USD Fundamentals: US Enters Technical Recession, Fed Delivers Another 75bp Hike

The big surprise from the US last week was the miss in the GDP report, which meant the US is already in technical recession (defined as two consecutive quarters of GDP contraction below 0%). While economists are not worried much about a technical recession nor equate it with a real recession, the news was enough to rattle markets and send bond yields further down.

The extension of the decline in yields was largely behind the USD pullback last week. However, the Forex market is a relative game, and while falling US yields was the big news last week, bond yields are falling in other countries too (and more than in the US) as they are facing a recession as well. Eventually, the Fx market will realize this and start moving flows back into the US dollar, which should limit any further USD losses from here.

The Fed’s resolute hawkish stance is, of course, the main factor behind the current USD uptrend. They hiked rates by 75bp again last Wednesday, taking the Fed funds rate to 2.5% - one of the highest among developed countries. However, chair Powell’s communication in the press conference was perceived as dovish as he suggested that smaller rate hikes (50bp and 25bp) are likely to be appropriate from now on. Still, the persistently high inflation and upward pressures on wages are likely to keep the Fed on the hawkish trajectory, even if the economy is weakening more seriously now. For instance, the PCE inflation and the employment cost index reports released Friday surprised to the upside again.

The US calendar this week is no less busy. The Nonfarm payrolls will be the main focus as investors and economists will look closely if the labor market is starting to feel the heat from the Fed tightening. The consensus expects around 250K jobs for the NFP. While it is an unlikely scenario, a material risk to the dollar is a big miss in the NFP report this Friday. That will fuel recession fears further and could lead to a further and sharper decline in the US dollar. But barring this scenario, and if the NFP prints at or close to expectations, the dollar should remain overall supported as the Fed is set to stay firmly hawkish for the time being as it fights inflation.

EUR Fundamentals: Eurozone GDP Better than Expected, but Markets Focused on Energy Crisis and Bleak Outlook for Future Growth

The past week was perhaps a telltale about what lies ahead for the euro. The common European currency performed rather poorly and wasn’t even able to gain much against a weakening dollar; EURUSD closed the week only marginally higher.

Stronger than expected GDP growth and higher CPI inflation were not enough to help the EUR recover. This again highlights the fact that the market remains much more worried about the outlook for the months ahead than how well Europe is holding up now. Indeed, it was reported that last week Russia cut gas supplies again, and flows through the Nord Stream pipeline are now only at 20% of capacity compared to 40% before. This sent European gas prices (TTF futures contract) to an all-time record, as investors fear that European countries will have to deal with a severe energy crisis this winter when gas is most in demand.

Higher gas prices also translate into higher electricity prices in Europe. It is a huge negative shock to the European economy and the main factor that drives the bearish EUR trend. Unfortunately, there are no signs on the horizon that Europe’s energy crisis will improve any time soon. With the ECB having its hands tied and not able to affect energy markets, the path of least resistance for the euro remains down. EURUSD is likely to eventually revisit parity (1.00).

EURUSD Technical Analysis:

EURUSD is basically stuck in consolidation between 1.01 and 1.0250 since July 20. It is now making another test on the upside of the consolidation range at 1.0250. A breakout here could open the potential for a further 100 pips or so upside move, but EURUSD is likely to encounter strong resistance there.

Namely, the 1.0350 zone remains the first band of strong resistance. Progression through and above it won’t be easy. But even if EURUSD manages to pull off something like that, 1.05 is not far and is itself an important resistance area. All in all, the technicals suggest EURUSD will have a hard time climbing higher from here.

To the downside, the parity (1.00) zone remains in focus as key support. Below it, 0.98 and 0.95 are the next support zones lower.

GBP Fundamentals: Thursday Bank of England Meeting in Focus

The pound managed to recover broadly last week, though the rally in GBPUSD doesn’t seriously threaten the uptrend at this stage. GBP’s fundamentals remain weak overall, and the recovery is so far mainly driven by the improvement in risk sentiment (stocks rallied, yields fell).

The week ahead features an important Bank of England meeting. Still, it is unlikely any decision the BOE makes or forward guidance it communicates will have much of a lasting impact on GBP. Instead, the currency will continue to be driven by larger-scale factors, such as the stagflationary state of the UK economy and the ripple effects of the war in Ukraine and the sanctions on Russia. Like the euro, GBP should remain under pressure, with the added volatility from oscillations in risk sentiment (GBP is more sensitive to risk sentiment than the EUR). On balance, both the rebound in risk appetite and GBP’s rally look unsustainable in the current environment.

The Bank of England should raise rates by 50bp, which is widely expected and factored in by financial markets. On the domestic front, the focus will also be on political developments, namely the race between Rishi Sunak and Liz Truss for Prime Minister. Swings in their chances to win could result in swings on GBP crosses.

GBPUSD Technical Analysis:

GBPUSD’s recovery continues, and the pair is now making an attempt to break above the 55-day moving average (blue) around the 1.2250 level. While the rally is already stretching some 500 pips from the lows under 1.18 in mid-July, the price action is not yet indicative of a bullish reversal.

The current 1.2250 zone that GBPUSD is testing is the first key resistance that should keep the downtrend intact. But if the upside attempt doesn’t end here, then a move toward 1.25 could be next. Here, GBPUSD should meet even stronger resistance.

Looking down, the 1.20 zone is the first and crucial support. Below it, the lows around 1.18 and then 1.15 will come into focus.

JPY Fundamentals: The Peak in USDJPY Is Behind Us

The story for JPY pairs remains all about yields. Last week we got more of the same - recession fears grew stronger as US GDP growth disappointed and US Treasury yields nosedived. So did USDJPY as the yen surged across the board. Our short EURJPY trade issued 10 days ago has already reached its target at 135.00, for a profit of +470 pips.

With the latest slide in global bond yields, there is a greater sense that USDJPY has peaked and that the bearish trend in the yen has ended. From here, we may start seeing the opposite, and the name of the game could be JPY strength. That will be especially the case if the falling yields are accompanied by falling stock markets.

US data like the Nonfarm payrolls will likely be key also for JPY pairs this week. It will shape how much markets fear recession and inflation to which bond markets are most reactive. These factors will continue to drive the yen. Given the large moves last week, some consolidation would not be surprising on JPY crosses. However, the longer-term trend has likely turned in favour of the yen, and eventually, we are likely to see a further reversal of the yen’s losses from earlier this year.

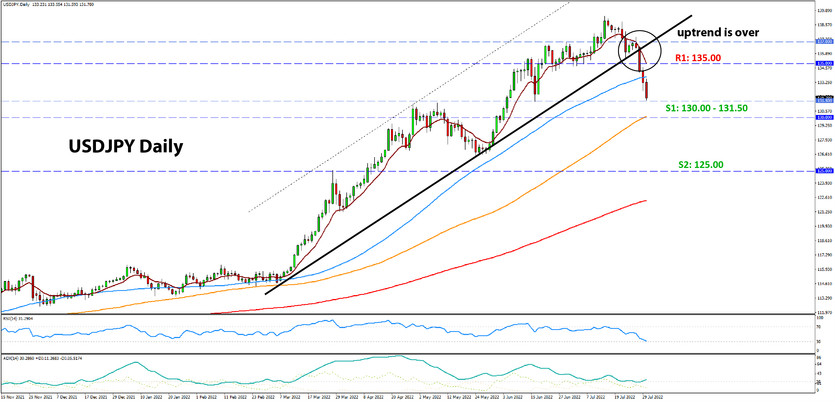

USDJPY Technical Analysis:

USDJPY has now more seriously reversed, and we can safely say that the phase of the powerful bullish momentum has ended. The pair is now moving below 132.00 and is set to soon make an attempt at the 130.00 - 131.50 area. This is the first notable support for USDJPY in the current context, so watching the price reaction here will be important.

In a bearish scenario, following a break below the 130.00 - 131.50 support, USDJPY will likely quickly fall toward 125.00. This is the next important technical zone down.

To the upside, USDJPY traders will watch the now broken 135.00 area as the first resistance that should reject any rallies.