USD Weekly Fundamental Outlook: Traders Watching Wednesday CPI Inflation; Dollar to Stay Strong, but Consolidation Possible in Near Term

We are entering a quiet period on the economic calendar following a busy previous week. The dollar retained strong levels, though it experienced a short-term correction after the Fed meeting on what seemed like a “buy the rumor sell the fact” behavior. The markets were already positioned for a very hawkish Fed, which Powell and company delivered, but Powell’s comment that an even larger 75bp hike is off the table for now was a reason for some profit-taking that triggered a retracement.

Nonetheless, it is clear to everyone that the Fed was not dovish at all, so this meeting doesn’t change the long-term bullish USD dynamics. The Fed is fully on course to tighten policy aggressively in the coming months, and at least two more 50bp rate hikes are likely in June and July (taking interest rates to 2% in summer already). Quantitative tightening will also commence on June 1 and speed up to a pace of 95 billion per month by September (that is almost as fast as QE was in the past). This Fed hawkishness should continue to support the US dollar during the coming weeks and months as no other central bank can match this level of hawkishness at the moment. In addition, the Covid lockdowns in China and the increasingly risk-averse global market environment are also a tailwind for the dollar at the moment.

However, there is scope for some consolidation near-term given the overbought conditions and notable USD appreciation already. On Friday, we sent this newsletter explaining why a short-term pause in the dollar trend is likely.

The highlight of this week’s US economic calendar is the CPI report. Inflation is expected to start falling from this month (as base effects fade), so watch out for a possible surprise lower in the CPI report this Wednesday. In such a case, this could as well be the trigger for another leg of the USD correction, as US yields would also likely decline if the CPI prints below the forecasts (8.1% headline; 6.0% core). Several Fed speakers are also scheduled on the calendar, whose comments could also drive the dollar as they’ve done in recent months.

EUR Weekly Fundamental Outlook: ECB Communication Increasingly Hawkish, but Euro Not Benefiting

Traders didn’t have much to focus on the light EUR calendar last week, except for speeches by ECB Governing Council members. And there was interesting commentary from them, with the main takeaway being that ECB communication is increasingly favoring rate hikes this year and an end to extraordinary loose monetary policy. With inflation now running way above the ECB’s 2% target, it is becoming clear that they will start hiking interest rates this summer. This will lift the ECB’s interest rates from negative for the first time in 8 years.

ECB members last week also commented on the EUR exchange rate, suggesting further weakness is undesirable. While this initially triggered a bounce in the euro, it was short-lived in the end. The fact that none of this “hawkish” talk by the ECB is helping the currency is a signal that investors are worried about the larger picture and not so much about what the ECB will do.

Obviously, the war in Ukraine and the implications of the energy crisis are the main reason for this negative outlook, and both are likely to persist for a prolonged period. This should keep the euro under pressure over the coming months.

This week there are also some ECB speakers, including President Lagarde as well as Governing Council members Knot and De Cos.

EURUSD Technical Analysis:

The bear trend as defined by this downward channel (see chart below) remains intact here. However, the pair is showing the first signs of consolidation following the repeated rejections of levels under 1.05. Momentum indicators like the RSI show that the pair was deeply oversold, so some consolidation or correction at this stage seems likely, which will reduce the oversold conditions.

As can be seen, EURUSD is now trading in a bear flag pattern. Thus, the trend continuation to the downside would likely come when this flag breaks. For now, however, support at its lower line around 1.05 is holding.

To the upside, the nearest resistance is toward the upper boundary of the flag, currently around 1.0650. The more important resistance, however, is located toward the previous lows at the 1.0750 - 1.08 zone.

GBP Weekly Fundamental Outlook: Sterling Extends Drop as BOE Signals Fewer Rate Hikes Ahead

The pound dropped like a rock last Thursday as the Bank of England voiced increasing concern about the economic outlook and indicated that fewer rate hikes will be delivered than originally planned this year. This was evident from the BOE statement, MPC votes, and the economic projections.

The MPC was very divided on the vote on interest rates (5-4 vote), where 4 MPC members wanted a bigger 0.50bp hike. However, the BOE’s projections showed a grim outlook, where MPC members see inflation and growth rapidly falling next year. This was the signal that much fewer rate hikes will be needed than the market expected, triggering the sharp sell-off in GBP after the meeting.

While the currently high inflation will get the BOE to deliver at least a few more rate hikes, the markets care about the future. The dovish shift at the BOE will likely keep the pound weak for the foreseeable future. This could also mean that the GBP’s sell-off can now broaden versus other currencies and not only against the dollar.

The UK calendar is very light for this week and features only the GDP report as the main event.

GBPUSD Technical Analysis:

After the break below 1.30 on April 22, GBPUSD progressed lower quickly. By late April, it was already trading below 1.24. This resulted in deeply oversold readings on the RSI and other momentum indicators (see chart below), which already seems to be taking some steam out of this bearish trend.

Last week, GBPUSD plunged by almost 300 pips on the Bank of England day, but there has not been much follow-through since then. This is indicative that a consolidation phase may be starting. Given the volatile nature of GBPUSD, a consolidation could mean 300-400 pips swings in both directions.

The 1.25 zone is the first resistance, followed by 1.2650 – 1.27.

To the downside, support seems to be building around 1.2250, but it is unconfirmed for now. The next one lower is the important 1.20 area.

JPY Weekly Fundamental Outlook: Yen Can Fall Further as BOJ Has no Intention to Ditch Dovish Policies

It was a very quiet past week in Japan as the country was off due to the golden week holiday. As suspected, this led to lower activity on JPY pairs, though the fact that key technical levels were not broken probably helped to keep volatility subdued.

With JPY traders returning this week, we could see more action. Not much has changed regarding the key fundamental drivers and the outlook for the yen, however. The trend of a weak JPY remains intact and continues to be mainly driven by a dovish Bank of Japan, which stands in contrast to most other central banks that are already raising interest rates.

Thus, JPY traders should continue to have global stock indices and general risk sentiment on their radar. For now, the trends of higher Treasury yields and relatively stable stock markets remain intact, which should keep the bearish pressures on JPY in place. The risk to this outlook is that if these trends reverse – for example if stocks and US Treasury yields fall hard, then some yen strengthening would be likely.

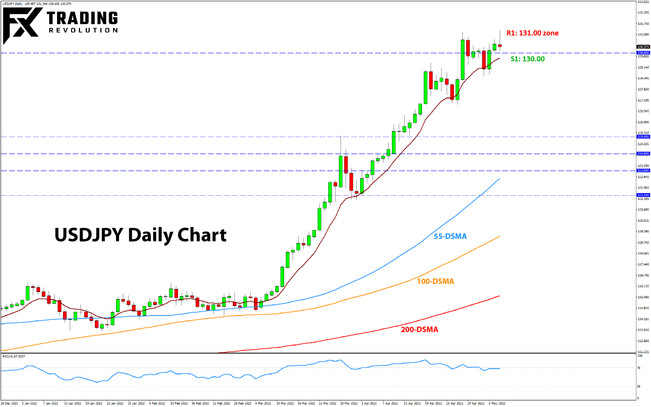

USDJPY Technical Analysis:

USDJPY is opening the new week with a fresh cycle high and rejection above 131.00. The daily candle has not closed yet, but if it ends near current levels of 130.20, it will form a small bearish engulfing candle.

Given the predominant and strong bullish trend, this would not be a significant bearish signal in the current context. However, it could be a warning sign that the correction or consolidation will extend from here, instead of another leg higher.

The key resistance for USDJPY thus remains in the 131.00 zone. To the downside, the 130.00 level is now key support as multiple technical indicators converge around it.