USD Fundamentals: Fed to Hike 75bp After High CPI Print Last Week

The USD rebounded from the correction last Tuesday following the release of the notably higher CPI figures than projected by consensus forecasts. Before the CPI inflation data, the markets were pricing in “only” a 50bp rate hike from the Fed at this week’s meeting. Now, another 75bp hike is fully priced in, and furthermore, markets are playing with the idea of an even “larger” 100bp hike on Wednesday.

This rapid hawkish repricing of Fed interest rates is the reason behind the latest USD rebound. There is probably more of this move to play out as the Fed has every reason to stay the most hawkish central bank right now, which should continue to push the dollar higher. With the US economy still not slowing significantly, the Fed has the leeway to do QT and hike rates by “large” 75bp and 100bp. Other central banks like the ECB and BOE have a much narrower space to tighten policy.

The US dollar should stay supported into and after the Fed meeting on Wednesday. The immediate market reaction upon the announcement would depend on the specifics, like whether the Fed hikes by 75bp or 100bp. The quarterly economic projections will also be released at this meeting, which the Fed uses as a forward guidance tool for future policy.

EUR Fundamentals: Watching PMI Reports on Friday

The upside retracement in EURUSD came to an abrupt end last week as the US dollar surged again on the shift in expectations for Fed interest rate moves. The downtrend in EURUSD remains intact, and a break to fresh cycle lows still looks like the probable scenario for this pair.

That said, the euro held up better versus other currencies and, in fact, ended the week higher against the risk-sensitive AUD, CAD, NZD, and GBP. This indicates that mixed forces are in play here, although the overall bearish fundamentals for the Eurozone remain unchanged. A deep recession during the winter months is still a probable scenario, and this will keep capital flows away from the Eurozone, thus having a negative impact on the currency. But, the British pound and other currencies are also in a similarly “tough spot”, so on a relative basis, the euro may not fall much versus these weaker currencies.

The week ahead is rather light until Friday, when we will receive the latest updates on the manufacturing and services PMI surveys. Worse than expected numbers would confirm the “negative” recessionary scenario for the Eurozone and could push the euro down again.

EURUSD Technical Analysis:

EURUSD tested the 1.02 resistance last week and was rejected there. The pair returned toward the 1.00 level, and as we said last Monday, such action confirms that the 1.02 resistance is strong and holding. The downtrend channel that defines the bearish trend since February is fully intact also (see chart below).

Thus, more downside action looks like the probable outcome for EURUSD. The current levels around parity (1.00) are the first support. The next zones to watch are 0.99 near the previous lows, and 0.98, which represents some notable Fibonacci levels.

GBP Fundamentals: BOE Meeting in Focus, but Their Decision Unlikely to Help the Pound

The UK is off today for the queen’s funeral, so GBP trading is less active than normal. GBP volatility should return tomorrow when UK institutional traders are back at their desks.

The GBP is hit on two fronts in the current environment: 1) the significant weakness of the domestic economy and 2) the deteriorating global risk sentiment. GBP is a relatively risk-sensitive currency and is negatively impacted when risk aversion is the name of the game in markets. This is what happened last week when stock markets fell following the “hotter” than forecasted CPI inflation report from the US.

A more hawkish Fed is bad for global risk sentiment, and virtually all risk-sensitive currencies fell sharply last week. If weakness in stock markets continues, it could quickly translate into similar pronounced and sharp GBP weakness.

The focus is on the Bank of England meeting on Thursday, when the markets expect them to hike rates by 50bp. The MPC votes as well as the rate statement, will be closely watched too. However, no matter the specifics of the BOE’s decisions, there is little they can do to help the GBP. Aside from the BOE, the calendar this week is rather light, hence global risk sentiment and appetite for US dollars should remain the main drivers in the Fx market.

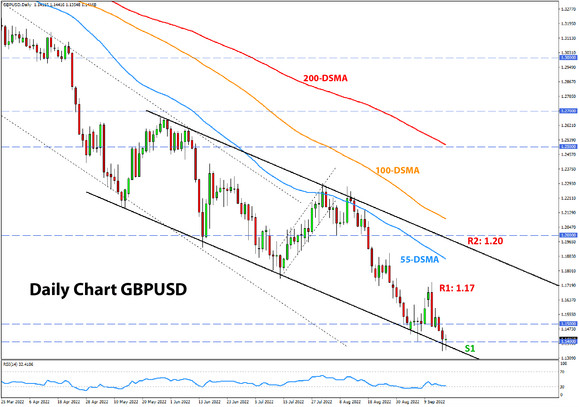

GBPUSD Technical Analysis:

GBPUSD is following the expected path we laid out in recent weeks. First, it rebounded at 1.15 two weeks ago, then retraced toward the 1.17 resistance (which we also highlighted as a key zone), and is now falling toward 1.14, where it is reacting with the support here. As can be seen on the chart below, GBPUSD has drawn a down-sloping channel, with its support line standing around current levels (1.14).

GBPUSD could now recover from here or could also trade downward gradually at the slope of the trendline (walking the line). Of course, it could also break the trendline to the downside, but that would likely need an “extreme” crash scenario like the one in March 2020 when the Covid pandemic hit. That being the case, in the “gradual” scenario, there is potential for GBPUSD to slide toward 1.13 and 1.12 over the next few weeks.

To the upside, 1.17 and 1.20 remain the key resistance zone.

JPY Fundamentals: Real Intervention Getting Closer, BOJ Meets This Thursday

The yen rebounded after USDJPY hit the 145.00 level for the 2nd time in two weeks last Tuesday. The reason behind the reversal was more verbal intervention from Japanese currency authorities. This time it was news hitting the wires that “the BOJ is checking currency rates”. Such official press releases coming from the BOJ are an important signal that the central bank is getting increasingly nervous about the speed and degree of JPY’s weakness.

Indeed, past interventions from the BOJ (last one in the late 1990s) were preceded by similar press releases. Thus, the market took the statement as a sign that the BOJ is preparing to do actual intervention if the yen falls further. It appears that USDJPY at 145.00 is now the “short-term” line in the sand, while 150.00 could be the more important one that may trigger real intervention from the BOJ. As volatility remains high, so is uncertainty, and that makes the situation difficult for everyone. Traders should remain extra careful when trading any JPY pairs, as actual intervention can take the market down by 500 pips or more in the space of a few hours or minutes. Recently, we released a special update on the developments with the yen and the long-term outlook for USDJPY.

The Bank of Japan meets on Thursday, and the main question will be exactly that, intervention. Will they announce something about it or actually take some steps toward it already? The BOJ has already said on multiple occasions this summer that they won’t alter their monetary policy stance because inflation in Japan is transitory, and the ultra-loose policy is still needed. So, on this point, there should be no surprises from the BOJ at this meeting, with the only potential surprise coming on the question of intervention.

USDJPY Technical Analysis:

After four weeks of steady gains (around 1000 pips higher), USDJPY consolidated sideways over the past week. It is now compressing around the 143.00 zone and flirts with the 9-period EMA (purple line). A break below the 9 EMA could trigger a faster fall, and USDJPY may quickly trade to the first important support zone, which is 140.00.

Under 140.00, the next support is the 137.00 zone, which may turn out to be very important if tested. Namely, a rising trendline is lining up in this area, in addition to previous highs and lows. The 135.00 zone is also not far, and this whole 135.00 – 137.00 area may be tested as one wider support band. This wouldn’t be surprising in USDJPY now, especially given the increased volatility.

To the upside, the 145.00 zone has been solidified as resistance now that it has been tested twice. Above 145.00, USDJPY is in uncharted territory. The 147.00 zone could be important as it’s the multi-decade high reached in 1998.