relief For EUR

The euro also performed well on the Omicron risk-off episode, probably not solely because of its safe-haven qualities but also due to the oversold conditions and already extended short positioning before the news hit the wires. Some correction was already overdue after the recent sell-off, and the EUR has got that relief now.

The bearish dynamics remain intact, however. Lockdowns across Europe are still very much the norm, and the economy will take a big hit. All while inflation is slower than in other countries. Hence, no reason for the ECB to be turning as hawkish as others, which should keep EUR relatively weaker than peers.

This week’s focus is on flash CPI inflation data on Tuesday. Consensus expectations stand at 4.4% y/y for the headline CPI and 2.3% for the core CPI. Hotter actual numbers may give another reason for the EUR to extend its recovery, though that too is unlikely to be anything more than a retracement within a trend. So, while the consolidation may extend for a while longer depending on various factors (such as calendar events and Omicron), it should be shallow and ultimately likely to provide better levels to re-enter short.

EURUSD Technical Analysis:

EURUSD fell further last week and reached the 1.12 target of the head and shoulders pattern before rebounding on Friday’s risk-off reaction. Nonetheless, the technicals show us that a correction was already overdue, and with the reaching of the 1.12 H&S target, one is even a healthy development to consolidate the market.

As we can see on the daily chart below, the RSI indicator was already in oversold territory and remained flat as the price fell to the low under 1.12 (bullish divergence). Furthermore, EURUSD fell below the lower line of the downward channel, also an indication that it may have overshot to the downside. Also, a hammer-like candle has formed on the weekly timeframe. All in all, these factors suggest a correction may have started with last week’s low, and the price can consolidate for a while.

The low around 1.12 remains the first support zone in the current context. If the price pushes down again and moves below 1.12, the downtrend could extend, but given the oversold conditions, it doesn’t seem worth chasing it down, not before some consolidation has taken place.

To the upside, the first resistance comes at the minor high around 1.1375, and then the next resistance is the big 1.15 – 1.1550 zone.

British Pound Fundamental Outlook: Focus on BOE Speakers and Omicron Variant in a Light Calendar Week

For most of the past week, the pound was a laggard, and Friday’s risk-off action seems to have only amplified sterling’s underperformance. It was down on the week against the safe-haven JPY, CHF, USD, and EUR, while it rallied sharply against risk-sensitive currencies such as AUD, CAD, and NZD. Thus, GBP sits right in the middle on the risk sentiment Fx spectrum - neither a safe-haven nor a full “risky” currency. GBP’s Friday performance was typical for a risk-off situation.

In the meantime, Brexit news was quiet last week, helping to keep the sterling downtrend moderate. And with every country now stressing about the new Omicron variant, Brexit may go into the background again as the UK Government obviously has OTHER PRIORITIES at the moment. Brexit remains a potential risk, nonetheless, at least until triggering article 16 is dismissed as a possible option.

It’s a light week on the UK calendar except for speeches by MPC member Mann and BOE Governor Bailey (Tue & Wed). Rate hike comments will be closely watched to gauge if the latest developments with the might be changing their minds ahead of the critical Bank of England meeting on December 16. We all remember their fiasco from earlier this month when they promised a rate hike but did not deliver. Traders have probably learned their lesson now!

Overall, not much has changed for the GBP outlook, and like most others, at the moment, its performance will primarily depend on how the situation with the new mutation progresses. In this regard, if lockdowns are imposed (of which the UK has been free from since summer), the pound could feel the pressure as this may also mess up the BOE’s hiking plans (again!).

GBPUSD Technical Analysis:

Cable fell to 1.33 and even briefly traded below it during Friday’s volatile action but then recovered and ended the week around 1.3325. The almost doji-like candle on Friday suggests that GBPUSD may be about to start a consolidation as well. However, unlike EURUSD, GBPUSD is not as oversold (RSI above 30), nor has it reached the lower bound of its downward channel. In this regard, GBPUSD can fall to 1.32 before it fulfills these conditions.

Watch last week’s low, which is the first support level. If the price moves below it, then GBPUSD could quickly reach 1.32 and lower. But also keep in mind that some big weekly support is lined up just under the 1.33 level (we discussed this last week), so this is definitely not the best place to go short for swing or longer-term trades.

To the upside, the first resistance is at 1.34, while the more important (stronger) one is at the 1.35 zone.

Japanese Yen Fundamental Outlook: JPY’s Safe-Haven Characteristic Come to the Forefront

A fresh wave of risk-off selling was all it took to take JPY to the top-performing position in Fx. The Omicron news hit suddenly, and traders didn’t think twice to dump their risk-on bets.

But, we have to note that the overextended JPY short positioning probably played a large role in the Friday sell-off and the thinned liquidity due to the US Thanksgiving and Black Friday holidays. The yen depreciated significantly in September and October, and unsurprisingly short positioning has reached extreme levels during this process. Hence, it only took a “small scare” for some of those shorts to be unwound, which is enough to trigger a big drop under such circumstances.

This week, it will be all about how things develop with the new Omicron variant. Does it gets worse, or will scientists ease our worries and confirm vaccines should still be effective? How deadly is this new Omicron variant?

The answers to those questions will determine how the risk sentiment mood develops, which will likely be the dominant driver of JPY this week (and also for the broader Fx market at this point).

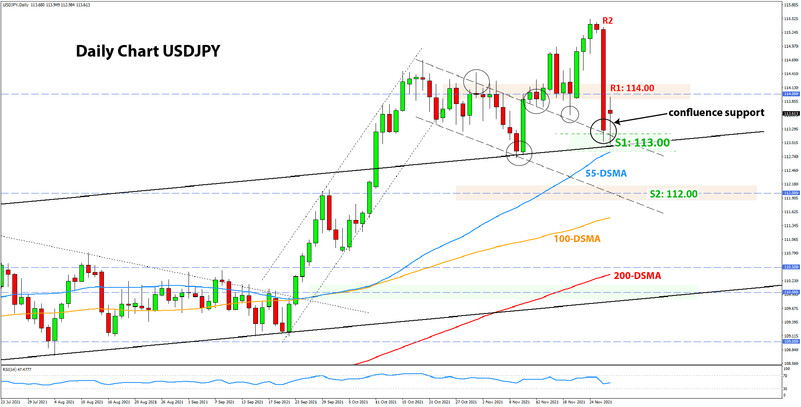

USDJPY Technical Analysis:

It was a strange week for USDJPY, first breaking above the previous high of 114.98, traveling to a high of 115.50, and then dumping hard to end Friday at 113.25. Essentially, this now means that the breakout above the 114.00 weekly/monthly resistance area may have been a fake one.

The focus now is on the 112.00 support zone, which must hold if the September/October uptrend is to remain intact. If the price moves below 112.00, then the move above 114.00 will be confirmed as a fakeout. This would be a significant bearish signal for USDJPY.

Before 112.00, support is located at 113.00 (last week’s low), which has already been tested early this Monday morning. So far, USDJPY is bouncing, and the bulls are trying to make another go at the 114.00 resistance.