USD Weekly Fundamental Outlook: Dollar Powers Higher on Fed’s Aggressive Tightening Plans

The dollar is extending the rally as the policy gap between the Fed and other central banks continues to widen. US Treasury yields climbed further, and over the Easter break, Fed speakers kept talking about fast QT and 50bp rate hikes. The most hawkish voice at the Fed, St. Louis Fed President James Bullard (voter this year), even talked about the possibility for even larger, 75bp rate hikes. He wants to swiftly raise rates to 3.5%, which in his view will effectively curb inflationary pressures.

US data released over the past week confirms the Fed’s concerns and is in line with their plans. Retail sales were solid and came at expectations, while inflation climbed again to 8.5% y/y for the headline figure and 6.5% for the core CPI. In the meantime, the labor market remains strong, with the unemployment rate hovering near pre-Covid levels. The Fed has all the reasons to tighten aggressively, and while previously some have doubted the Fed’s rhetoric, the markets are now starting to believe the hawkish narrative. Few other central banks are in the same position, and this divergence should continue to underpin the USD dollar during this and the following weeks.

The calendar is light, with only housing data, the Philadelphia Fed manufacturing index, and other 2nd tier data. There are also speeches from several Fed Presidents as well as Chairman Powell, who are all likely to repeat the similar hawkish messages from recent occasions as a lead-in to the Fed meeting on May 4.

EUR Weekly Fundamental Outlook: Euro Slides As ECB Caves In To Growth Worries

The ECB didn’t live up to the expectations of EUR bulls and delivered a fairly dovish message at last Thursday’s meeting. Although they confirmed QE will end over the summer, and rate hikes will likely come in the autumn, they kept policy largely unchanged from the March meeting. The most bullish EUR traders have hoped for more - an earlier end of QE and start of rate hikes.

The ECB is stuck between a rock and a hard place. Inflation is high, but the hit to economic growth from the Russia-Ukraine war could be even greater. So, while they want to be hawkish in response to the high inflation, the slowing economy is limiting the scope to tighten policy. Ultimately, the weakening economy will have a downside impact on inflation too; hence the ECB doesn’t need to rush into tightening like others (e.g., the Fed).

In the Fx market, this policy divergence should keep downtrends in EURUSD and other EUR pairs intact. Traders will also focus on the French election on Sunday, April 24, though sitting President Macron is widely expected to win it. Nonetheless, should there be any surprises, such as a Le Pen win, it would add to the troubles for the Eurozone and be negative for the euro currency.

On the calendar, the focus will be on the flash services and manufacturing PMI data due on Friday. ECB President Lagarde will also speak at a panel discussion on Thursday.

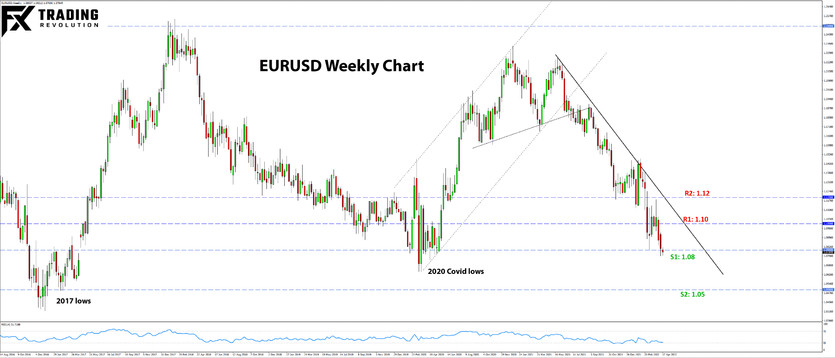

EURUSD Technical Analysis:

EURUSD is hovering around the 1.08 level at the start of this shortened post-Easter trading week. The pair has fallen a long way from levels above 1.15 in late 2021 to now testing a multi-year support zone at the 1.08 area.

As can be seen on the chart below, 1.08 is where the 2020 Covid lows are located. The lows from the 2011-2017 period are also nearby. This is a crucial support area for EURUSD. If it breaks, we could be in for an acceleration of the bearish price action. The 1.05 area stands as the next big weekly support lower.

To the upside, the 1.10 zone remains a key resistance that keeps the downtrend firmly intact. Above it, the 1.1150 – 1.12 zone is the next technical resistance.

Note: EURUSD technicals are at a critical juncture at the moment. To see why check out these analysis pieces of the monthly chart and the weekly chart.

GBP Weekly Fundamental Outlook: Relatively Stronger and Weaker Versus Different Groups of Currencies

The employment data released last Tuesday showed the UK labor market is in good shape, while the CPI inflation report the following day was again above consensus forecasts. This boosted the pound and has kept it relatively resilient over the past week.

And while GBP is strengthening against weak currencies (i.e., EUR, JPY), it is coming under pressure versus the strong USD. This trend is consistent with the current divergence in central banks’ policy expectations. The Bank of England sits somewhere in the middle between the very dovish BOJ and dovish ECB on the one end and the hawkish Fed, Bank of Canada, RBA, and RBNZ on the other end. Thus this trend of relative GBP strength and weakness versus these selected groups of currencies can continue.

On the calendar, Fx traders focus on Friday’s retail sales and PMI reports. On the Bank of England front, there are scheduled speeches from Governor Bailey and MPC member Mann on Thursday.

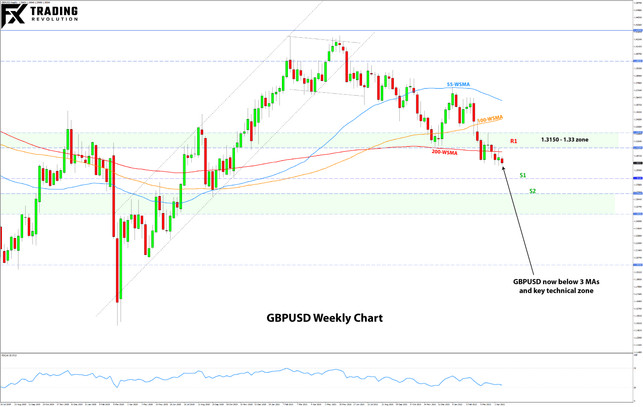

GBPUSD Technical Analysis:

That 1.30 zone in GBPUSD remains under heavy pressure and may finally be ready to crack.

While technically, the more important support for GBPUSD was located a little higher (1.3150 – 1.33), this psychological 1.30 area has held surprisingly well so far. However, the repeated bearish attempts here and the inability of GBPUSD bulls to lift the pair much higher suggests that a downside breakout is becoming increasingly likely.

Support zones below are 1.2850, ahead of 1.27 and then the big 1.25 area. To the upside, the first resistance should be at the old support of 1.3150 – 1.33.

JPY Weekly Fundamental Outlook: Bearish Trend In Full Swing

The Bank of Japan is left in the dust behind other central banks that are tightening policy and have already started raising rates and unwinding QE. The BOJ’s QE and YCC policies are keeping 10-year Government bonds capped at the 0.25% limit while yields of other countries are rising fast, making the yen a very unattractive currency to hold right now.

BOJ Governor Kuroda was speaking yesterday, and while he said that fast depreciation of the yen is undesirable, he also reiterated again that a weak currency is good for the Japanese economy and that there is no need to stop with the easing policies. All of this is consistent with more JPY weakness as the overall message from Japanese officials is still focused on easing policy, with little concern for the steep decline in the yen.

USDJPY extending the rally through the 130.00 level now seems to be only a matter of “when” not “if”. This implies that other JPY pairs would, of course, move higher as well accordingly.

Finally, note the risks to the now widely-held bearish JPY outlook. Mainly those are related to a sharp reversal in risk sentiment (e.g., stock markets) and/or the rise in Treasury yields. If either or both of those reverse, it will be much easier for the JPY to reverse some of its recent losses too.

USDJPY Technical Analysis:

USDJPY is now officially trading at 20-year highs. The pair surged past the 2015 high of 125.85 last week and is now moving steadily toward the 130.00 level. The last time USDJPY was trading at these levels was in May 2002. George W. Bush was President of the United States, and Japan was preparing to host the Korea-Japan world cup.

There is little in the way to stop USDJPY from reaching that 130.00 level next. In fact, judging by the powerful trend momentum here, it will most likely break above it soon. Then all focus will be on the 135.00 level, which should provide some resistance considering that this was a major swing high in 2002.

To the downside, we can spot support far into the distance around that 125.00 area. It acted as a moderate resistance on the way up, and if it is tested from the other side, it could be a good area to establish fresh long positions.