Don't Miss: Where The Major Currencies Will Be Moving In 2022 - Yearly Forex Outlook & Scenarios For EURUSD, GBPUSD, USDJPY

US Dollar Fundamental Outlook: 7.0% Y/Y Inflation Fails to Impress USD Bulls

The greenback extended its corrective decline before modesty rebounding on Friday to close the week off the lows. This was despite the US CPI inflation report showing a 7.0 y/y increase, the highest in 40 years (note here that rising inflation usually leads to a stronger currency as it fuels rate hike expectations).

The usual suspects are quoted for the lackluster USD performance so far in 2022, such as that Fed rate hikes are already almost fully priced in amid the extended long dollar positioning around the turn of the year. That argument is probably largely correct, as a USD retracement was much-needed following that strong rally in November.

With the next Fed meeting scheduled for next Wednesday (Jan 26), the broad consolidation will likely continue, though we may already start to see some flows coming back into the dollar, helping it maintain a firmer tone compared to the past two weeks. For instance, the same argument for positioning may soon start working in the other direction as long positions were probably lightened with the USD decline last week.

The longer-term fundamentals of the Fed being ahead of others in tightening policy remain firmly intact, and investors’ focus should return to this theme sooner or later. Another reason to expect USD firmness to persist over the coming months is an increasingly likely global economic slowdown (or at least deceleration). Previous instances of synchronized global slowdowns suggest that the US dollar is usually a preferred currency for Fx investors to hold. The Fed rate hikes - which are now a given for this year - can only push the global economy further into deceleration and also increase the USD’s attractiveness from a yield perspective at the same time.

The US economic calendar is light, featuring only 2nd tier data such as the Empire State (Tue) and Philly Fed (Thur) Manufacturing indexes, and housing data (Wed-Thru). Adding to the light trading week will be the fact that there will be no FOMC speakers due to the Fed’s blackout period ten days before the next meeting.

Euro Fundamental Outlook: Markets May Refocus on ECB Dovishness Amid Light Eurozone Calendar

The euro had a mixed performance in the past week, stronger versus some and weaker versus other currencies. Overall, there is nothing to suggest individual EUR strength at the moment, but rather any gains against selected currencies seem to be part of moves driven by broader stories (such as the USD weakness) unrelated to Europe.

We have a very quiet Eurozone data calendar this week, with only the German ZEW economic sentiment survey on Tuesday, the ECB minutes on Thursday, and a speech by ECB’s Christine Lagarde on Friday worth noting. The markets will carefully look at the ECB minutes for the staff’s thinking regarding inflation and their QE program, but any surprises are unlikely here as the ECB and President Lagarde have already very clearly communicated their “dovish” stance.

The light calendar means that, much like last week, the EUR will be left to trade on the longer-term macro drivers and global developments. Here the ECB’s dovishness and lagging Eurozone economy will remain in the back of traders’ minds, which should eventually push the currency lower, particularly versus others with hawkish central banks (e.g., USD, GBP, CAD).

EURUSD Technical Analysis:

When looked from the daily chart, it appears EURUSD staged an upside breakout of the flag formation last week. However, a view at the weekly chart (shown below) tells that this breakout is far less convincing than the daily chart would make one believe.

The weekly chart indicates that the resistance trendline is not broken until a sustainable move above 1.14. EURUSD is testing exactly this zone at the moment. Another reason the breakout looks less convincing is that the upper border of the flag hasn’t been completely broken, despite the move above 1.14.

As noted in the previous weekly edition, the 1.15 zone remains a key focus as resistance, particularly because of the cluster of technical zones aligning there, such as the moving averages (weekly-200 and daily-100) and prior lows.

Support to the downside is seen at 1.1350 and 1.1300, with the latter looking like a more significant zone because it represents the most recent prior swing low. A break below it would signal to the bears that a new bearish leg may be starting, which could accelerate the downside action.

British Pound Fundamental Outlook: Solid Data This Week Should Keep BOE Rate Hike Odds Intact

Last Friday, UK data was good, although the immediate direct impact on GBP was muted. The pound was up already earlier in the week, largely as part of the broader USD correction that played out. Nonetheless, GBP ended a 2nd-best performer, behind the JPY, as the market stays focused on the high probabilities that the Bank of England will raise rates again at their next meeting on February 3.

Elsewhere on the political front, calls for Boris Johnson’s resignation have gained much attention in the news with little impact on the pound. This is because, even if Boris resigns, investors don’t expect a big change in UK policy from a new PM. No changes in policy means no changes for the UK economic outlook, hence markets don’t care.

This week’s UK calendar is the busy one for the month, seeing the releases of the employment reports (Tue), CPI Inflation (Wed), and retail sales (Fri). In addition, BOE Governor Bailey will testify before the Treasury on Thursday, whose comments may add to GBP volatility.

On balance, this week’s data is likely to be good again, which should keep BOE rate hike probabilities intact. As a result, GBP should remain firm on a broader basis, with scope for pronounced strength or relative weakness against selected currencies.

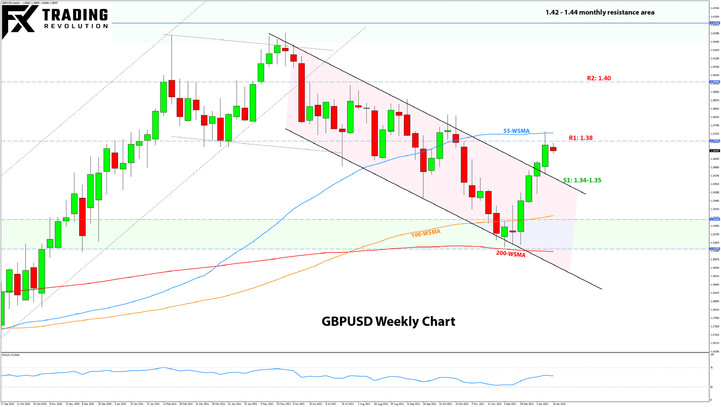

GBPUSD Technical Analysis:

GBPUSD broke through the resistance trendline around 1.36 and went as high as 1.3750 before reverting lower on Friday. The 200-day (not shown here) and 55-week (blue) moving averages that both sit near 1.3750 seem to have stopped the rally from going higher to 1.38.

It’s also worth noting that these 200-daily and 55-weekly MAs coupled with the October highs around 1.38 are a strong resistance in this wider 1.37-1.38 area. So, it’s still possible that GBPUSD will have a difficult time climbing further higher from here, despite last week’s break above the trendline. Still, if GBPUSD manages to rise above 1.38, then all focus will be on 1.40 as the next resistance zone.

To the downside, the first support is seen at 1.36, and then 1.35, making this whole band of 1.35-1.36 on the weekly timeframe a potentially significant first support zone. Further lower, there is no support until the December 1.3150 lows.

Japanese Yen Fundamental Outlook: JPY Top-Performer as Stocks Stay on the Defensive; BOJ Meets on Tuesday

The yen was the top-performer of the eight major Fx currencies, as stocks remained fragile while yields failed to extend the advance from a week before. In addition to this, a broader USD correction likely helped to push the USDJPY pair a little father lower and fuel the more notable JPY strength. However, it appears unlikely that the JPY’s gains can last or extend much in the current context, especially if the USD correction is already over and starts reversing.

Of course, developments around US Treasury yields (which are expected to keep rising) and equity markets (which are testing a key support zone) will remain crucial for where the yen moves. In this regard, yields and risk sentiment (stocks) can keep pulling the Japanese currency in different directions, especially if stocks break the support and embark on a steeper decline (bullish JPY). On the other hand, if stocks start climbing again, then JPY depreciation could return soon in line with the trend from late last year.

The focus on Japan’s economic calendar is the Bank of Japan meeting Tuesday. As usual, no changes to the BOJ policy stance are expected, though this meeting may get more attention in the news as it will see the release of updated economic forecasts (GDP and inflation).

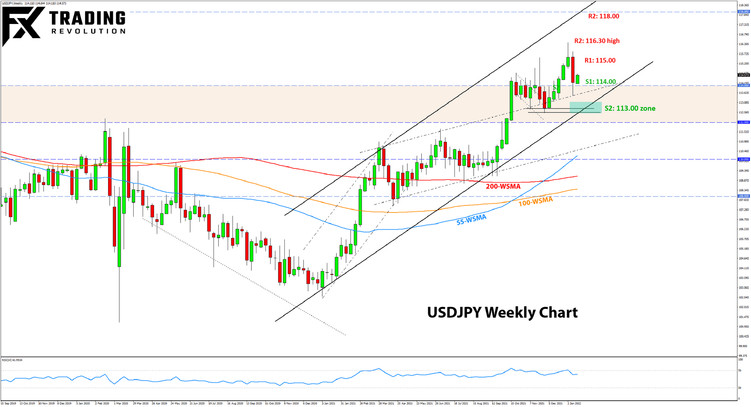

USDJPY Technical Analysis:

USDJPY fell by 150 pips last week (on the close), and at one moment on Friday, it was down by more than 200 pips. This is a notable rejection off the highs there, and many are already calling it a top. However, the last piece of the support is far from being broken. In fact, the key 113.50 - 114.00 zone was the exact spot from where USDJPY rebounded.

That 113.50 low and then the swing lows around 113.00 from November are key support because they converge with the rising trendline of the 1-year old uptrend (see chart). A break below this support would clear the way of further support zones all the way down to 111.00 and 110.00. That’s a 200-300 pips downside potential that will much more likely materialize if this 113.00 zone gives way.

To the upside, 115.00 is the first resistance in focus, ahead of the highs just above 116.

Although still way too early to discuss, another development worth watching here is that USDJPY has the potential to draw a head and shoulders pattern in the coming weeks, if a right shoulder starts forming.