US Dollar Fundamental Outlook: Could Thursday’s CPI Report Save the USD from Further Losses?

The greenback corrected broadly lower last week and ended down versus all of the major currencies, except for the JPY and CAD. However, aside from the somewhat crowded USD long positioning, the large moves were mainly driven by strong recoveries in other currencies (e.g., EUR, GBP) and had little to do with the Fed or USD-specific factors.

While the moves have led to a big correction on the chart, USD bulls may not be ready to capitulate just yet. For instance, Friday’s jobs reports were stellar across the board, with much stronger than forecasted Nonfarm Payrolls, accompanied by higher wage growth and higher participation rate. In addition, there were significant upside NFP revisions for previous months. All of this highlights the strength in the US labor market and is good news for the Fed – a green light if you will – for them to hike rates, do QT, and be as hawkish as they want (need).

That being said, it’s important to note that the corrective moves from last week can extend on the back of further position adjustments both in the USD but also in the euro and other currencies. Given those two forces pulling the dollar in different directions, it will be no surprise if the Fx market enters a broad range at this stage (e.g., in major pairs like EURUSD and the dollar index (DXY).

This week we have the latest CPI release on Thursday. Headline inflation is expected to remain hot above 7.0%, with core CPI forecasted to also nudge higher to 5.9%. Traders will closely watch the actual figures, where hotter numbers could again refuel hawkish Fed expectations, such as a 50bp hike in March and a total of 6-7 hikes this year (implying hikes at every meeting). The USD could receive support under such a scenario, though it’s worth noting that recent upward CPI surprises have not resulted in immediate USD strength (although they certainly did on a longer horizon like over the past 7-8 months).

Fed speakers are scheduled to speak this week (Mester, Bowman), whose comments may add to market volatility and potentially support the dollar via more hawkish Fed pricing.

Euro Fundamental Outlook: It Was Not the ECB, CPI Inflation Surprises Caused EUR’s Reversal

Everyone expected a dovish ECB, but those hot (flash) CPI reports days before the meeting seem to have changed their mind. The ECB was hawkish!

OK, maybe not as hawkish as other central banks, but ECB Chief Lagarde sounded much less dovish than most anticipated during the press conference, hence the HUGE reaction in EUR pairs. Like Powell the week before, Lagarde did not deny any of the speculations about ending QE earlier or an ECB rate hike later this year. This was the big surprise, and investors who held short EUR positions closed out as a result.

Having said that, it’s worth remembering that the ECB will definitely remain less hawkish than others (BOE, Fed, BOC) because the Eurozone situation is different from these other countries. The EU economy has recovered much slower than peers, inflation is still lower than elsewhere and (importantly) is mainly driven by the rise in energy prices (oil and especially gas). This situation suggests that if energy prices start to fall, the ECB will likely be the first one to abandon any hawkish plans as Eurozone inflation would start falling fast. Hence, from this perspective, it’s questionable how sustainable this EUR rally based on a hawkish ECB can be in the months ahead.

Nonetheless, the ECB’s hawkish shift can fuel some further relief rallies in the euro. It is a big change from a central bank that was widely expected to keep interest rates at 0% throughout this year. Many investors have been short euros, and there is room for a further squeeze in those positions. Breakouts above key technical zones could trigger such position liquidation and could drive the euro even higher in the near term.

This week, the EUR calendar is quiet except for the EU commission economic forecasts, released on Thursday.

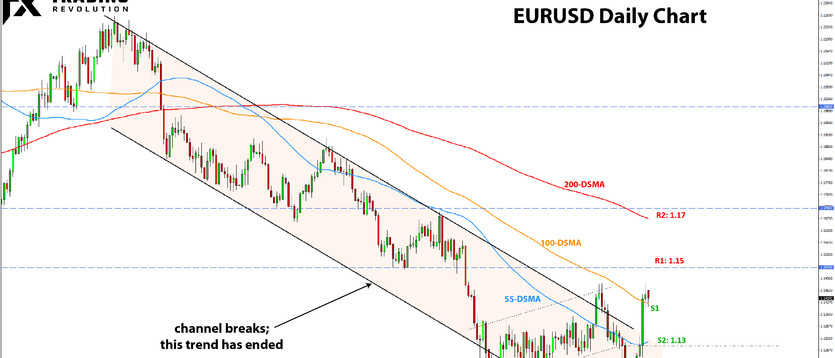

EURUSD Technical Analysis:

After two months of subdued volatility, we are finally seeing more active action in the EURUSD pair. The past week caught many traders wrong-footed and resulted in a complete reversal of the bearish moves two weeks before. The 8-month descending channel has now been broken, ending this bearish leg or potentially the trend itself.

EURUSD is now back near the critical 1.15 technical zone, which currently stands as the key resistance (1.1483 was the high last week). In support of the bullish case, the price has now broken above the 100-day moving average (orange). However, it’s important to note that the 100-week moving average (not shown here) is not yet broken and stands at 1.1497. This and the multiple past highs and lows here in the 1.15 area further highlight its importance. A break above will be significant and likely result in EURUSD reaching the next important technical zone higher which is the 1.17 area.

To the downside, the first modest support is at 1.14. If the price breaks below this zone, EURUSD could reach 1.13, which is the more important support zone in the current context.

British Pound Fundamental Outlook: BOE Delivers a Hawkish Surprise, but Bailey Takes it Back at Press Conference

The Bank of England also surprised hawkishly, with 4 of 9 MPC members voting for a 50bp hike (total vote was 5-4 for a 25bp hike). This spooked the market initially, but the press conference with Governor Bailey 30 minutes later was much more dovish and resulted in GBP paring back some gains. Governor Bailey focused on the risks in the current situation, highlighting that the rate hikes are not coming because of strength in the economy but because of the overshooting inflation, which he said, “We must stop from becoming entrenched.”

The BOE is obviously between a rock and a hard place. Given this, the outlook for GBP also becomes more uncertain for the weeks ahead. While rate hikes are good for a currency, when it’s done for bad reasons (i.e., high inflation but low GDP), it can often end up being bad for the currency too. While the pound may continue to receive some sporadic boosts from such hawkish BOE announcements and rhetoric, staging a sustainable rally will likely prove more challenging. In the end, GBP may end trading in a broader range as well before a clearer directional bias can emerge.

The calendar for the week ahead is relatively quiet, with only the preliminary GDP report on Friday of pertinent importance for GBP.

GBPUSD Technical Analysis:

Following that fake breakout of the descending channel and return back inside it, GBPUSD has resorted to trading around the 1.35 level. The price action could stabilize around this pivotal level, which seems to be in the mid-point between the key support (1.3150 - 1.133) and the key resistance (1.37 - 1.38).

Given the recent wild price action in both directions on the daily timeframe, it’s difficult to say where cable could move next. Range trading from here also looks like a decent possibility, though for the moment, the price action hasn’t drawn out one yet.

In this regard, it could be that the 1.33 and 1.37 zones will cap the price action and keep it between them for the time being.

Japanese Yen Fundamental Outlook: JPY a Bystander In The Volatile Action Last Week

The yen was just a bystander to all the action last week and mostly took cues from other currencies for its direction. The JPY was weaker on the weekly close, mainly driven by rising bond yields in other countries, last week mainly triggered by the hawkish shift at the ECB. High inflation prints in other high-income countries (e.g., UK, US, Canada, etc.) push their Government bond yields higher, widening the divergence with 0% yields in Japan.

Now that the ECB has signaled a willingness to think about raising rates from 0%, Japan and Switzerland remain the countries with the lowest yields of all. Thus, they would likely also be most sensitive to new episodes of risk aversion, in which case we can expect them to outperform significantly.

And while this yield divergence can keep pulling JPY down for now, it could completely reverse, should risk sentiment deteriorate. In a risk-off scenario, especially with stocks falling, the JPY will likely be a top-performing currency again.

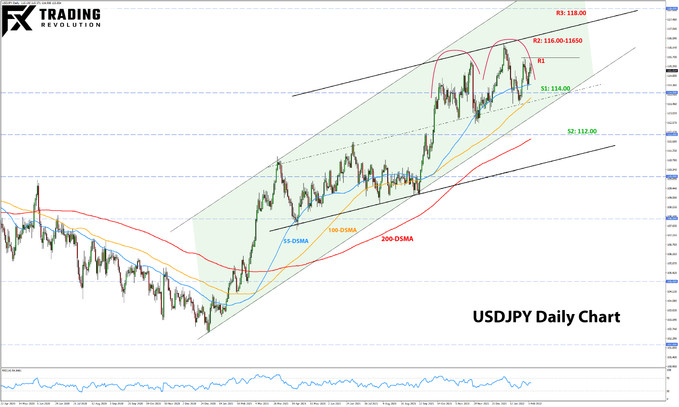

USDJPY Technical Analysis:

While the technical picture on EURUSD and GBPUSD changed dramatically in recent weeks, USDJPY has been much less affected. The pair remains within its already established ranges and channels and struggles to climb and stay above the 115.00 level.

The key support remains around the trendline of that channel, which has now nudged up toward the 114.00 level. Thus, we can assume that this 114.00 zone is the key support for USDJPY now. A break down will likely clear the road for steeper losses, with 112.00 being the next important support zone.

To the upside, 115.00 is only moderate resistance but has so far held on several occasions. Above it, the focus is on the highs around 116.00 - 116.50. Further higher, 118.00 is the next key resistance zone.

Finally, note that the potential for a bearish head and shoulders remains, with the right shoulder possibly forming at the moment. That 114.00 support zone would be crucial for this potential H&S pattern too.

Don't Miss: Where The Major Currencies Will Be Moving In 2022 - Yearly Forex Outlook & Scenarios For EURUSD, GBPUSD, USDJPY